Macro Briefing - Wednesday, Oct. 29

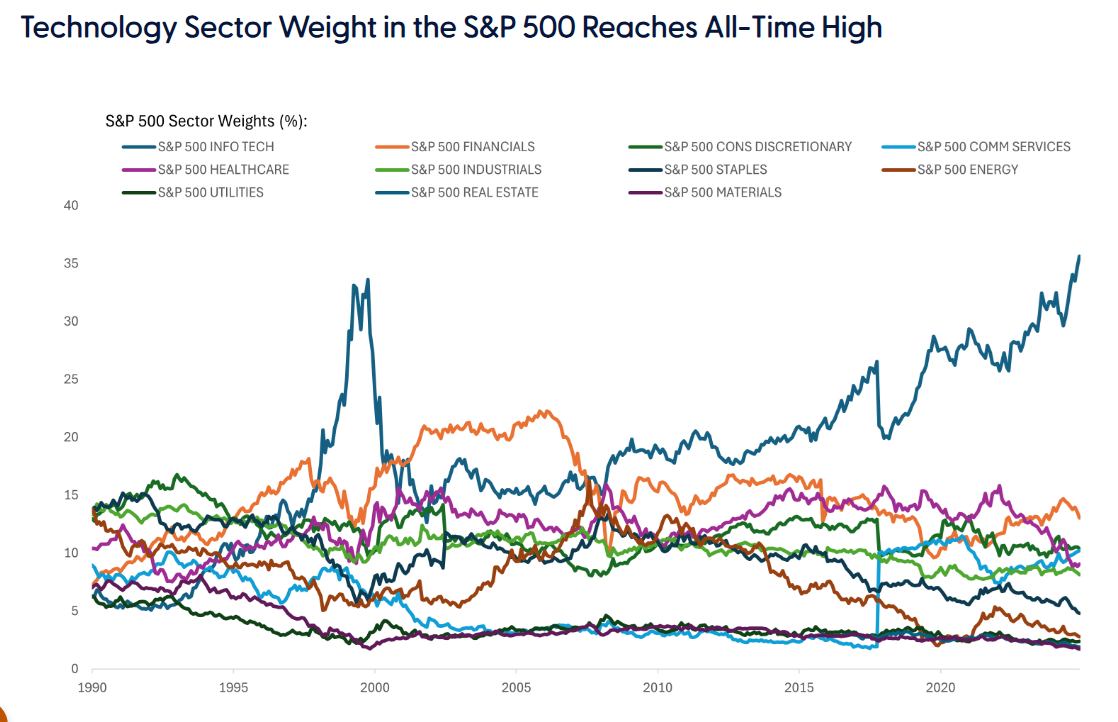

Technology stocks have increased to a record-high weight in the S&P 500 Index, surpassing the previous high set in 2000 at the peak of the dotcom bubble. “This suggests the tech sector is overvalued, which it may be at a 34% premium to the forward price-to-earnings (P/E) ratio of the S&P 500,” writes Jeff Buchbinder, chief equity strategist at LPL Financial.

(Click on image to enlarge)

Manufacturing activity continued to contract in the Richmond Fed’s district in October. The regional Fed bank’s composite manufacturing index picked up to -4, but remains negative.

The growth rate of US home prices continued to slow in August, according to the Case-Shiller Home Price Index. The value of single-family homes in the US rose 1.5% vs. the year-ago level, down from 1.7% in July.

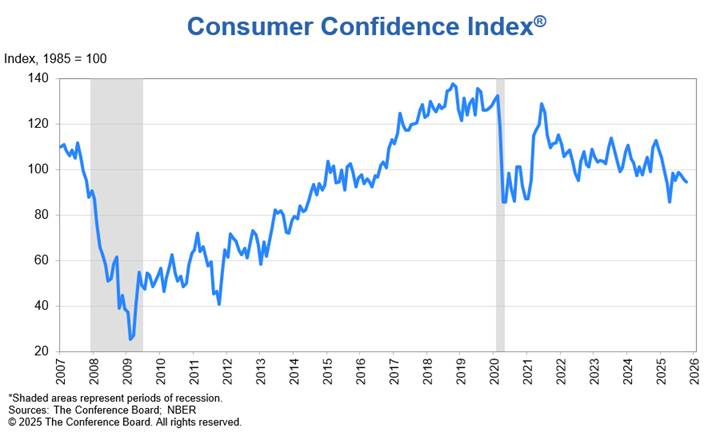

The US Consumer Confidence Index was steady in October, the Conference Board reports. “Consumers’ view of current business conditions inched upward, while their appraisal of current job availability improved for the first time since December 2024,” says a senior economist at the consulting firm. “On the other hand, all three components of the Expectations Index weakened somewhat. Consumers were a bit more pessimistic about future job availability and future business conditions while optimism about future income retreated slightly.”

More By This Author:

Foreign Stocks Still On Track To Outperform US In 2025Macro Briefing - Tuesday, Oct. 28

Macro Expectations: Betting Markets