Key Events In Developed Markets For The Week Of Oct. 10

Source: Shutterstock

Despite the headline rate of inflation being depressed in the US, core inflation continues to rise. We look for a 0.4% month-on-month increase in prices, nudging core inflation up to 6.5%. In the UK, next week's new jobs figure will be in focus, where we suspect the unemployment rate will notch a little higher

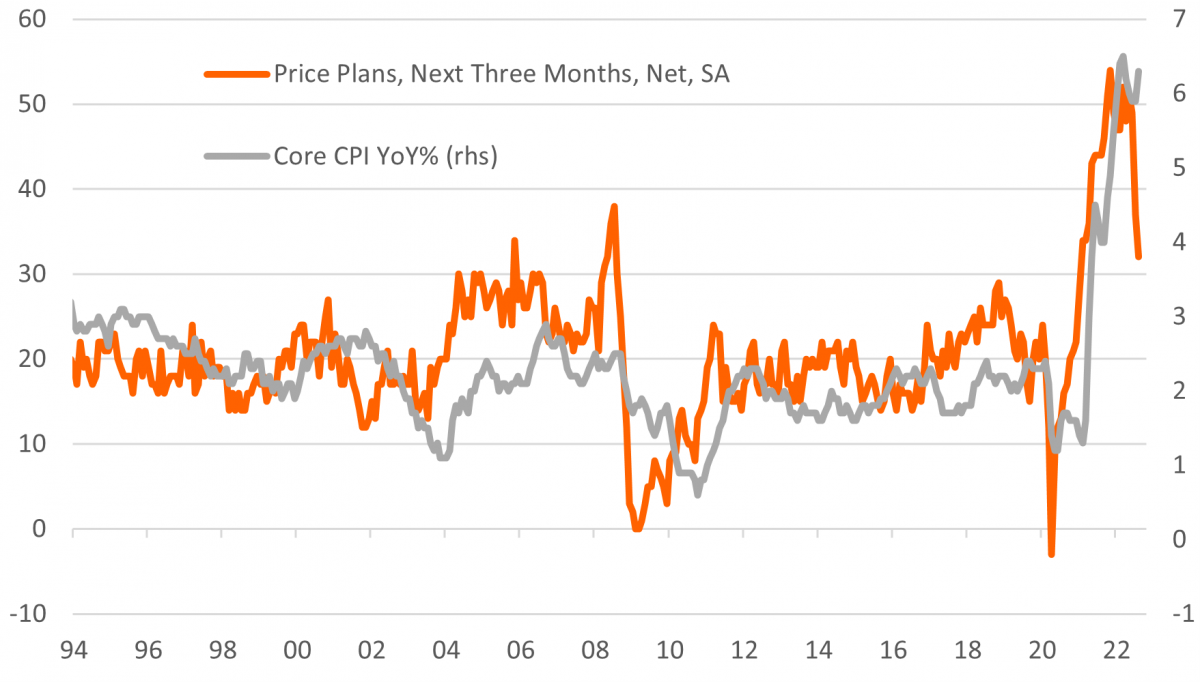

US: core inflation set to rise rapidly in the short term

The main US data report to watch next week will be consumer price inflation. The headline rate will be depressed by the lagged effects of the fall in gasoline prices, which is also likely to translate into lower airline fares to some extent. However, the core (ex food and energy) component is set to continue rising at a rapid pace. We look for a 0.4% MoM increase in prices, which would nudge the annual rate of core inflation up to 6.5% from 6.3% - remember it was down at “just” 5.9% in June and July. This unfavourable shift is primarily due to housing costs and recreation prices and should cement expectations for a fourth consecutive 75bp interest rate increase from the Federal Reserve on 2 November.

However, the medium-term outlook for inflation is looking more encouraging. Inflation expectations continue to fall back – we will get an update from the NY Federal Reserve Bank’s survey and the University of Michigan consumer sentiment report next week, which publish both short and longer-term consumer expectations of inflation – while corporate price plans appear to be rapidly declining. In this regard, we will be closely watching the NFIB small business optimism report. Within it, there is a series for the proportion of businesses that are looking to raise their prices in the coming period. Last month it plunged and as the chart below shows, it has historically had a great relationship with predictive power for core inflation. If it falls further this would give us more confidence that the Fed will hike rates more modestly in December given this softening inflation backdrop in an environment of weakening economic activity.

Also watch for retail sales. Auto sales rebounded and should provide a lift while gasoline will be less of a drag given a recent stabilisation in prices. We will also get the minutes of the Federal Reserve’s September FOMC meeting when they hiked rates 75bp.

Corporate price plans rapidly declining

(Click on image to enlarge)

Macrobond, ING

UK: jobs data in focus as BoE mulls huge November hike

The UK unemployment rate fell last month. This was driven not by a corresponding increase in employment but by another surge in the number of people classed as inactive – that’s neither in work nor actively seeking it. This is overwhelmingly because of an increase in long-term sickness, and it’s hard to escape the conclusion that this is linked to pressure in the health service. This is likely to be the dominant trend in next week’s new jobs figures, even if we suspect the unemployment rate will notch a little higher again. For the time being, the Bank of England will view all of this through the lens of worker shortages. The Bank’s latest survey of firms has shown another increase in wage growth expectations and no material improvement in the number of companies finding it hard to get staff. We’re expecting a 100bp rate hike in November, though this will partly depend on how sterling trades between now and then. If the situation calms, we wouldn’t rule out a 75bp move, not least because the committee is heavily divided.

Eurozone: expect the energy crisis to worsen the trade deficit

The eurozone focuses on industrial performance next week with industrial production and trade in goods data due to be released. The trade data continues to be dominated by the energy crisis. A trade surplus of around €20bn per month turned into a deficit of around €40bn in July as energy prices soared. With August seeing new highs reached for natural gas prices, expect the trade deficit to have increased. In terms of production, shutdowns due to high energy costs are likely to have had a significant effect already.

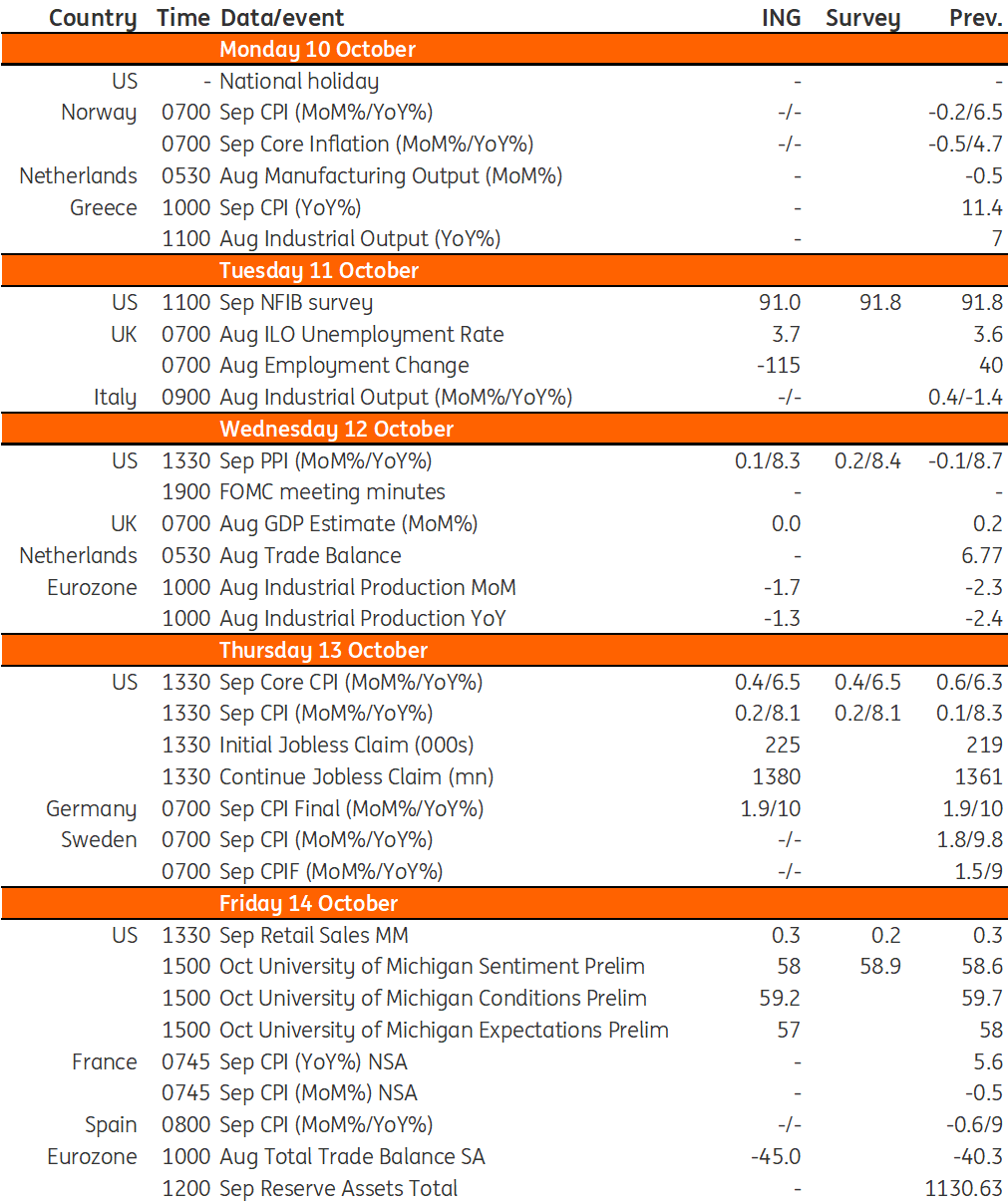

Key events in developed markets next week

(Click on image to enlarge)

Refinitiv, ING

More By This Author:

Key Events In EMEA For The Week Of Oct. 10Resilient US Jobs Market Backs The Case For Another 75bp Hike

The Commodities Feed: Oil Moves Higher

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more