Key Events In Developed Markets For The Week Of Monday, October 2

In the US, a government shutdown looks probable as Congress is deadlocked over an agreement to provide funding for the start of the fiscal year. Meanwhile, the Bank of England's Decision Maker Panel survey could help cement expectations for a November pause.

US: A government shutdown looks probable

A government shutdown now looks probable with Congress deadlocked over an agreement to provide funding for the start of the fiscal year from 1 October. So from next week, we could see upwards of 800,000 workers furloughed – sent home without pay – while hundreds of thousands of other 'essential' federal government workers including homeland security, prison staff, military and legal workers would be required to continue working despite not being paid. National parks and museums may close in many instances and businesses surrounding them would inevitably be impacted while contractors employed by the federal government will also see payments being delayed or lost completely. Consumer and business sentiment will take a hit and spending inevitably weakens during these episodes.

Historically, a government shutdown lasts perhaps one to two weeks and the economic fallout is typically quite limited. For example, the Office of Management and Budget estimated that the 16-day government shutdown in 2013 crimped third-quarter 2013 GDP by roughly 0.3 percentage points. The ready reckoner is that 0.1-0.2pp of quarterly annualised GDP growth is lost for every week the shutdown drags on, but the economy makes perhaps half of it back when there is an agreement and back pay is returned. In an extreme example of it lasting a couple of months with an agreement being reached by early December, we could be talking about a dent to GDP growth of nearly a full percentage point. Given consensus expectations are only 0.6% for fourth quarter annualised growth, this would run the very real risk of a negative GDP print for the quarter.

Another issue resulting from this is that many of the key official data releases will not be published, including this Friday’s jobs report from the Bureau for Labor Statistics. We’ve put it in the calendar and assumed a slight slowdown in hiring, but it could be several weeks before we actually see the real numbers. Consequently, we are going to focus more on third-party data releases, including the ISM reports. These are expected to continue pointing to modest GDP growth, with higher oil prices adding to near-term price pressures. Nonetheless, the lack of jobs data and potentially, inflation figures in subsequent weeks means that the Federal Reserve will not have as much information as it would like when it comes to policy decisions. Given the lack of clarity on the state of the economy, it would strengthen the case for the Fed to hold interest rates steady again in November. This would give more time for the economic slowdown we anticipate to emerge, and with core inflation likely to continue moderating, makes it all the more likely that the Fed’s hiking cycle is already over.

UK: Bank of England survey to help cement expectations for a November pause

There’s a distinct lack of data due between now and the Bank of England’s November meeting. So having paused the rate hike cycle in September, there’s not a huge amount that’s likely to prompt a different verdict in a few weeks' time. Another rate hike at the next meeting would probably require a big upside to either services inflation, wage growth, or perhaps both. That’s a couple of weeks off though, and next week we’re left with just the BoE’s Decision Maker Panel survey. This is something policymakers generally watch quite closely, and it’s been pointing to less aggressive price and wage rises among firms over recent months. Admittedly, the BoE has put less weight on surveys recently as the hard data has generally pointed the other way, but we think these are important forward-looking signals and point to improvements in the BoE’s favoured inflation metrics over coming months.

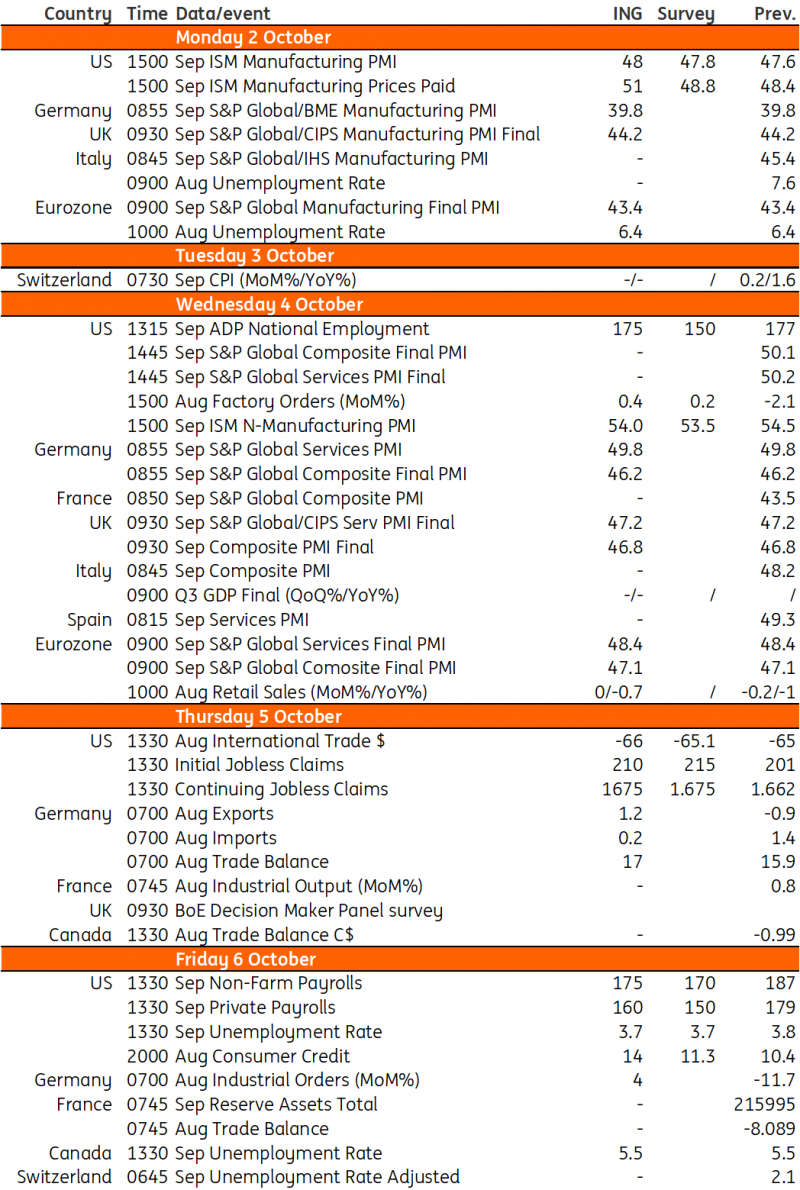

Key events in developed markets next week

(Click on image to enlarge)

More By This Author:

Key Events In EMEA For The Week Of Monday, October 2

Italian Inflation Continued To Decelerate In September

US Inflation Slows, But Higher Savings Mean A Resilient Consumer

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more