All eyes on President Biden's plan for the huge $3 trillion infrastructure package, something that won't be straightforward to get through Congress. We also expect US jobs numbers to improve again on better weather and reopenings.

Image Soruce: Shutterstock

US: Biden's massive infrastructure package will be a tough sell

With the ink on the $1.9tn fiscal relief plan barely dry, next week sees President Joe Biden push ahead with the $3tn Build Back Better green energy and infrastructure plan.

On Wednesday, he is heading to Pittsburgh to outline the strategy, which is centered on decarbonising US electricity production by 2050. There would be incentives and legislation surrounding energy-efficient buildings and vehicles with additional rail and road infrastructure investment. The money would also be provided to boost 5G and broadband internet access.

It looks as though these measures will be packaged up with higher taxes for corporates and top earners together with increased property and capital gains tax rates to “reward work, not wealth”.

The difficulty will be getting it passed by Congress, given the need for 60 Senators putting it forward for a vote. The Democrats got around this for the $1.9tn plan by using budget reconciliation processes, but it will be trickier for this massive infrastructure plan. It may need to be broken up into smaller packages and diluted to some extent should Republicans put up stiff opposition. It is not going to be an easy sell.

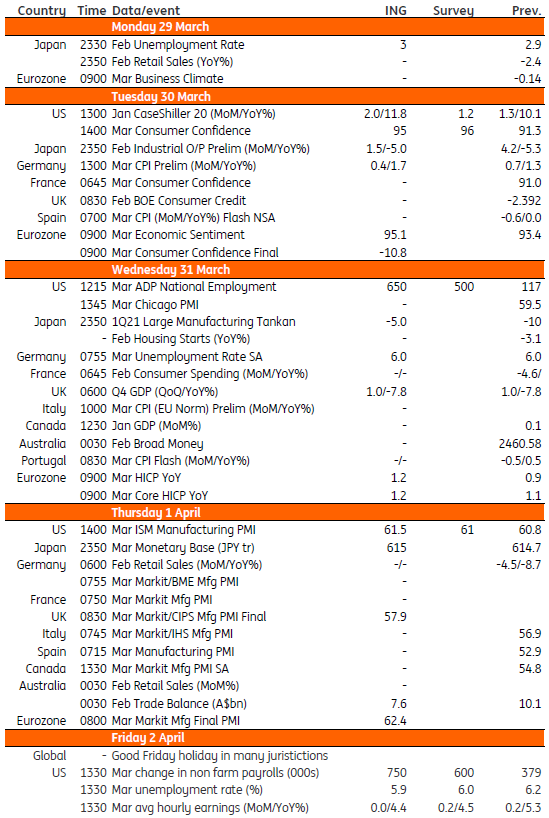

We also have a heavy data slate with the ISM index on Thursday, and the jobs report on Friday. Both should be very strong as better weather in March versus February, a strong vaccination programme rollout, and ongoing reopening steps taken by the individual states lift activity and the need for workers.

Nonetheless, the Fed will continue to make it clear that they won’t look to tighten policy until the economy has “all but fully recovered.”

Eurozone: Inflation set for further rise

Eurozone inflation is set to continue its rise on Wednesday when March figures are released. Expect food and energy prices to be the main drivers for now, although there is a chance that industrial goods prices will also increase more than expected due to supply chain issues and input shortages. Also important will be the breakdown of consumer confidence figures on Tuesday. Consumers have become more upbeat, but have their spending expectations also risen, with vaccinations likely to provide relief in the coming months?

Key events in developed markets next week

Refinitiv, ING

Disclosure: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclosure: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.

The problem with starting huge programs of any kind through creating huge taxes is that no matter what, there will always be provisions to exclude certain privelged groups from those taxes, and so the revenue will not be adequate. It has been that way forever and I don't see any peaceful way to change it. Very unfortunate. And certainly the federal reserve bank team would protect at least some of the stock market interests. So the end result will be rampant inflation.

So why is it that the mistakes made by parts of the government primarily injure those not involved in making those mistakes?

Let me remind folks that what got Mr Biden elected was not votes FOR him, but much more, votes AGAINST Mr Trump. THIS is why another choice is needed: "NONE of the Above!!!"

Too true.