Leading Economic Index Joins The "V-Shaped" Data Recovery

Last week the Conference Board released their report on the Leading Economic Index (LEI) along with data on the Coincident Economic Index (COI). The LEI rose 2.8% in May after falling 7.5% in March and down 6.1% in April. The report notes the improvement in unemployment insurance claims accounts for about two-thirds of the LEI improvement. With consumers representing a large part of the economy, an improvement in the job market is important. Three of the ten components that go into the LEI calculation are suggesting weaker economic conditions, one being the new orders component. The Coincident Indicator rose 1.1% after falling 2.2% in March and down 10.4% in April. In evaluating the ratio of the LEI to the COI, one can clearly see the "V-shaped" rebound occurring with this data metric. A trend reversal with this ratio tends to occur as the economy looks to be recovering.

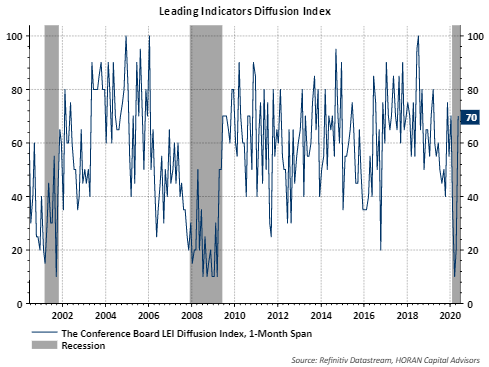

As noted earlier, three of the ten components of the LEI were detractors from the index. In other words, seven of the ten were positive, resulting in the diffusion index equaling 70%. The rebound in the diffusion index is another sign of improving economic data.

Certainly, news around the virus is making headlines. However, as more states and their economies open up, an improving economic environment becomes more sustainable.