Macro Briefing - Thursday, Sep. 25

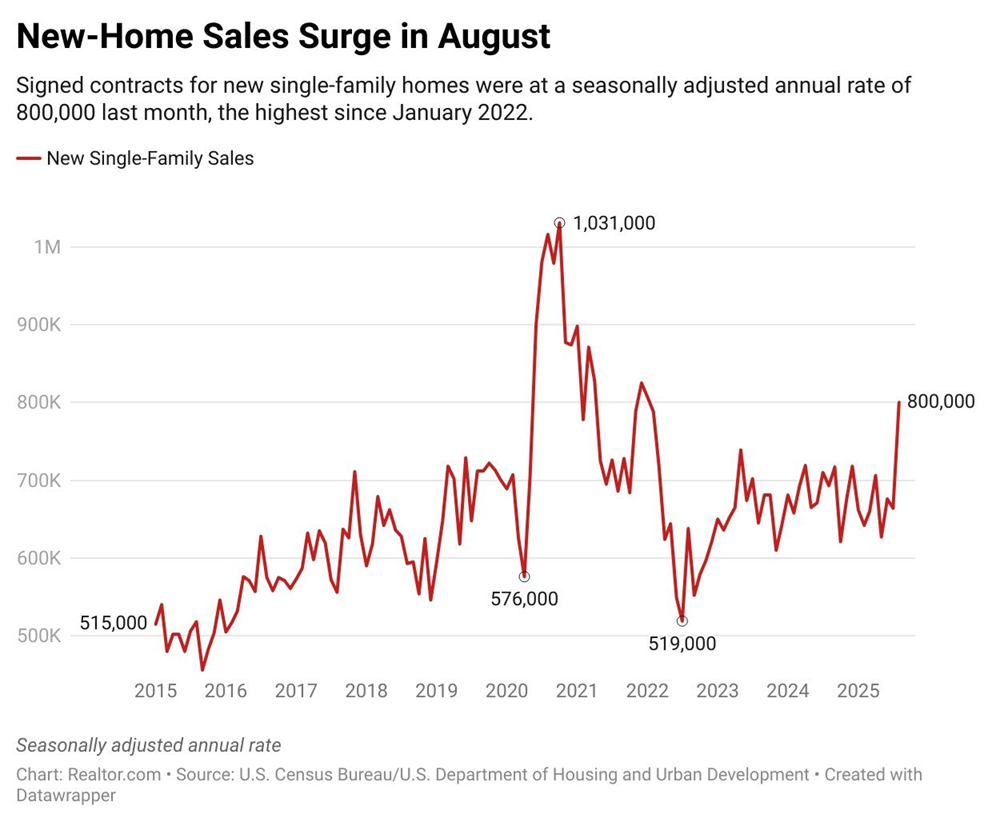

New US home sales surged in August. Signed contracts for new single-family homes jumped to a seasonally adjusted annual rate of 800,000, a 21% from the previous month and 15% above the year-ago level. Nancy Vanden Houten, a lead US economist at Oxford Economics, said the increase “likely overstates any improvement in housing activity. New home sales are prone to heavy revisions. A flat-ish trend in sales, similar to what has been evident all year, seems more likely.”

The White House Office of Management and Budget tells federal agencies to prepare layoff plans if a government shutdown starts next week. OMB said to identify programs, projects and activities where discretionary funding will lapse on Oct. 1 with no alternative funding sources.

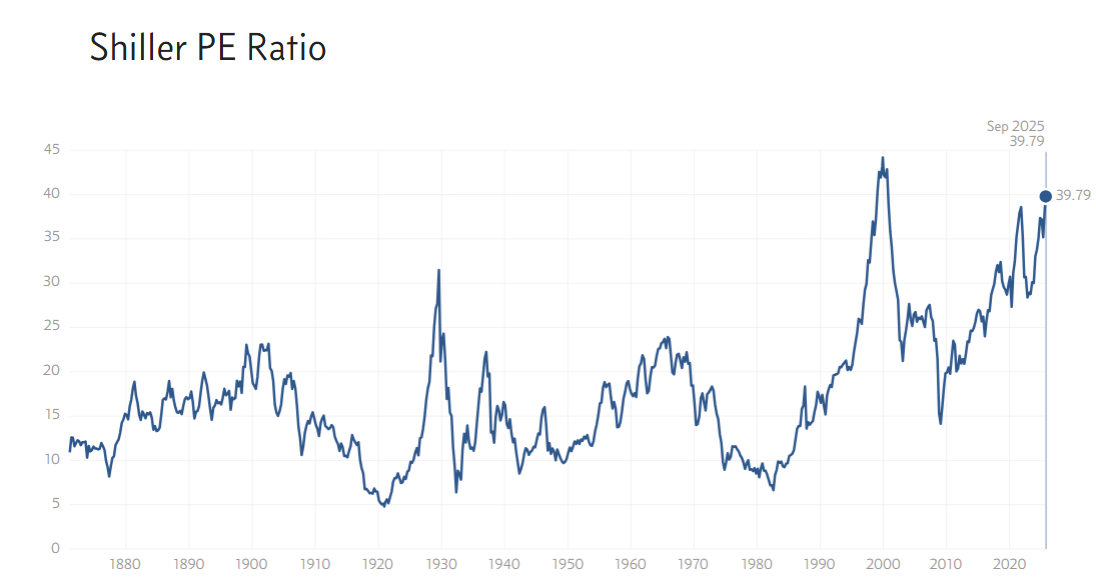

Federal Reserve Chair Powell said “Equity prices are fairly highly valued,” on Tuesday. He added: “it’s not a time of elevated financial stability risk.”

Lithium Americas (LAC) shares rose sharply as the Trump administration said it’s seeking equity stake in the Canada-based mining company. The announcement follows the Department of Defense’s purchase of a 15% equity stake in rare earth miner MP Materials in July.

Nvidia (NVDA), a leader in AI chip, said it would invest $5 billion in Intel, a former leader and now struggling firm in the semiconductor manufacturing industry. “This may be the first step of an acquisition or breakup of the company (Intel) among U.S. chip makers though it is entirely possible the company will remain a shadow of its former self but will survive,” said Nancy Tengler, CEO of Laffer Tengler Investments, which owns shares in Nvidia.

Rising grocery prices are a “major source of stress for roughly half of Americans”, reports The Hill: “Grocery prices rose 0.6 percent from July to August, the steepest one-month gain in roughly three years, according to the Consumer Price Index. They’re now 2.7 percent higher than a year ago and up nearly 30 percent from before the pandemic.

US stock market valuation approach record high, based on the Shiller Price-Earnings Ratio: “With the S&P pricing in 23-24 times expected earnings and expectations priced into that multiple of about 15% annualized earnings growth over the next five years, that sounds pretty rich to me,” said Ron Albahary, chief investment officer at LNW in Philadelphia.

More By This Author:

Is A Highly Valued Stock Market A Warning Or The New Normal?Macro Briefing - Wednesday, Sep. 24

US Q3 GDP Nowcasts Indicate Solid Growth After Fed Rate Cut

Disclosure: None.