Lower US/World Wheat Stocks & 2022 US Corn Yield Surprises

Photo by Jesse Gardner on Unsplash

Market Analysis

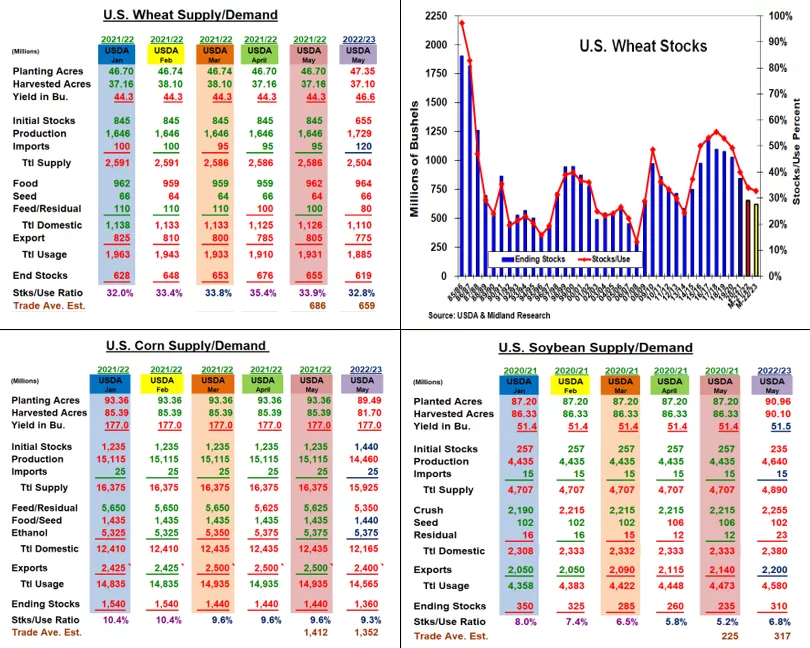

The USDA’s May supply/demand updates had some surprises in both their current & 2022/23 wheat (WEAT) and corn (CORN) supply/demand updates released this month. US & World weather along with the Black Sea conflict helped to tighten wheat’s local and international balance sheets this month. This spring’s delayed US plantings also prompted an unusual early USDA move to reduce corn’s US 2022/23 corn yield on its initial supply forecast. The conservative old-crop soybean (SOYB) export change keeping this demand below the current sales level with a bit of surprise too.

This month’s 1st US winter wheat crop was sliced 65 million bu below the trade’s expectations at 1.174 billion bu. A sharply lower hard red crop of 590 million because of 2022’s drought cutting harvested acres & yields helped tighten total US stocks to 619 million; the lowest level in 9 years. Excessive wetness in the N. Plains, dryness in Europe & the ongoing military action curtailing Ukraine’s trading & planting operations also swung the USDA’s world-ending stock outlook to 267 mmt; the lowest projected carryover since the 2016/7 crop year. This puts the focus on US & European weather for the next 4-8 weeks.

Despite Ukraine’s export restrictions, the USDA left US 21/22 corn demand levels unchanged in May. However, DC’s 4 bu cut in 2022’s US corn yield to 177 reducing the coming year’s output by 380 million bu was a surprise.

These reduced supplies prompted the USDA to lower their 22/23 feed demand by 300 million bu because of high feed costs reducing livestock & poultry numbers in 2023. Overall, US corn stocks are projected at 1.36 billion bu.

The USDA’s modest 25 million bu increase in the US old-crop exports to 2.140 billion bu means that this week’s sales remain 8 million higher than the 21/22 crop outlook with 4 months to go. No 2022/23 US yield change was made which is normal, but the USDA upped beans’ crush (higher vegoil demand for energy) and exports from their Ag Outlook forecast because of 2022’s higher plantings. Higher S AM plantings have USDA’s world stocks up 15 mmt in 22/23.

What’s Ahead:

The markets will be highly tuned to the planting progress and crop development of the N American, European and Ukrainian production areas with the winter wheat coming to harvest and the major row crops hopefully being seeded. Given the general tightening of the feed, food, and oilseed sectors, hold your remaining 10% of 2021/22 corn & soybean supplies and have just 20-25% of 2022/23 output sold.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more