Key Events In Developed Markets And EMEA For Next Week

Image Source: Pixabay

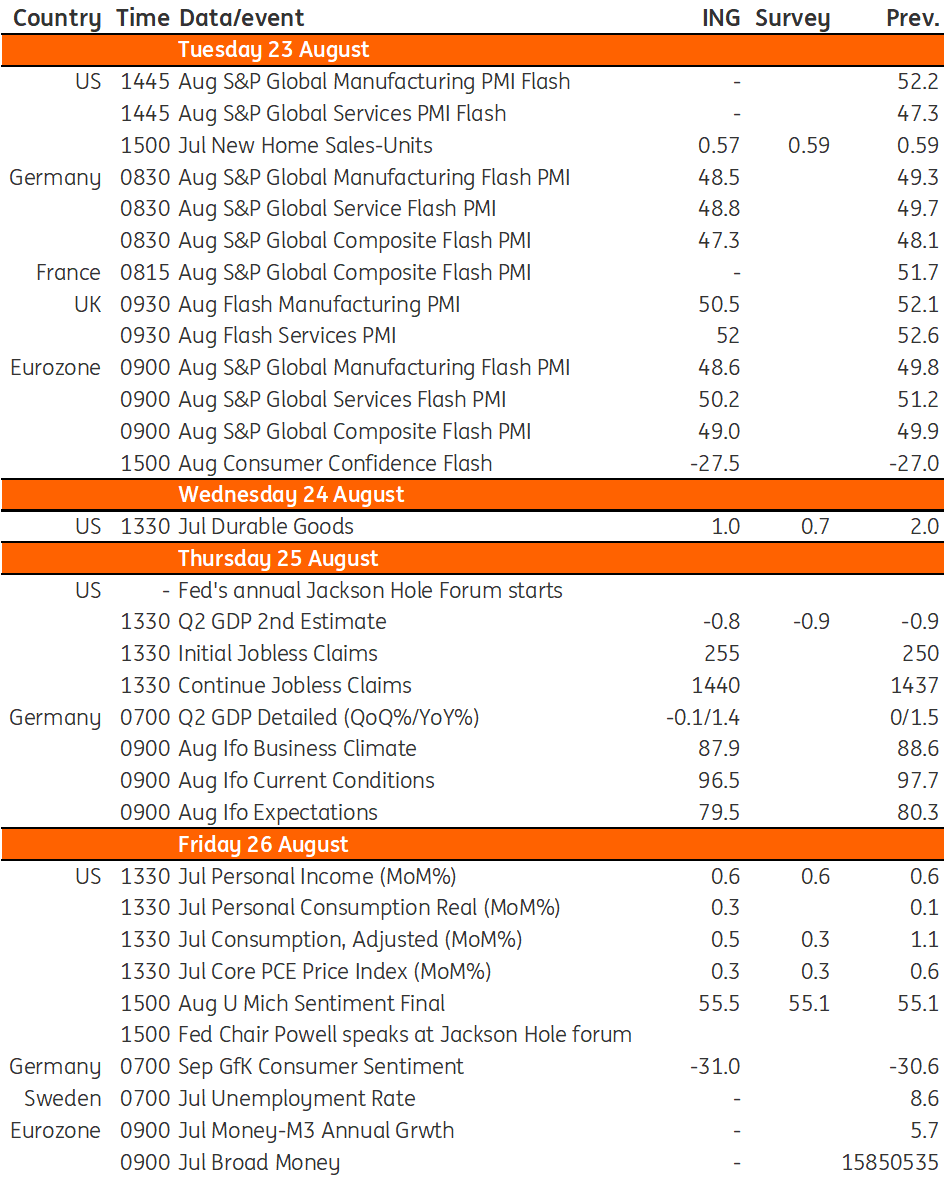

The key event next week is the Jackson Hole policy symposium, which should give a clearer view of the Fed's rate hike decisions. We expect 2Q GDP to revise upwards to -0.8%, with modest increases in consumer spending and retail sales. In the eurozone, August PMIs and consumer confidence data should indicate a further contraction in economic activity.

US: Second-quarter GDP expected to be revised modestly higher to -0.8%

The market remains split as to whether the Federal Reserve will hike rates by 50bp or 75bp on 21 September, but things may become clearer after the annual Jackson Hole policy symposium begins next Thursday which will see Fed officials and other global central bankers, finance ministers and academics converge in Wyoming. Fed chair Jerome Powell will give the keynote speech. However, even after this event, it is all to play for with the August jobs report to be published on 2 September and the August inflation report on 13 September. We currently favor 50bp moves in September and November with a final 25bp hike in December, but should payrolls rise strongly yet again (350k+) and inflation move upwards, then we would likely switch to a 75bp hike on 21 September.

The data calendar includes revisions to 2Q GDP, which was initially reported as -0.9%. We suspect that consumer spending could be revised modestly higher following the revisions in the retail sales report so are tentatively suggesting -0.8%. We will also get July consumer spending numbers, which should be OK with lower gasoline prices boosting household spending power, and supporting consumption elsewhere. Durable goods should also hold up, buoyed by robust Boeing aircraft order numbers.

Eurozone: The PMIs are expected to deteriorate further in August

Next week Tuesday will give a sense of where the eurozone economy is headed in August as both PMI and consumer confidence data will be out. The PMIs will be especially closely watched as the composite PMI dipped below 50 in July, indicating a contraction in economic activity. We expect a further deterioration for August as businesses and consumers struggle with even higher energy prices, and drought is adding to production problems in Germany. This will also impact consumer confidence, which had already dropped to an all-time low in July. Don’t rule out another new record for August.

Developed Markets Economic Calendar

Image Source: Refinitiv, ING

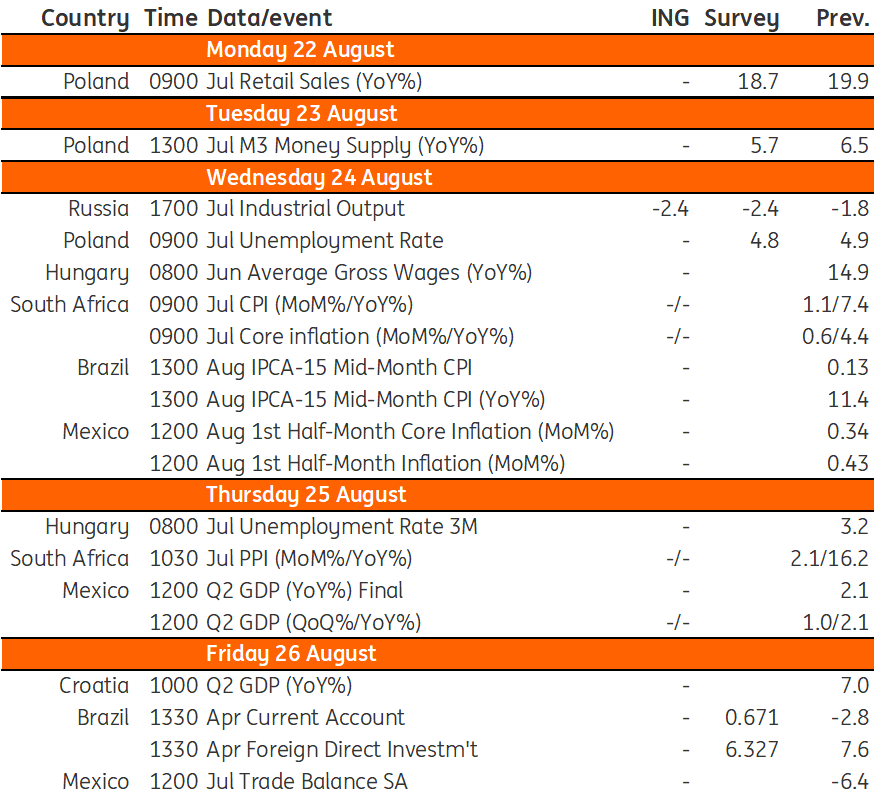

EMEA Economic Calendar

Image Source: Refinitiv, ING

More By This Author:

FX Daily: Silent End To A Loud Week

Central Bank Of Turkey Surprises With A 100bp Rate Cut

Asia Week Ahead: Key Central Bank Moves And Inflation Reports

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more