Looking Ahead Of Wall Street: Cisco Systems, Shake Shack, King Digital Entertainment

Earnings season is continuing to roll on as three big companies are reporting this week. What should investors be looking for?

Cisco Systems (NASDAQ: CSCO):

Technology company Cisco Systems will announce it's third quarter 2015 earnings results on Wednesday, May 13 before the market opens. The company is expected to post earnings of $0.53 a share and $11.54 billion in revenue, up from $0.46 earnings per share and $11.5 billion in revenue the same quarter a year prior.

Cisco System’s transition into cloud computing has allowed the company to grow beyond it's traditional area of routers and switches. In it's Q2 2015 report on February 11 of this year, Cisco saw a 40% increase in it's earnings driven by data relevant product and services. Cisco also reported that it's Unified Computing System data center platform had been adopted by more than 41,000 customers.

However, in the third quarter Cisco faced a few hurdles including troubles in it's typically well-performing switching business, inconsistent demand from telecom carriers, and it's instability in emerging markets. Despite this, analysts are generally confident on Cisco Systems ability to overcome these headwinds.

On average, the top analyst consensus for Cisco Systems on TipRanks is Moderate Buy.

Shake Shack (NYSE: SHAK):

Hamburger restaurant chain Shake Shack is set to announce it's first quarter 2015 earnings results on Wednesday, May 13 after market close. Analysts expects the company to post a loss of ($0.03) a share.

The company currently operates just 63 restaurants in nine different countries, with 16 of them located in the metropolitan New York City area. The company said it plans to expand slowly with a goal to open 10 new locations in the United States every year, as well as add more international locations.

Shake Shack shares have not been doing so well lately, having fallen more than 12% on Thursday, May 7. Investors began to question the stock’s valuation back in March due to the measured growth strategy presented by CEO Randy Garutti and Chairman Danny Meyer. Consequently, excitement for the stock has worn off and the stock has dropped.

On average, the top analyst consensus for Shake Shack on TipRanks is Hold.

King Digital Entertainment (NYSE: KING):

Mobile game maker King Digital Entertainment is slated to announce first quarter 2015 earnings on Thursday, May 14 after market close. Wall Street expects the company to post earnings of $0.46 a share, up from $0.41 earnings per share the same quarter last year.

In the last quarter, King Digital posted earnings of $0.57 per share, beating analysts’ estimates by $0.10, but also marking an 11% decrease from the same quarter a year prior. The company posted adjusted revenue of $559.2 million, down from $601.4 million year-over year, but coming ahead of analysts’ consensus estimate of $519.93 million.

King Digital received a big boost in downloads for the sequel to it's wildly popular game, Candy Crush, which picked the company up from out of a deepening hole. The company has said the success of the second Candy Crush game proves it's ability to create popular games and extend the lifespan of it's brands.

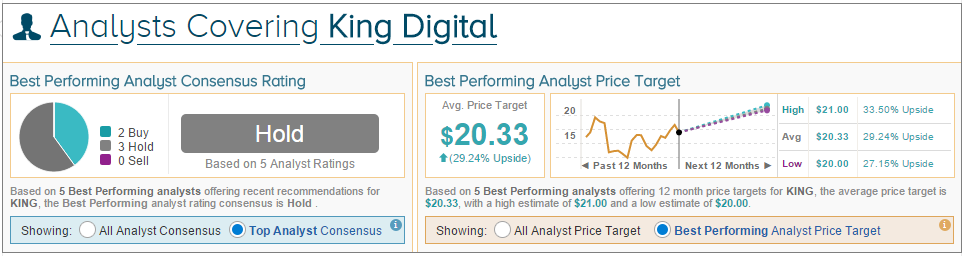

On average, the top analyst consensus for King Digital Entertainment on TipRanks is Hold.

Disclosure:To see more visit more