KraneShares Global Carbon ETF

In this Correction period for stocks, particularly technology and “innovation and disruption” stocks, carbon credits (KRBN) stand out as strong in comparison. Where I have discretion, I have added it to portfolios.

On April 23, I made a general recommendation (text of that note is provided below as an addendum to this note) which you may want to consider. As always, anything I recommend, I also purchase. I have high confidence in the future of carbon credit pricing. My KRBN position is around 3%

KraneShares Global Carbon ETF (KRBN), which tracks the IHI Markit Global Carbon ETF, invests in futures contracts based on the carbon credits prices in Europe (inception 2005), 10 Northeastern states (inception 2009) and California (inception 2013). Learn more about credits in the addendum below.

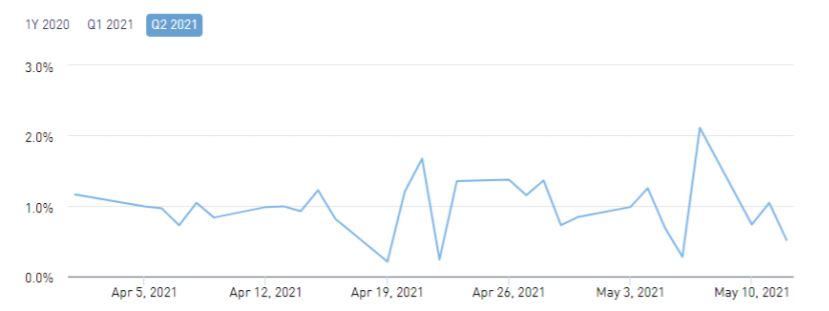

KRBN trading volume was minimal until the current administration in Washington announced plans to rejoin the Paris Agreement on climate change. The volume picked up dramatically when the United States officially rejoined the Agreement. The carbon credits markets preceded the original Paris Agreement and proceeded uninterrupted during the last few years when the United States withdrew from the Agreement. The credits market is independent of the U.S. federal participation in the Agreement. Europe is committed to their carbon credits program, and the credits programs in the United States are operated by the States not the Federal government.

The world bank predicts a price of at least $50 per ton of emitted CO2 and perhaps $100 per ton if the CO2 targets are to be met by 2030. The most recent price of the credits is about $35. The price was $31.57 at the time of my April 23 recommendation.

Carbon credits have a tailwind of government intentions to make them increasingly scarce and increasingly expensive. No other equity asset in our portfolios has a comparatively strong positive government tailwind.

The fund had $324,444,503 in total assets as of 05/12/21, which is a strong market adoption rate for a new fund less than 1 year old (inception 07/30/21). [AUM update 05/13/21: $337,723,721]

I reiterate my recommendation of this fund as a portfolio correlation diversifier with high likelihood of attractive price appreciation over the long-term.

The nice-looking chart below shows the price of KRBN from its inception July 30,2020, with the daily volume in green histogram bars below the price panel. The outer boundaries of the shaded areas around the price are 1, 2 and 3 standard deviations from the 50-day moving average.

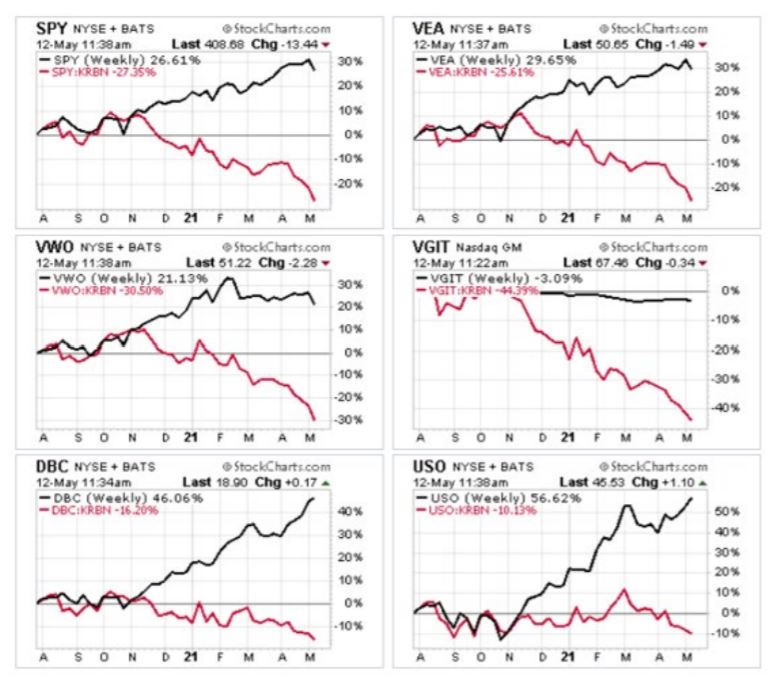

The fund has outperformed the S&P 500, global diversified commodities, crude oil, and natural gas as shown in the 4 panels below where the performance of KRBN is divided by the performance of the other asset.

This set of chart shows the performance of six key assets in black, and the performance of each asset versus KRBN in red. In each case the position of the red line (asset performance divided by KRBN performance) is below the zero line, showing KRBN to be the outperformer.

The key assets outperformed by KBRN are:

• (SPY) S&P 500

• (VEA) Developed stock markets ex-USA

• (VWO) Emerging markets stocks

• (VGIT) Intermediate-term US Treasuries

• (DBC) Diversified global commodities

• (USO) Crude oil

KRBN has been trading at a premium to the underlying index since inception. I don’t have a good idea on whether its premium will persist or be moderated as the credits market and the fund grow. However, I do not expect the premium (or discounts) to become valuation problems over any moderate holding period.

The global carbon credits index itself was created in 2016 and is shown below. It did have a flattish period in the last half of 2018 and in 2019; and it did take a dive when COVID struck.

While the long-term trend for carbon credits price is clearly up in historical fact and highly likely in political future, the price of credits will moderate or decline when the economy weakens or declines, because the demand for energy weakens or declines, and thus the demand for the “license” to emit CO2 moderates or declines.

On balance, however, economies rise over time, and governments intend to squeeze CO2 emitters, making carbon credits an interesting and valuable portfolio addition.

Disclaimer: "QVM Invest”, “QVM Research” are service marks of QVM Group LLC. QVM Group LLC is a registered investment advisor.

Important Note: This report is for ...

more