Key Events In Developed Markets And EMEA For The Week Of March 25

Image Source: Pixabay

Next week in the US, we'll see the Fed's favoured measure of inflation, the core PCE deflator. Here, we expect to see a few signs of weakness in real consumer spending. Over in Hungary, our view is that the NBH will deliver a 75bp cut, accompanied by some hawkish guidance on monetary policy strategy in the second quarter of 2024.

US: Potential for a second consecutive real consumer spending number

Having started to waver on the back of hotter-than-expected inflation prints, the March FOMC meeting and a relatively dovish assessment from Federal Reserve Chair Jerome Powell have reinvigorated the market’s belief that the Fed will deliver meaningful interest rate cuts this year, most likely starting at the June FOMC meeting. We will no doubt hear more from individual FOMC members on how they see the risks surrounding the central case view from the Fed of three 25bp rate cuts this year and three in 2025.

In terms of data, the main focus will be on the personal spending and income report. This also includes the Fed’s favoured measure of inflation, which is the core personal consumer expenditure deflator. In January, it rose 0.4% month-on-month, more than double the 0.17% MoM rate we need to consistently hit to bring the annual rate back to 2% over time. Given the CPI and PPI numbers that have already been released, the consensus is firmly backing a 0.3% outcome, which – while not ideal – is progress. Given that this is published on Good Friday when many offices will be closed, thin market conditions could mean outsized market moves on any data surprise. There is also potential for the report to signal the second consecutive negative MoM reading for real consumer spending.

Other numbers include new home sales and durable goods orders. Mortgage rates dropped in early February, and this has already lifted existing home sales. We expect new home sales to repeat this story. However, mortgage application numbers have subsequently dropped back, and actual transactions will do the same in March. Meanwhile, Boeing aircraft orders remain weak and will be something of a drag on overall durable goods orders growth.

Hungary: 75bp cut and hawkish guidance expected

The highlight in Hungary next week is the National Bank of Hungary's rate-setting meeting. February was a good opportunity for the NBH to accelerate easing, but we can’t say the same this time. Developments since the last meeting have been mixed and could again, in our view, justify a more cautious approach. We expect the central bank to deliver a 75bp cut, accompanied by some hawkish guidance on monetary policy strategy in the second quarter of 2024. The current account balance will deteriorate in the fourth quarter based on monthly statistics, possibly turning into a small deficit due to the slump in goods exports in December. The latest set of labour market data will be challenging to read. We expect strong wage growth to continue, with some deceleration due to base effects. On the other hand, we forecast employment data to deteriorate and the unemployment rate to rise, suggesting a further easing of labour market tightness.

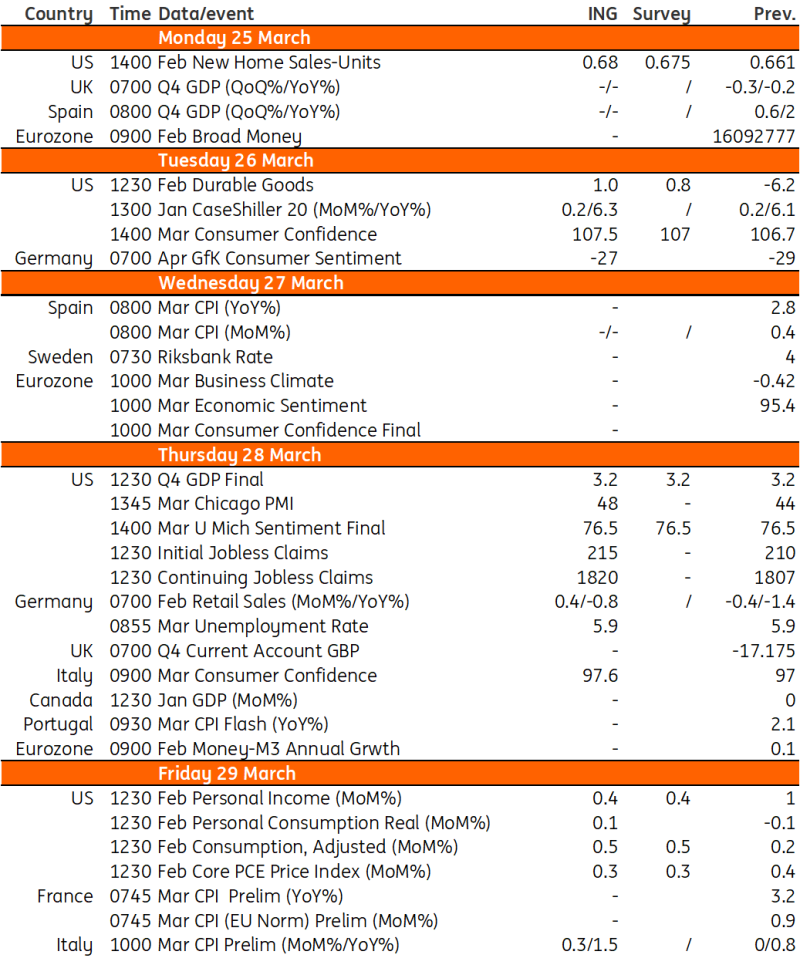

Key events in developed markets next week

Image Source: Refinitiv, ING

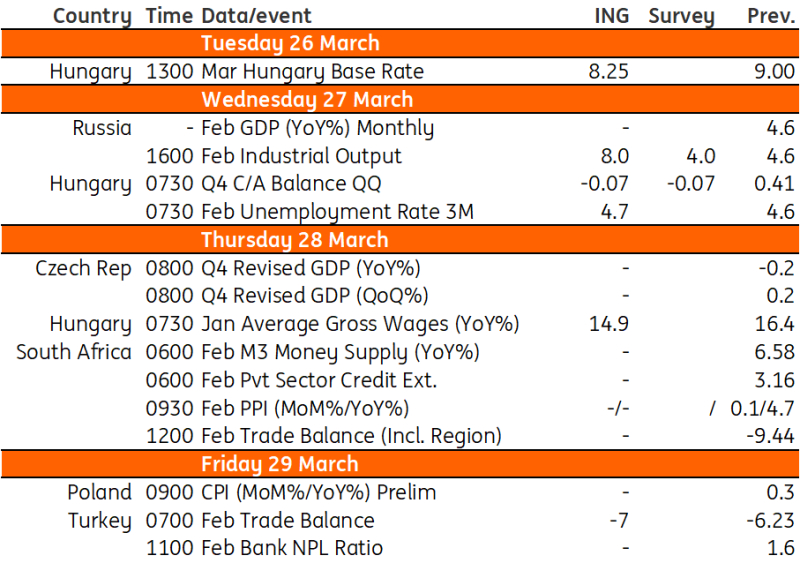

Key events in EMEA next week

Image Source: Refinitiv, ING

More By This Author:

The Commodities Feed: Stronger USD Weighs On The ComplexRates Spark: A Dovish Week

FX Daily: Strong Dollar At The End Of Central Bank Week

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more