Macro: Thanksgiving Week Releases

Image Source: Pexels

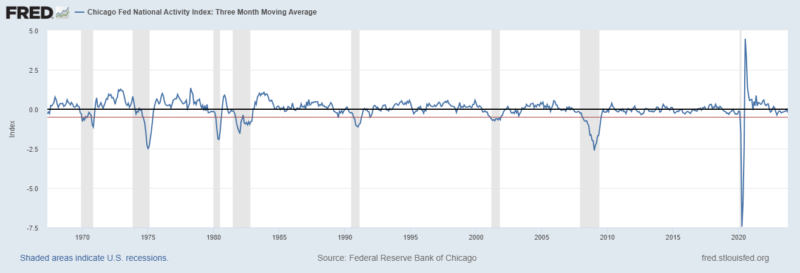

Chicago Fed Activities Index

As expected, there was a drop in the readings for the month of October versus the strong September period. We are near concerning levels, which would be below -.5.

(Click on image to enlarge)

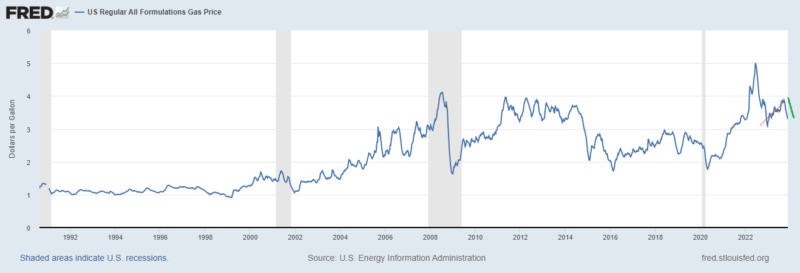

Fuel Prices

Prices are continuing to move down.

(Click on image to enlarge)

Existing Home Sales

Sales are down once again, and inventory appears to be up. This is all about affordability. Many home owners may be locked into their home because of the large difference between their existing mortgage and current market rates. Prices need to adjust to match buyers and sellers.

(Click on image to enlarge)

(Click on image to enlarge)

Durable Goods

Like much of the data, October's numbers are weak versus those of September. This data series continues to show growth slowing.

(Click on image to enlarge)

Unemployment Claims

This was the best number of the week. There were less people being fired leading into the holidays and less people continuing to claim benefits, which is an indication that there was some net hiring. Initial claims dropped from 233,000 to 209,000, and the reading is back below the four-month moving average. Meanwhile, continuing claims data is right above the four-week moving average.

(Click on image to enlarge)

(Click on image to enlarge)

US Flash PMI

- The Composite data came in unchanged from October at 50.7, indicating a slight expansion.

- Services readings came in at a four-month high at 50.8 versus 50.6 in October.

- Manufacturing numbers came in at a three-month low at 49.4 versus 50 in October.

- Output data came in at a three-month low at 50.4 versus 51.2 in October.

- Input price inflation appears to have eased, while output prices increased.

Japan Flash PMI

- Overall readings slowed to 50 from 50.5.

- There was a reported weakness in manufacturing, down to 46.4 in November from 48.2 in October.

- Services data was up .1 to 51.7 from 51.6 in October.

Eurozone Flash PMI

- There was a slight uptick in all categories from contractionary levels.

- Composite data came in at 47.1, up from 46.5.

- Services data came in at 48.2, up from 47.8.

- Manufacturing readings came in at 43.8, up from 43.1.

- Output numbers came in at 44.3, up from 43.1.

More By This Author:

Macro: Leading Economic Indicators — Reflections Of 2006?Macro: Industrial Production

Macro: Unemployment Claims — Uptick In Current Initial And Continuing Claims V 4-Week Average

Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the ...

more