Macro: CPI - Coming Down Very Slowly

Headline CPI came in at 3.12% in November, which is .11% lower than in October. From September to October the headline dropped .46%. For the year, we’ve averaged a monthly drop of .29%. So the pace of disinflation is slowing.

Additionally, YOY changes in prices are still higher than June, so we’ve made no progress in the 2nd half of the year.

The Core CPI dropped a measly .03% to 3.99% and both price measures remain above the 2% target.

(Click on image to enlarge)

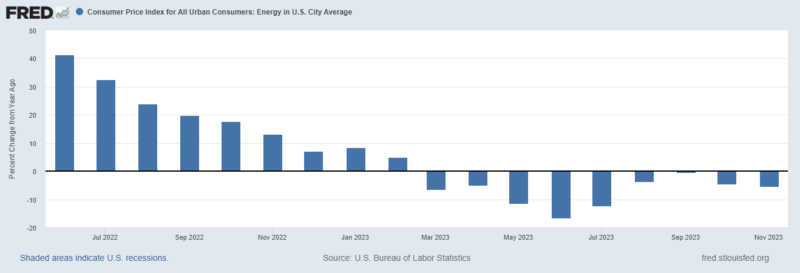

The headline number is being helped lower by energy prices which are down 5.4%.

(Click on image to enlarge)

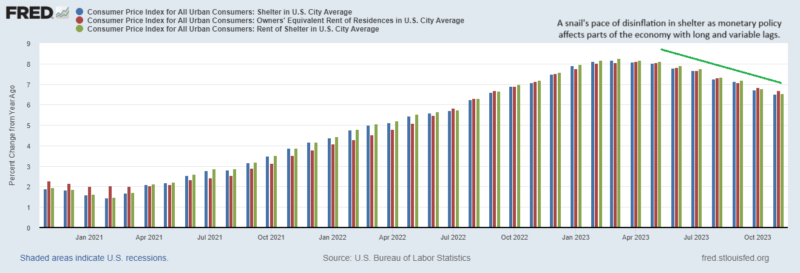

The Core is being buoyed by services inflation which is still running at 5.5% and shelter inflation which is running over 6.5%.

(Click on image to enlarge)

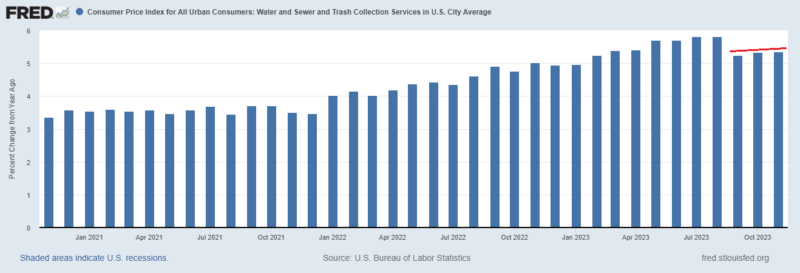

The inflation is not because of goods, its about labor and the cost of facilities. This shows up in a few series, notably in motor vehicle maintenance and repair. It’ll cost you 8.5% more in 2023 to take your car to the shop; but the parts cost the shop 1.5% less than last year. There is also a jump in water/sewer and trash collection which is still running hot at 5.35%. This isn’t surprising given all the union activity helping their members keep up with cost of living increases. You’ve been touched by the Teamsters.

(Click on image to enlarge)

The market reaction: Bond yields jumped 7 bps and oil went down 4%. Fingers crossed that oil keeps going down because the shelter component is being stubborn. The market is now giving a rate hike tomorrow a 1.6% probability, up from .2%. The market thinks the May meeting is the most likely time for a rate cut. A cut at the March meeting is being given a 42% chance.

More By This Author:

Macro: EmploymentMacro: GDPNow - 1.3%

Macro: ADP Employment

Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the ...

more