Key Week For Bull/Bear Battle

Good News, Bad News

An encouraging economic report was released Monday, which increased concerns about a sooner rather than later Fed rate hike. From Reuters:

Consumer spending rose 0.5 percent last month after being unchanged in July, the Commerce Department said. The growth in August was just above the median forecast in a Reuters poll of economists…Even after adjusting for inflation, spending was 0.5 percent higher, the biggest gain since March. Growth in personal income ticked up 0.3 percent, in line with forecasts.

Big Picture Deteriorating

This week’s stock market video shows while the bulls are still in control, their margin of error is getting quite thin as interest rate concerns increase.

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

1994 Fears Linger

With the Fed signaling “considerable time” may be removed from their policy statement in the coming months, market participants are concerned about a 1994-like event taking place in late 2014 or early 2015. From Businessweek:

The last time consumer-price increases were slowing before the Fed started increasing borrowing costs was in 1994…“The critical example for the markets is 1994, and that’s the thing that we all fear,” Gary Pollack, the New York-based head of fixed-income trading at Deutsche Bank AG’s private wealth management unit.

Investment Implications – The Weight Of The Evidence

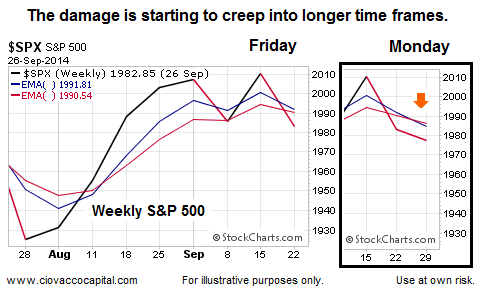

Our market model called for a reduction in our equity exposure last week based on evidence of waning economic and market confidence. As shown in the two weekly snapshots of the S&P 500 below, the market’s indecisiveness is starting to impact the intermediate-term trend in a negative manner.

Since the look of a weekly chart is much more important at the end of the week, the bulls do have some time to repair the damage. Therefore, we will continue to hold a mix of stocks SPY, leading sectors XLV, bonds TLT, and an offsetting position in cash until the evidence improves.

Two Big Reports Coming

If there was ever an economic report that could flip the bull/bear field, it would have to be the monthly employment report, which is coming this Friday. Wednesday brings the latest read on U.S. manufacturing activity.

Disclosure: None.