Kimco: Good Yield, Bad “Dividend Quality”, I Pass

Kimco appeared in a screen I wrote about in a 7/5/18 blog post that searched for high-yielding good-quality REITs. At first glance, I liked Kimco but when I looked under the hood of its distributions, my like turned to hate, so much so, I’m going to revise the screen to make sure REITs like Kimco are excluded.

First Thing Frist

I don’t hate that Kimco is a retail REIT. Specifically, it owns local open-air shopping centers with merchants-tenants geared toward convenience, services and omnichannel retailing. Yes, there’s been a ton of hand-wringing about Amazon and the e-commerce apocalypse it unleashed on brick and mortar retailing, and there are, indeed, a lot of merchants that are being badly hurt. I get all that. But what we actually have is disruption, not destruction. The latter means everybody is doomed. The former means change and that those who adapt will be fine, and those who don’t will not.

For more on my views regarding the type of retailing Kimco caters to, and the merits of investing in it via the REIT vehicle, see my recent post on Brixmor (BRX). In fact, my initial draft of that post wasn’t just for Brixmor; I initially wrote about both Brixmor and Kimco and adopted bullish stances on both. Kimco’s cash on cash returns (my REIT-oriented version of an important real estate metric) wasn’t nearly as strong as those of Brixmor, but it was just passable under my screen, and Kimco’s use of debt was less aggressive than the case with Brixmor. And Kimco had a higher yield . . . sort of . . .

REIT Yields Can Be Tricky

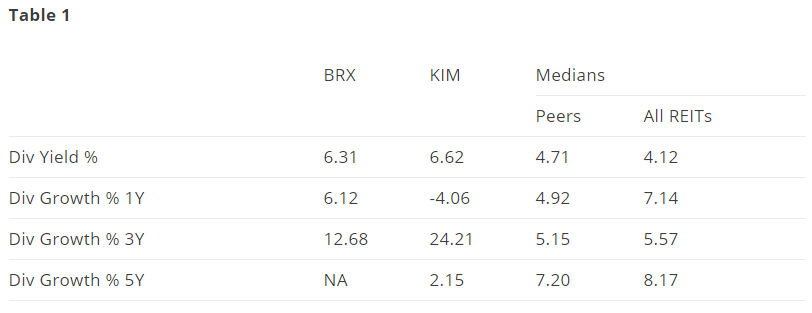

Table 1, which I intended to use in the BRX-KIM post, shows how easily REIT investors can go astray when it comes to yield.

(Click on image to enlarge)

Data from S&P Compustat via Portfolio123.com and reflects Compustat standardization protocols, TTM = Trailing 12 Months, MRQ = Most Recent Quarter. The Peer group refers to Retail REITs.

KIn the second row of the Table, Kimco shows a reduction in the dividend in 2017. Say what!!!!!

Most sources, including the Kimco Investor Relations website, paint a different and much more favorable picture. There could be a data error, as many might be quick to assume, but data collection and distribution is pretty sophisticated nowadays, and that drove me to dig. When something doesn’t look quite right, I double check myself, often aggressively, before writing up a support ticket at the data provider.

Actually, it didn’t take much digging for me to find the solution here. It’s in a document REITs release only after the close of a calendar year, the document showing the tax treatment of yields; i.e. the document that shows how much of the dividend (strictly speaking, distribution) comes from ordinary income and how much comes from other sources; returns on capital, capital gains, and something called an Unrecaptured Section1250 (a tax thing related to property sales the details of which can easily be Googled if you’re really into it).

Because quarterly dividend releases don’t break down the components of the distribution, we live in a world in which quarterly dividend information can turn out to be incomparable to annual numbers. (Attention regulators and accountants: How about waking the @$&# up and doing something about this!)

It’s not usually an investment buster since asset selling is a recurring part of a REITs business, meaning capital gains and 1250 distributions, although less predictable than distributions from ordinary income, can usually be tolerated. As I said before, REITs aren’t corporations. As pass-through entities in which the shareholders are closer to the business results, ebbs and flows will be more felt.

Kimco is turning over it shopping center portfolio so it has capital gains and 1250 recaptures. That’s fine.

But it has a lot of something else I don’t like; pure unadulterated returns of capital. Lately, its shown itself willing to act just like a mutual fund or a closed-end fund that wants to “manage” its dividend (i.e. when it can’t afford to maintain the dividend, it returns some capital in a form that looks, smells and feels just like a regular dividend unless and until somebody gets the tax treatment documents).

REIT Returns of Capital

What makes this so pleasant, from the standpoint of a REIT that wants to look good, is that sources that publish yields typically use information from quarterly dividend releases, so they have no way of showing that Kimco’s yield from good-quality distributions (ordinary income, capital gains, and 1250 recaptures) is a heck of a lot lower than 6.6%. It’s about 3.7%. And by the way, even this is a wild-a**-guestimate based on the 2017 numbers. We have no idea what the 2018 breakout is and we won’t until; Kimco releases the next tax-treatment document in January 2019.

So how big a problem is this?

Well, from a shareholder tax perspective, it might actually be pretty darn good. Returns of capital do not count as ordinary income, short-term gains or long-term gains. You can ignore them when you fill out your returns for the 2018 tax year. It’ll catch up to you eventually when you sell; returns of capital lower your cost basis and lead to larger capital gains or smaller capital losses — assuming you or your accountant keeps accurate records and that the IRS catches you if you don’t

So in one sense, what the heck. You’re getting back 6.6% of your income and with rates so low today, why on earth should anybody ask too many questions, especially when it’s all perfectly legal.

The problem is analogous to the what we refer to under the heading “earning quality,” the thing that scares the daylights out of investors. Earnings quality, strictly speaking, is not about ethics or fraud. (That’s a whole different thing.) It's about aggressive accounting practices that companies lawfully use to make reported earning look higher than they would if the CFO graduated with an only a 2.0 GPA and didn’t master all the fancy techniques. The problem with these aggressive accounting techniques — which, and I cannot emphasize this enough, are 100% legal — is sustainability in the future. The greater the use of aggressive accounting, the less predictable future earnings are because the data we use for analysis is filled with more things we can’t count on to recur down the road. Earnings quality research is all grounded in this notion; the notion of sustainability.

This is my problem with the return of capital distributions. We can’t project them as we can with income. This, by the way, is why so many good-yielding closed-end funds sell at big discounts to NAV. Investors regard return on capital, resorted to by the funds to try to get past periods when they can’t afford the full dividend, as a lesser quality payout.

Deconstructing Kimco’s Distributions

Nobody can hang Kimco because there’s stuff other than ordinary income in its distributions. This is so for many, perhaps most, REITs. Whether one can accept this or not depends on one’s view of what’s reasonable.

According to the NAREIT, a major REIT trade association, “On average, 76 percent of the annual dividends paid by REITs qualify as ordinary taxable income, 10 percent qualify as return of capital and 14 percent qualify as long-term capital gains.” My estimate of the ordinary income share doesn’t precisely match NAREIT but that’s OK: We’re in the same general ballpark and I don’t know NAREIT’s exact universe and measurement periods.

I don’t have data that breaks out the return of capital versus gains. For that, I have to look at tax-treatment releases and go anecdotally. For what it’s worth, my ad hoc examinations are in line with what NAREIT reports. What I can do with the data I can access is distinguish between regular dividends and other stuff (special dividends in the world of corporations but capital gains and returns of capital in the REIT world).

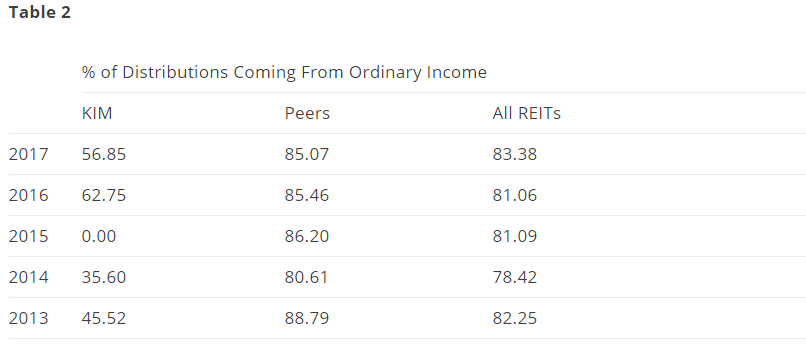

Table 2 deconstructs distributions, to the extent I can, for Kimco, retail REITs, and REITs in general.

(Click on image to enlarge)

How ‘bout Kimco’s 2015 figure! And how ‘bout the rest.

If you own or are bullish on Kimco because of the 6.6 yield and because you were comfortable that it could maintain, or possibly grow its distribution, how do you feel now?

Conclusion

I’m going to work on adjusting my screen to prevent situations like Kimco from making the cut. (Portfolio123 allows me to screen based on the deeper-level distribution breakouts we get each year). I won’t look to eliminate all non-ordinary-income items; as I said, it’s par for the course in this business. Even distribution cuts are OK here and there since unlike business corporations, REITs can’t build rainy day surpluses by retaining earnings. But I am going to aim for one or more rules that guard against non-income components being too much a portion of the distribution.

And by the way, Kimco may turn out to be a great opportunity. I love turnaround special situations. In retail, these can be tough as many struggling retailers tend to file for bankruptcy. But a retail REIT such as Kimco is different. Its ability to turn around will depend on how it leases up its malls, what merchants it gets and the rents they’ll pay. I sold Kimco because it failed to meet the spirit of the law of my screen (good yield, good quality). But I’ve been into retail a long time, having formerly covered the area. So I may look further into Kimco as a special situation and decide later to give it a go. But I won’t buy at a price that’s consistent with it being a good yielding high-quality income stock; if the market prices it that way, I’ll stay on the sidelines.

Disclosure: None.