Low Yield, High Growth Stocks For Your Retirement

Image Source: Pixabay

Dividend investors, do yourselves a favor and consider some low yield, high growth stocks for your retirement. See how focusing on dividend yield alone can cost you a lot.

A widely-held belief is that we need to build a high-yield portfolio for our retirement, then live off the dividend payments without touching the capital. But is it true? I say no. In fact, I believe a high-yield portfolio can even hurt your retirement.

The Case for Low Yield Stocks

Let’s start with Alimentation Couche-Tard (ANCTF), a low yield, high-growth stock, versus Canadian Utilities (CDUAF), a higher yield stock.

A yield-centric investor might say: “Today, it takes five and a half years for ANCTF to pay one year of CDUAF dividends.” To which I’d reply: “It also takes 122 years of a CDUAF’s dividends to equate to 10 years of ANCTF’s total returns.” When investors focus on one metric or factor, like the dividend yield, they can become blind to everything else.

To the follow-up argument that ANCTF’s total past returns are not guaranteed to go on for the next 10 years, I say neither are CDUAF’s dividends. Now let’s look at how low yield, high growth stocks measure up to high-yielding stocks.

What Low Yield, High Growth Can Do for You

For fun, I used our stock screener and followed these steps:

- I searched for stocks paying a yield less than 2% but showing a 10%+ dividend growth rate over the past five years.

- I looked at their total return graph for the past 10 years, which includes stock price appreciation + dividend.

- I repeated the process for 12 U.S. stocks and 12 Canadian stocks.

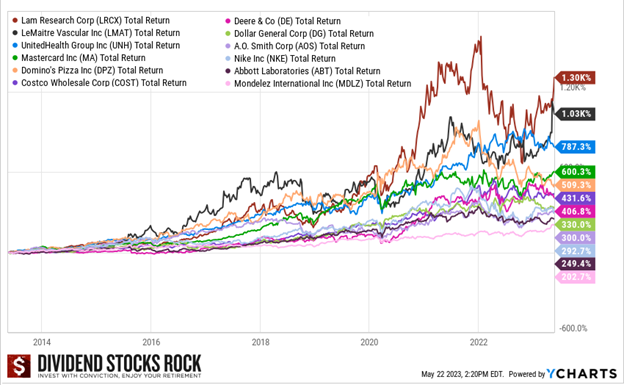

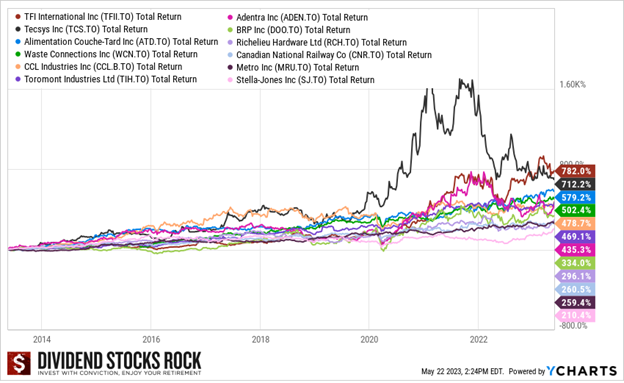

The results, shown below, reveal growth ranging from 203% to 1,300% for U.S. stocks and from 210% to 782% for Canadian stocks. To compare this to a benchmark, an ETF tracking the S&P 500 (SPY) reported 201.6% in total return while the iShares TSX 60 ETF was up 125.4%.

Long story short: the 24 low yield, high growth stocks killed it.

10-Year Total Returns for 12 U.S. Low Yield, High Growth Stocks

10-Year Total Returns for 12 Canadian Low Yield, High Growth Stocks

Most dividend investors agree that low-yielding stocks can come with a robust dividend growth policy (high-single-digit, often double-digit dividend growth rate) and substantial capital appreciation. Therefore, if you focus on total return, you want low-yield, high-dividend-growth stocks.

However, the case for building a high-yield portfolio is still valid at this point. Understandably, you might be more interested in getting paid in predictable increments than figuring out when it’s the right time to sell shares at their peak value. You might also be concerned about selling shares period, thinking that it hurts your portfolio. Is the total return of low yield, high growth stocks enough to offset these reasons for favoring high yield stocks?

To find out, let’s look at how some high-yield stocks have performed over the span of 10 years.

High Yield Stock Performance

Repeating my earlier steps, I searched for companies paying a yield more 4%-5%, and that were also paying a high yield 10 years ago. Therefore, a company like Enbridge didn’t qualify because its yield was around 3% in 2013.

Again, I picked 12 U.S. and 12 Canadian stocks. Now remember that for most of the 2013-2023 period, we had low interest rates, strong consumer confidence, and a growing economy. It was the perfect time to run a business.

10-Year Total Returns

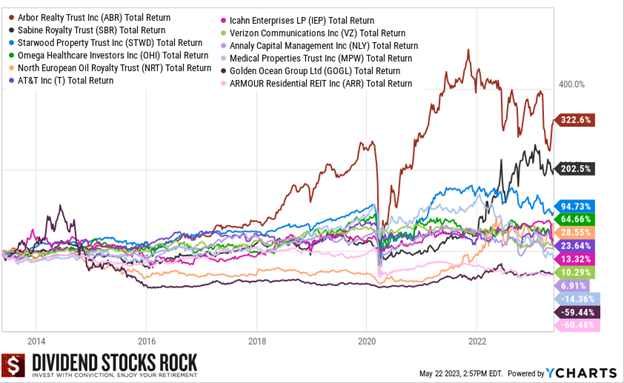

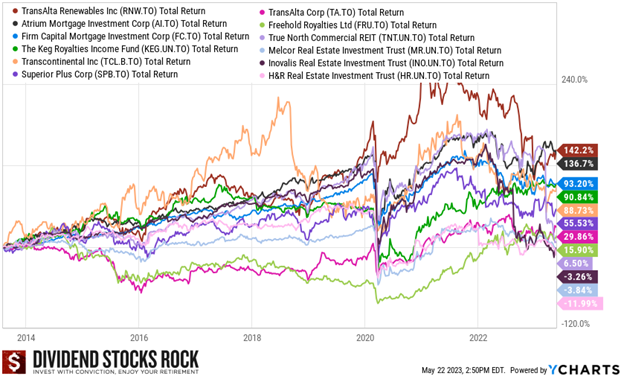

Here are graphs showing the total return of these high-yield stocks.

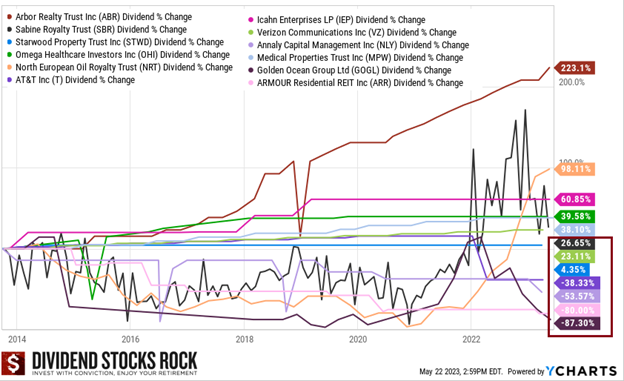

Total returns of 12 U.S. high yielders: much poorer than low yield, high growth.

Total returns of 12 Canadian high yielders: again, way below low yield, high growth.

Conclusion: high-yield stocks’ performance is terrible compared to low-yield, high-growth companies.

- Only 2 out of 12 U.S. stocks showed more than 200% total return, which was the low end of total returns for low yield, high growth U.S. stocks in the earlier graph.

- None of the Canadian securities reached 200% total return. Only two outperformed the iShares TSX 60 ETF.

- Even worse, 6 out of 24 (25%) reported a negative total return.

- In other words, you had a 25% chance of losing money, even after receiving the dividends, and only 16% (4 on 24) chances to match/beat the market.

10-Year Dividend Change

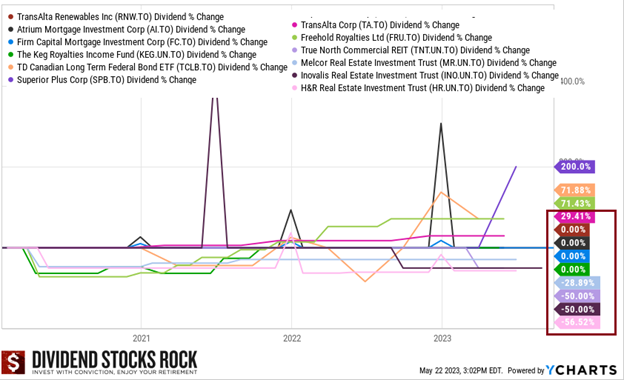

The next two graphs show how the dividend of the same 12 U.S. and 12 Canadian high-yield companies evolved over the 10-year period.

10-Year Dividend Change for the 12 U.S. High Yield Stocks

10-Year Dividend Change for the 12 Canadian High Yield Stocks

Conclusion: Retiring on those dividend payments would have been deadly for your portfolio.

- Out of 24 companies, 8 cut their dividend (33%) and 8 others didn’t match inflation in their dividend increase (increase below 30% over 10 years).

- That’s a 66.66% chance of investing in a company that doesn’t protect your buying power at retirement, and greatly hurts your retirement plan.

To be fair, there are bad low-yield stocks and great high-yield stocks. Also, picking 48 stocks and pulling out a few graphs won’t get me into Harvard for a thesis. This isn’t an academic study, but it’s enough to have a strong sense that something’s off when a company pays a yield more 5%.

Explaining Low Yield, High Growth

Why does a company pay a low yield and grow its dividend generously? What makes Visa (V) pay a yield less than 1% while AT&T (T) offers nearly a 7% yield?

The explanation is found within the dividend triangle. Ignore the dividend payment for a second and concentrate on the business’ health. What makes a business great? Growth. I look at revenue growth (ability to generate more sales) and EPS growth (ability to generate more profit). It’s a bit simplistic, but businesses that consistently grow their sales and profits tend to be good investments.

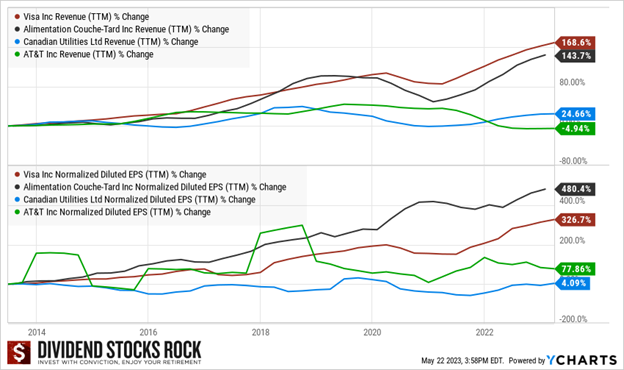

Below you can see the evolution of revenue and EPS for two low-yield, high growth stocks (Visa & Alimentation Couche-Tard) vs. two high yield, low growth stocks (AT&T and Canadian Utilities). This reveals that low-yield, high-growth stocks show a strong ability to grow their sales; and they’re even better at growing their profits.

Low Yield, High Growth Outperform High Yield in Revenue and EPS Progression

Both Visa & Alimentation Couche-Tard enjoy strong growth vectors and are able to expand their margins along the way. They’re growth stocks that happen to pay a dividend. The dividend is small because they’re growing very fast, often at double-digit rates.

In contrast, high-yield, low-growth stocks are mature businesses with limited growth potential. Some try to make changes to generate growth, but it doesn’t always work. AT&T completely failed when it attempted to participate in the media & entertainment industry, only to cut its dividend and spin-off its media segment.

In Closing

You’ll be better served in retirement if you look at total return rather than focus solely on dividend yield. Create a blended retirement portfolio that strikes a balance between low yield, high growth stocks and quality higher-yield stocks.

More By This Author:

Buy List – October 2023: Essex Property TrustMore About The Importance Of Cash From Operations

Financial Concepts To Better Understand Cash Flow