Looking Ahead Of Wall Street: Alcoa Inc., PepsiCo Inc. And Walgreens Boots Alliance Inc.

The new earnings season officially kicks off this week with three big players scheduled to announce quarterly reports. Find out what to look for in Alcoa Inc. (NYSE:AA), PepsiCo Inc. (NYSE:PEP), and Walgreens Boots Alliance Inc. (NASDAQ:WBA).

Alcoa Inc:

Alcoa will announce its second quarter 2015 earnings results on Wednesday, July 9 after market close. Analysts expect the company to post earnings of $0.23 a share and $5.79 billion on revenue, up from $0.18 earnings per share but down from $5.84 billion in revenue from the same quarter a year prior.

It is worth noting the analyst EPS estimate for Alcoa has fallen from $0.26 over the past 60 days, however Wall Street has a history of underestimating the company’s EPS over the past four consecutive quarters.

With that said, Alcoa shares have not been in the best position lately as the stock price has been lingering around its 52-week low of $10.94, last closing at $11.07. In an effort to boost shares and expand its business, the aluminum producer has been exploring 3-D printing jet engine parts.

Additionally, Alcoa acquired titanium and specialty metals producer RTI earlier this year, paying 13 times EBITA. The acquisition was one of the factors that drove the company’s earnings per share down in the past quarter.

Out of 10 analysts polled by TipRanks, six analysts are bullish on Alcoa and four analysts are neutral. The stock’s 12-month average price target is $16.89, marking a potential upside of 52.16% from where the stock is currently trading. On average, the all-analyst consensus for AA is Moderate Buy.

Click on picture to enlarge

PepsiCo Inc.:

PepsiCo is slated to announce second quarter 2015 earnings results on Thursday, July 9 before the market opens. The snack and beverage company is expected to post earnings of $1.24 per share and $15.8 billion in revenue, down from $1.32 earnings per share and $16.89 billion in revenue from the same quarter last year.

While the estimated EPS for Pepsi marks an eight cent decrease from the same quarter last year, the company has beat earnings expectations for the past four consecutive quarters.

The decrease in earnings and revenue expectations comes at a time when the soda industry is undergoing big changes. For example, Pepsi is currently in the midst of launching a new brand of beverages called “Stubborn Soda,” which is intended to be a move towards craft soda. With the rise in popularity with craft beers, Pepsi’s intention is to appeal to the same crowd with craft soft drinks.

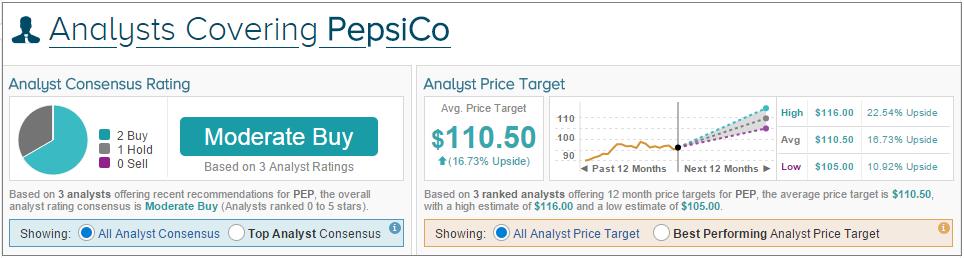

Out of three analysts polled by TipRanks, two are bullish on Pepsi and one is neutral. The average 12-month price target for Pepsi is $110.50, marking a 16.73% potential upside from where the stock is currently trading. On average, the all-analyst consensus for PEP is Moderate Buy.

Click on picture to enlarge

Walgreens Boots Alliance Inc.:

Walgreens Boots Alliance is set to announce its third quarter fiscal 2015 earnings results on Thursday, July 9 before the market opens. The company is expected to post earnings of $0.87 a share and $29.67 billion in revenue, down from $0.91 earnings per share but up from $19.4 billion in revenue year-over-year.

This will be the second earnings report since American drug store chain Walgreens successfully merged with a European drugstore chain Alliance Boots, creating Walgreens Boots Alliance.

In the third quarter, the company hit a post-merger all-time high of $93.42 and remains as one of the most popular retailers in the United States.

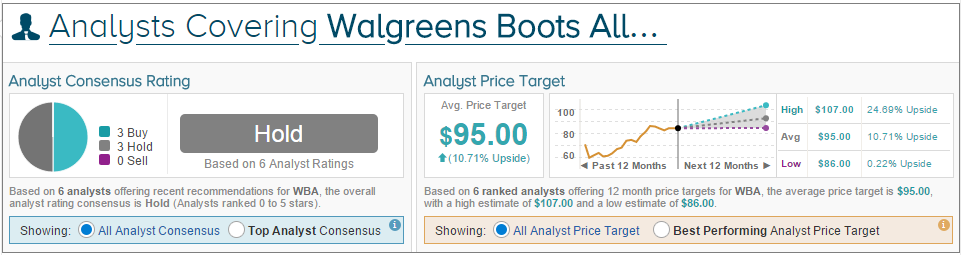

Out of six analysts polled by TipRanks, three are bullish on Walgreens Boots Alliance and three are neutral on the stock. The 12-month average price target for Walgreens is $95, marking a potential upside of 10.71% from where the stock is currently trading. On average, the all-analyst consensus for WBA is Hold.

Click on picture to enlarge

Disclosure: To see more, visit more