Large-Cap Stocks Continue To Lead US Equity Factors In 2023

Large-cap shares remains on track to dominate US equity factor performance for 2023, based on a set of ETFs through Wednesday’s close (Oct. 25). Within the large-cap space, technology shares are the driving force behind the outperformance.

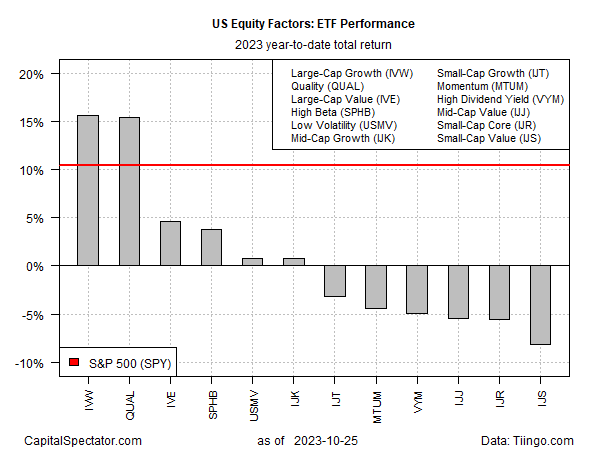

Year-to-date factor results are currently led by two upside outliers: large-cap growth (IVW) and quality (QUAL). Each fund is currently posting a 15%-plus gain for 2023, far above the rest of the field.

In a sign of the times, the value factor’s drag is conspicuous, even within the large-cap space. The third-strongest factor performance this year is large-cap value, but IVE’s 4.6% year-to-date gain is far below the rise for large-cap growth (IVW) and its quality-focused counterpart (QUAL).

Another striking trend in equity factor horse race this year is the widespread weakness for small-cap stocks. All three varieties – growth (IJT), core (IJR) and value (IJS) – are posting losses year to date.

Yahoo Finance notes that “an interest rate tightening cycle has raised the cost of capital and punished companies with smaller market capitalizations that often have more volatile balance sheets and financing needs than their larger peers.” The article relates that a JPMorgan study finds that by the end of 2021, 40% of companies in the Russell 2000 small-cap index were unprofitable.

Earlier this month, researchers at Bank of America advised: “”Despite the fastest hiking cycle in 40+ years, we believe the impact to S&P 500 earnings will be manageable. The real risk is in the Russell 2000.”

The bullish aura from Big Tech has been a clear advantage for large-cap shares, and for US-foreign comparisons. FT this week reports: “Seven large US tech companies have driven all of the gains in global stocks this year, pushing the US dominance of equity markets to new heights. The so-called ‘magnificent seven’ — Apple, Microsoft, Meta, Amazon, Alphabet, Nvidia and Tesla — have been propping up the S&P 500 index of blue-chip US companies for most of the year because of investor excitement about the growth of artificial intelligence.”

The degree of the tech effect in year-to-date results is crystal clear when comparing the iShares Technology ETF (XLK) to the top-performing factor funds in 2023.

The main takeaway: Big Tech is at once a growth factor and a large-cap factor, and the combination is unbeatable, at least so far. Indeed, tech-sector weights are the outsized leader for the big-cap growth (IVW) and quality (QUAL). For now, all roads to outperformance run through the Magnificent Seven Empire.

More By This Author:

US Soft-Landing Odds Rise As Q3 GDP Nowcast Ticks UpMarket Sentiment Suggests Fed Funds Rate Has Peaked… Again

US Stocks’ Upside Outlier Performance In 2023 Looks Vulnerable

Disclosure: None.