Long Beach And Los Angeles Shipping Backlog Ends

If you have no idea of what a container ship looks like when loaded with containers, here is one example. I have no idea what port this one may be pulling into.

Image via AngryBear

The backside of the container ship has 178 containers with the top corners empty. If you had the time and the know-how, I imagine you could spell something back there using the different colors. Depending on the size of the ship, you could stack 15,000 to 24,000 containers on a ship. Mostly 40 footers

and high cube. This article discusses the container backlog in LA and Long Beach. Supposedly it ended or at least capacity meets normal demand again. Until the next surge in demand occurs.

What was going on In LA and Long Beach?

The backup of container ships off Southern California’s coast that was at the heart of U.S. supply chain congestion during the Covid-19 pandemic has effectively disappeared.

The queue of ships waiting to unload at the ports of Los Angeles and Long Beach fell from a peak of 109 ships in January to four vessels this week, according to the Marine Exchange of Southern California. Shipping specialists say fewer ships than normal are heading to the main U.S. gateway complex for imports from Asia in coming days and that cargo volumes that had long swamped the ports now are receding.

LA and Long Beach Cleared Up its Backlog. Other places?

Bottlenecks continue to delay cargo at other major U.S. seaports and at inland freight hubs, but the end of the backup at the big ports in California signals broader supply-chain tangles troubling retailers and manufacturers are unwinding.

Deputy Director of the National Economic Council who leads the White House Task Force on supply-chain disruptions. Sameera Fazili:

“Clearly it is good given how much these supply-chain constraints were drivers of inflation last year.”

Port and Biden’s administration officials point to a range of factors that have helped ease congestion, including a tighter queuing system. Ships were lining up further out in the Pacific. New container yards freed up space on docks. Government initiatives fostered better collaboration between retailers, ports, railroads and truckers.

Why did the backlog dissipate?

The biggest gain potentially came from fewer containers landing in the busiest U.S. seaport complex for container imports. U.S. import volumes are declining, according to trade data analysts, and a growing share of the shipments are heading to other ports including the East and Gulf coasts. Importing goods to other than Southern California. Much of this was the result of stimulus money placed in consumers hands which did not happen during the 2008 recession. Biden uses his experience as a VP during the 2008 period.

The ports of Los Angeles and Long Beach together handled 686,133 loaded import containers in September. According to port figures, this is down 18% from a year earlier and the lowest level since June 2020. August imports fell 12% from last year, a steep drop during the traditional peak shipping season.

Ports including Savannah, Ga., Houston and New York and New Jersey have coped with backups triggered by the diverted cargo. In recent months, the big-box retailers have canceled many orders after a rush of orders earlier in the year. Changing consumer buying patterns left the merchants overstocked.

What is happening with Demand?

The data analysis group Descartes Datamyne, owned by supply-chain software company Descartes Systems Group Inc.:

Container imports to the U.S. in September declined by 11% from a year earlier and by 12.4% from August.

With decreasing and pent-up demand slowing, shipping lines have canceled between 26% to 31% of their sailings across the Pacific over the coming weeks, according to Sea-Intelligence. The Denmark-based shipping data group, indicating carriers are preparing for a continued drop in bookings. The daily backup of container ships waiting off the ports of Los Angeles and Long Beach during the pandemic has decreased. Pre-pandemic, it was unusual for more than a few ships to wait for a berth.

The Southern California backup began on Oct. 15, 2020, when the Marine Exchange reported five ships were queuing to unload at the Los Angeles-Long Beach complex. This was an unusual number compared with the one or two ships sometimes having to wait. The queue eventually swelled to dozens of ships. The shipping containers spilled out from the overfilled ports the products Americans stuck at home under Covid-19 restrictions ordered. Massive volumes of household goods, office equipment and electronics spurring a 20% surge in imports in 2021.

At one point, Port of Los Angeles Executive Director Gene Seroka surveyed the scene by helicopter from the port complex to Ontario, CA. and nearly 60 miles from the coast.

“You could see containers piled up everywhere. It was amazing.”

A Global Issue and Costs

Backups also hit other U.S. ports as well. Seaports in Europe and Asia were experiencing delays cascading across shipping and tied up vessels as companies sought space to move their goods. By January 2022, only 31% of container ships arrived at ports on time. This was down ~ 70% pre-pandemic, according to Sea-Intelligence.

The backups delayed deliveries of furniture, appliances and household goods to consumers and drove up ocean shipping rates to record prices, which helped push inflation in the U.S. toward a four-decade high.

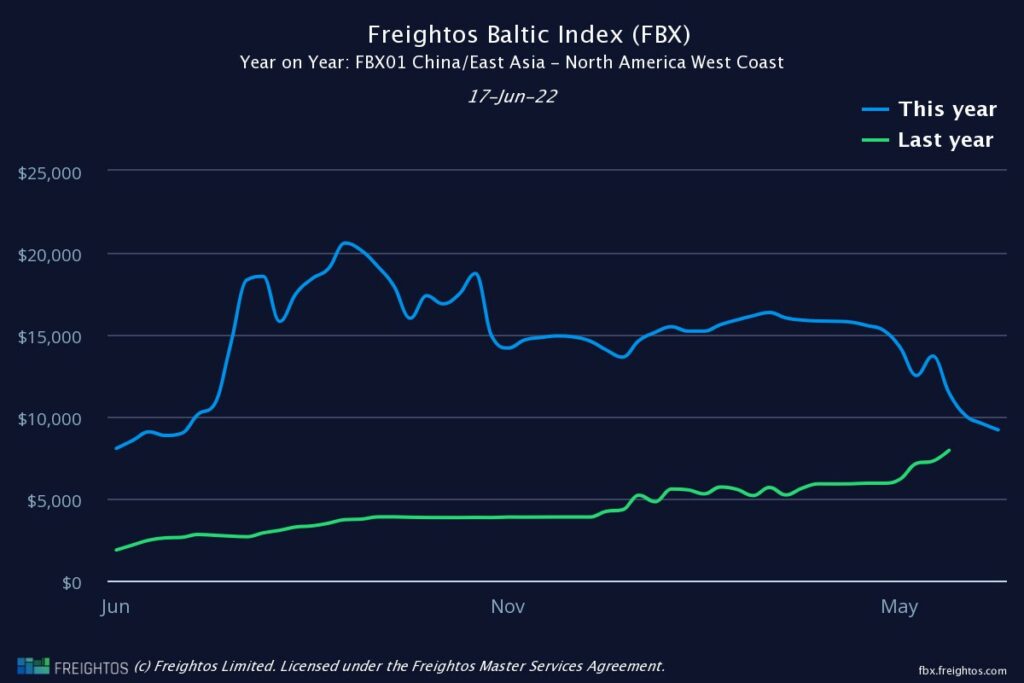

By September 2021, the average cost for shipping a container from Asia to the U.S. West Coast exceeded $20,000, a sixfold increase from a year earlier, according to the Freightos Baltic Index. Last week, the average cost to ship a container from Asia to the U.S. West Coast had declined 84% from a year earlier to $2,720.

The cost of container shipping increased dramatically over the last couple of years. However, rates appear to be stabilizing (at least for now). While in September 2021, it could cost over $20,000 to ship a container from China to the United States West Coast. In June 2022 the prices is half of what it was at $9,500. This rate is still 4x higher than in June 2020 when container shipping rates from China to the United States was around $2,500.

My experience has been, shipping either way using high cube 40 footers was anywhere from $3800 to $4200 depending on which way you were shipping.

More By This Author:

A Stale Beveridge DebateAre You Better Off Now Than During The 2008 Recession?

World Crop Quick Update