Key Events In Developed Markets And EMEA Next Week

We still favour a hawkish hold with the Federal Reserve leaving the door open to additional hikes –but if core inflation comes in above the 0.4% consensus on Tuesday, the odds will likely swing in favour of another increase. We see the European Central Bank continuing to raise rates by 25bp next week while keeping the door open for further hikes moving forward.

US: Favour a hawkish hold, but Tuesday's core inflation will be key

Next week is a major one for US economic events and data. The Federal Reserve’s FOMC meeting on Wednesday is the highlight. After the May 3rd decision – where Fed Chair Jerome Powell hinted that after 500bp of hikes in 14 months, they could pause at the June meeting – markets started to price in aggressive cuts for later in the year. However, over the subsequent 6 weeks, activity has remained resilient, inflation continues to run hot, payrolls jumped 339,000 and the Australian and Canadian central banks surprisingly hiked rates. Hawkish comments from a few Fed officials have added to the sense that they may not be done. Markets are currently pricing a 33% chance of a 25bp hike at the June meeting, while only around 1 in ten economists are looking for an increase.

There is an intense debate within the Fed and there is likely to be dissent, but we favour a hawkish hold, with the central bank leaving the door open to additional hikes if inflation fails to show signs of softening and the jobs market remains hot. However, should core inflation (released on Tuesday) come in at 0.5% month-on-month – or 0.6% rather than the 0.4% consensus expectation – then the odds would likely swing in favour of a hike on Wednesday, as the measure would be heading in completely the wrong direction.

The other major reports will be published after the Fed’s decision, with retail sales and industrial production due for release on Thursday and the University of Michigan consumer sentiment on Friday. Auto sales are likely to drag retail sales into negative territory. Meanwhile, industrial production is likely to come in flat to lower after a surprise 0.5% jump last month, given that the ISM manufacturing survey has been in contraction territory for seven straight months and lower oil and gas prices will have disincentivised oil and gas drilling activity.

UK: Wage growth key to Bank of England rate hike prospects

The news on wage growth has been getting slowly better recently, at least from the perspective of the Bank of England. Survey indicators suggest pay pressure is easing, while labour shortages appear to be less acute than they were a year ago. We expect the headline measure of wage growth, which excludes bonuses and compares the most recent three months to the same period last year, to edge higher – perhaps as far as 7%. But that’s partly a function of base effects, and if we look at a more timely measure of momentum in pay growth – comparing the latest three months to the three months prior – wage growth does appear to have peaked. The question is how long it will take to fall back towards pre-Covid levels, and we think this will be a slow process.

We expect a 25bp rate hike later this month, though for now, the jobs market data doesn’t scream the need for the Bank of England to take rates much higher than that. It does however suggest rate cuts are likely to take time to come through – and probably longer than in the US.

Eurozone: European Central Bank to hike rates by another 25bp

Macro developments since the May meeting have clearly had more to offer the doves than the hawks at the European Central Bank. Headline inflation has continued to come down but remains far off 2%, survey-based inflation expectations have also started to slow, growth has disappointed, and confidence indicators seem to have peaked. In previous times, such a backdrop would have been enough for the ECB to consider pausing rate hikes and waiting for the effects of the rate hikes so far to unfold fully. However, the central bank is now determined to err on the side of higher rates.

Despite recent decreases, actual headline and core inflation and expectations for a return to target in two years from now are clear arguments for the ECB to not only continue hiking by 25bp next week but also to keep the door open for rate hikes beyond then.

In terms of eurozone data, it’s set to be an interesting week. After revisions to GDP resulted in the mildest of recessions over the past two quarters, the question is whether the second quarter will show much of an uptick. Industrial data out this week should show an improving trade balance for April, helped by a stronger euro and lower energy prices.

Industrial production experienced a very weak March, but the potential for an uptick remains limited. For April, German data saw just a modest uptick, while the Netherlands and Spain posted sharp declines. As a result, our view of the eurozone economy over the second quarter isn't looking too strong for the time being.

Read our full preview here

Poland: Current account balance in surpluses

Current account balance (April): EUR1257mn

More favourable terms of trade (lower prices of imported commodities) and softer domestic demand (falling households consumption, destocking) underpinned improvement in Poland’s foreign trend balance in recent months. After the beginning of this year, Poland has been running current account surpluses. We forecast that in April, the external balance was in surplus of €1257mn. We expect that exports of goods jumped up by 8.3% YoY, while imports fell by 6.3% YoY. Improving the trade balance is one of the factors behind recent PLN firming.

Czech Republic: Last inflation number in double-digit territory

Inflation in the Czech Republic for May will be published on Monday. We expect a month-on-month stagnation after a 0.2% decline in April, which should translate into a big drop from 12.7% to 10.7% YoY, mainly due to base effects coming into play. In month-on-month terms, the main downward drivers are food (-1.0% MoM) and fuel (-4.2% MoM) prices. On the other hand, seasonal factors in tourism are pushing inflation up.

However, we do see downside risks, especially in food and housing prices which have the potential to collapse faster. In addition, inflation in Poland and Hungary is already indicating a clear downward bias for the May numbers. Looking ahead into June, we see a strong chance of inflation getting below 10%, confirming a quicker disinflationary pace than expected at the start of this year.

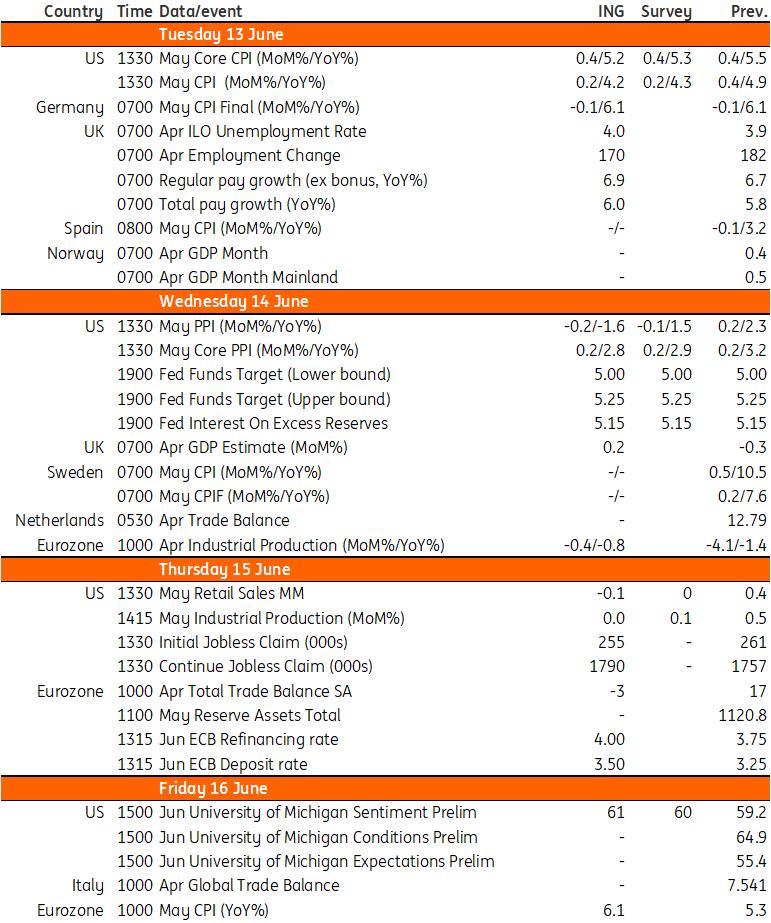

Key events in developed markets next week

(Click on image to enlarge)

Refinitiv, ING

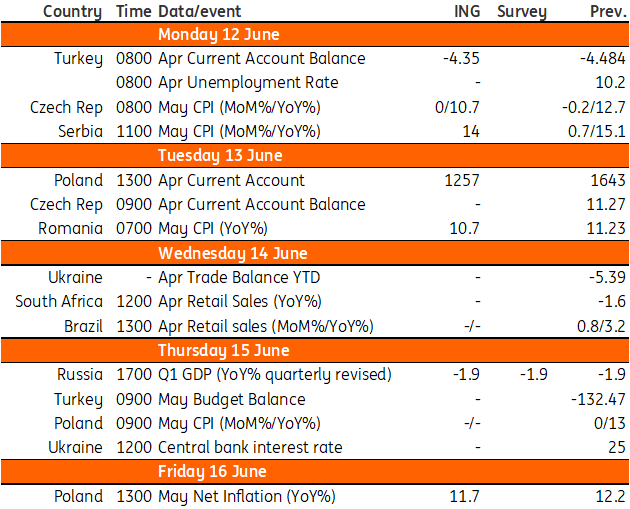

Key events in EMEA next week

Refinitiv, ING

Article written by: Adam Antoniak, James Knightley, James Smith, Carsten Brzeski, Bert Colijn and Frantisek Taborsky

More By This Author:

Fed Likely To Skip, But It’s Going To Be CloseFX Daily: Data sensitivity at its highest

Condensing Complex Macro Readings Into One Number For Rates

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more