Jobs: The Household Survey Tells A Different Story - Sunday, Feb. 4

Image Source: Pexels

The analysis below covers the employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on.

Current Trends

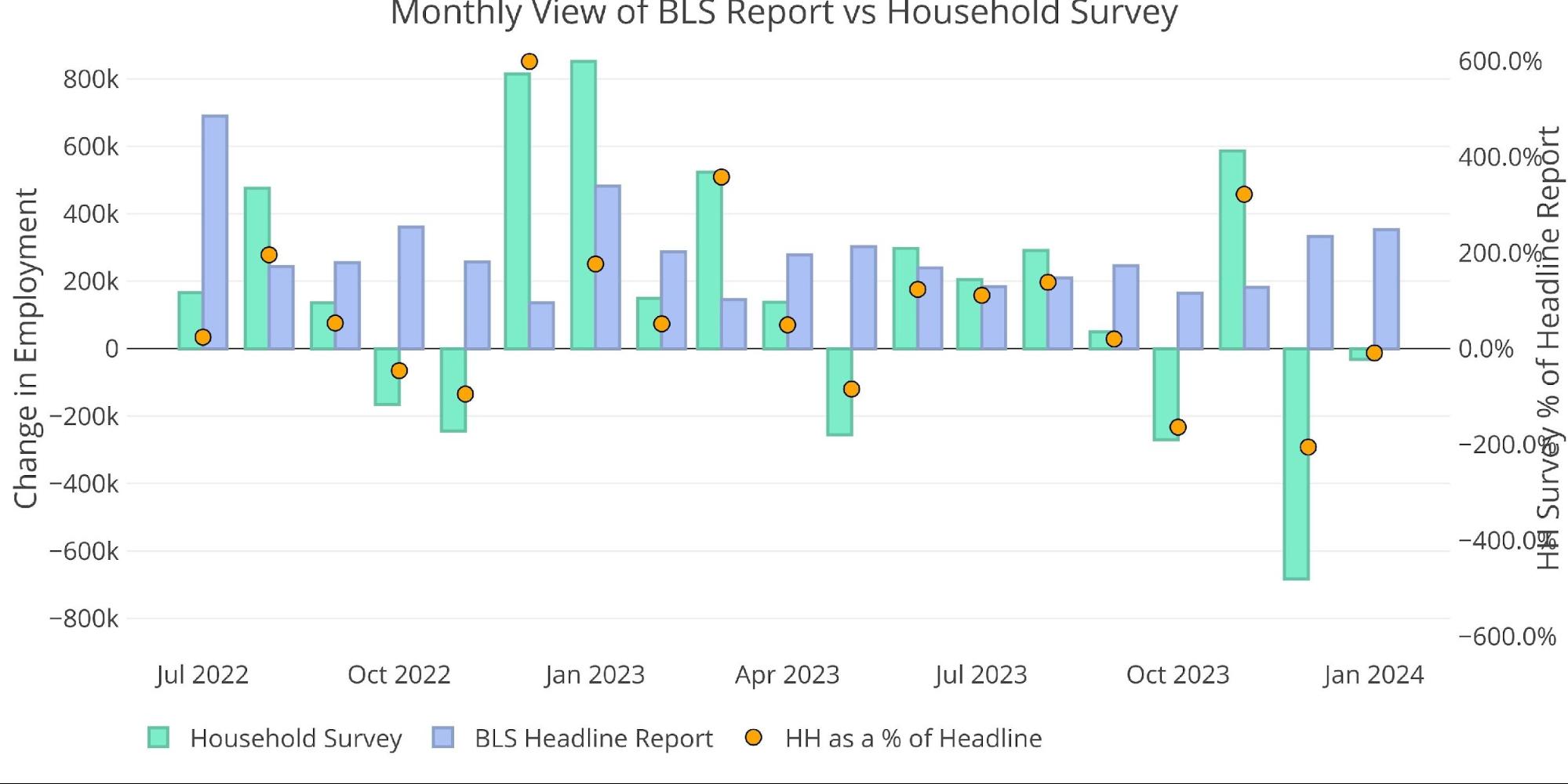

While the BLS reported a reading 353,000 jobs, the Household Survey actually reported a loss of -31,000 jobs. December was an even bigger miss, with a reading of 333,000 vs. -683,000.

(Click on image to enlarge)

Figure: 1 Primary Report vs Household Survey – Monthly

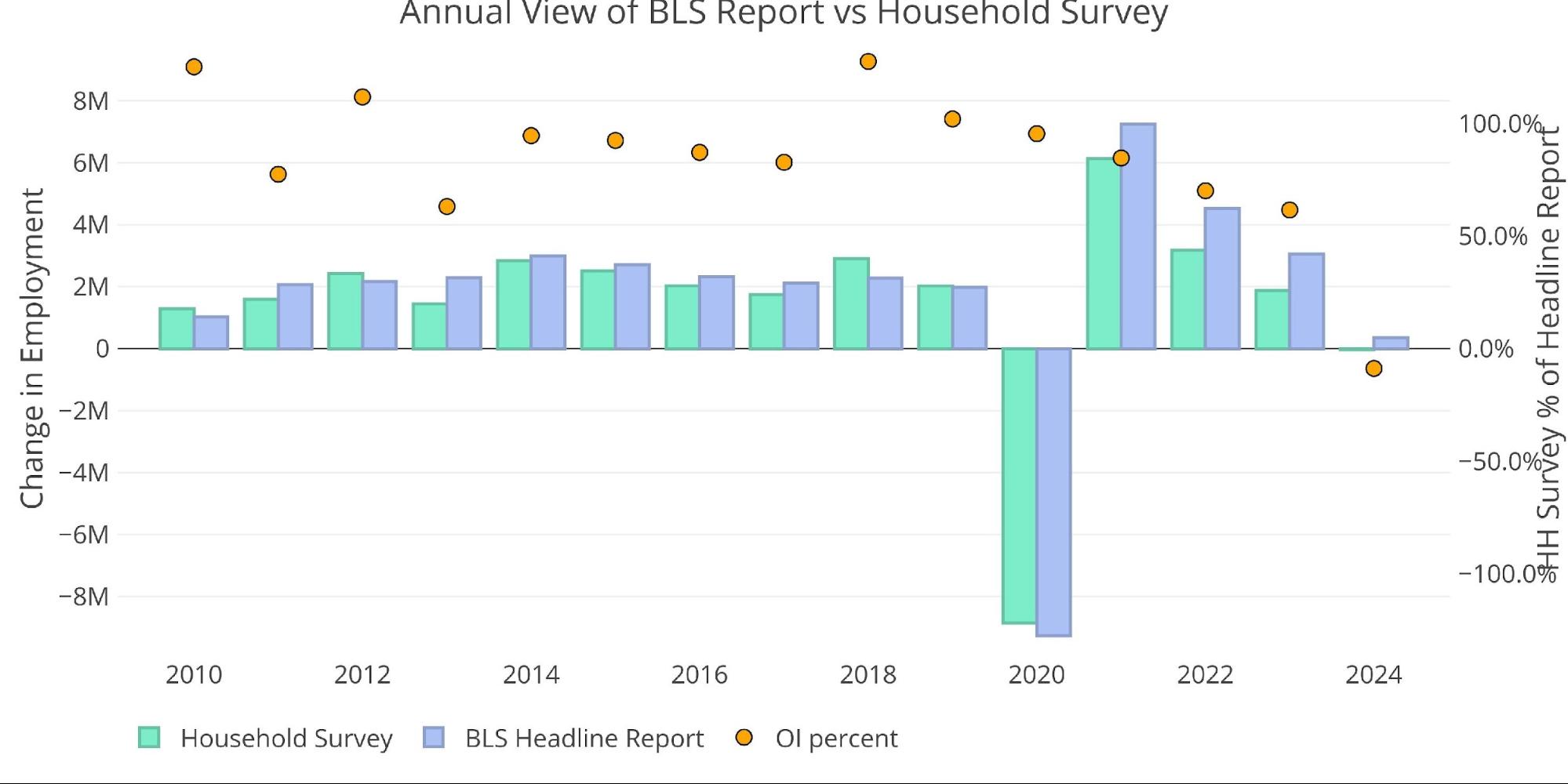

While November surprised to the upside, the overall trend continues to be the Household survey coming in lower than the BLS Report. This is important because many believe the Household survey is a more accurate measure of employment when compared to the headline number. The numbers have been deviating more and more each year since 2018.

(Click on image to enlarge)

Figure: 2 Primary Report vs Household Survey – Annual

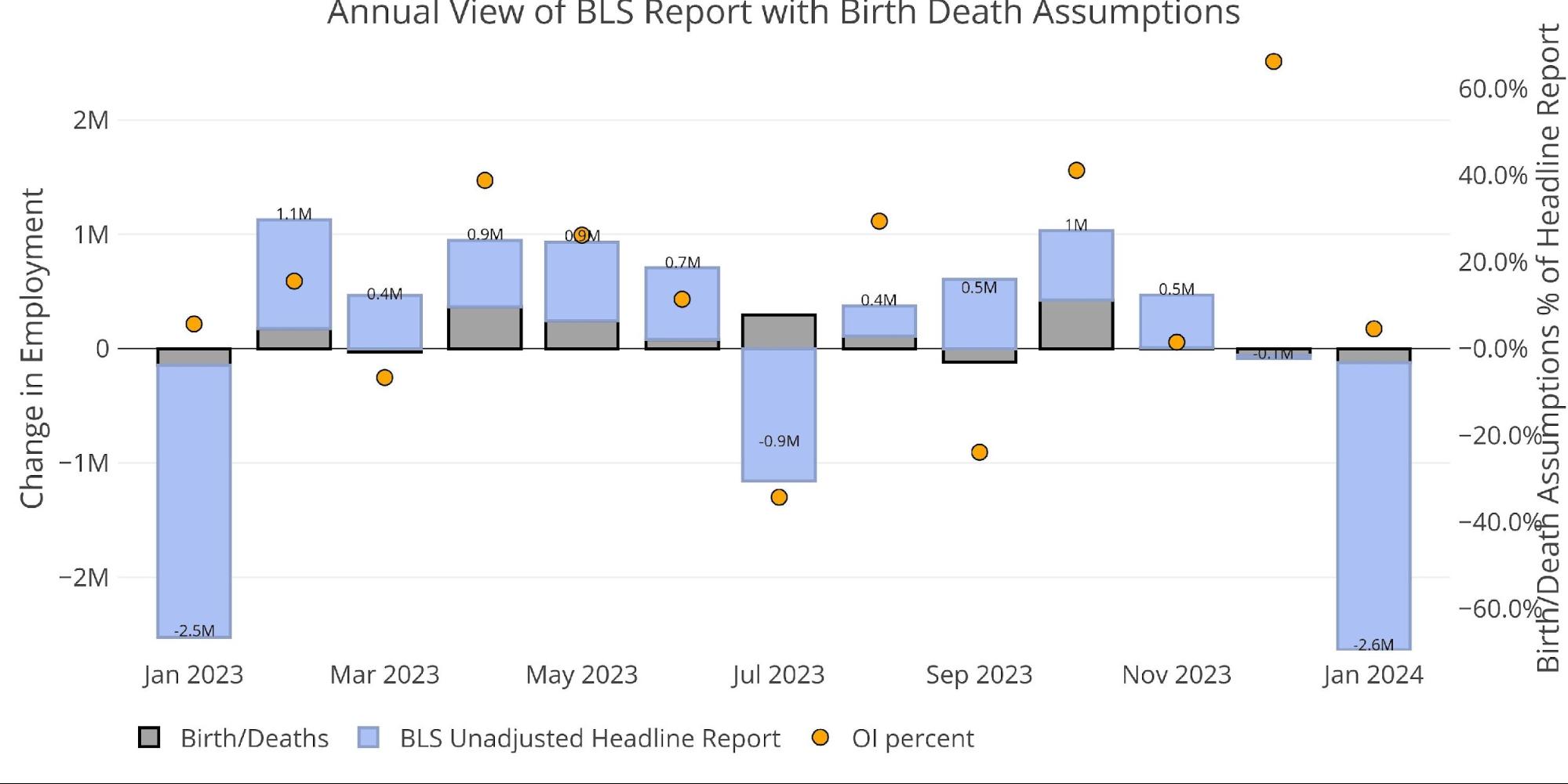

The BLS also publishes the data behind their Birth/Death assumptions. January always sees a big drop, but this one was smaller than last year (-144,000 in January 2023 vs. -121,000 in January 2024). Birth/death specifically refers to assumptions made about new business being formed.

(Click on image to enlarge)

Figure: 3 Primary Unadjusted Report With Birth Death Assumptions – Monthly

Digging Into the Report

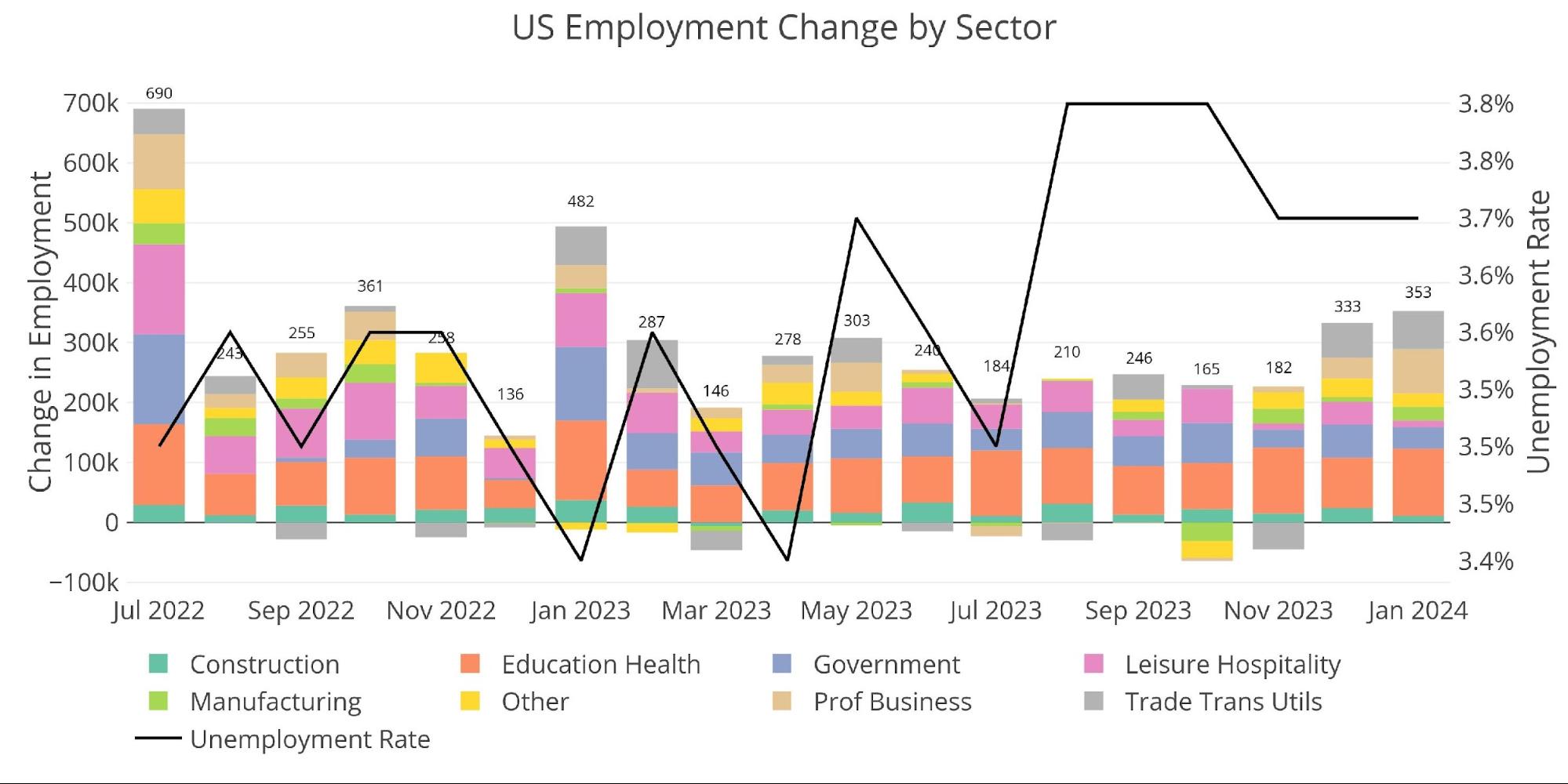

The 353,000 jobs reading surprised to the upside, and it was the biggest report since January of 2023.

(Click on image to enlarge)

Figure: 4 Change by sector

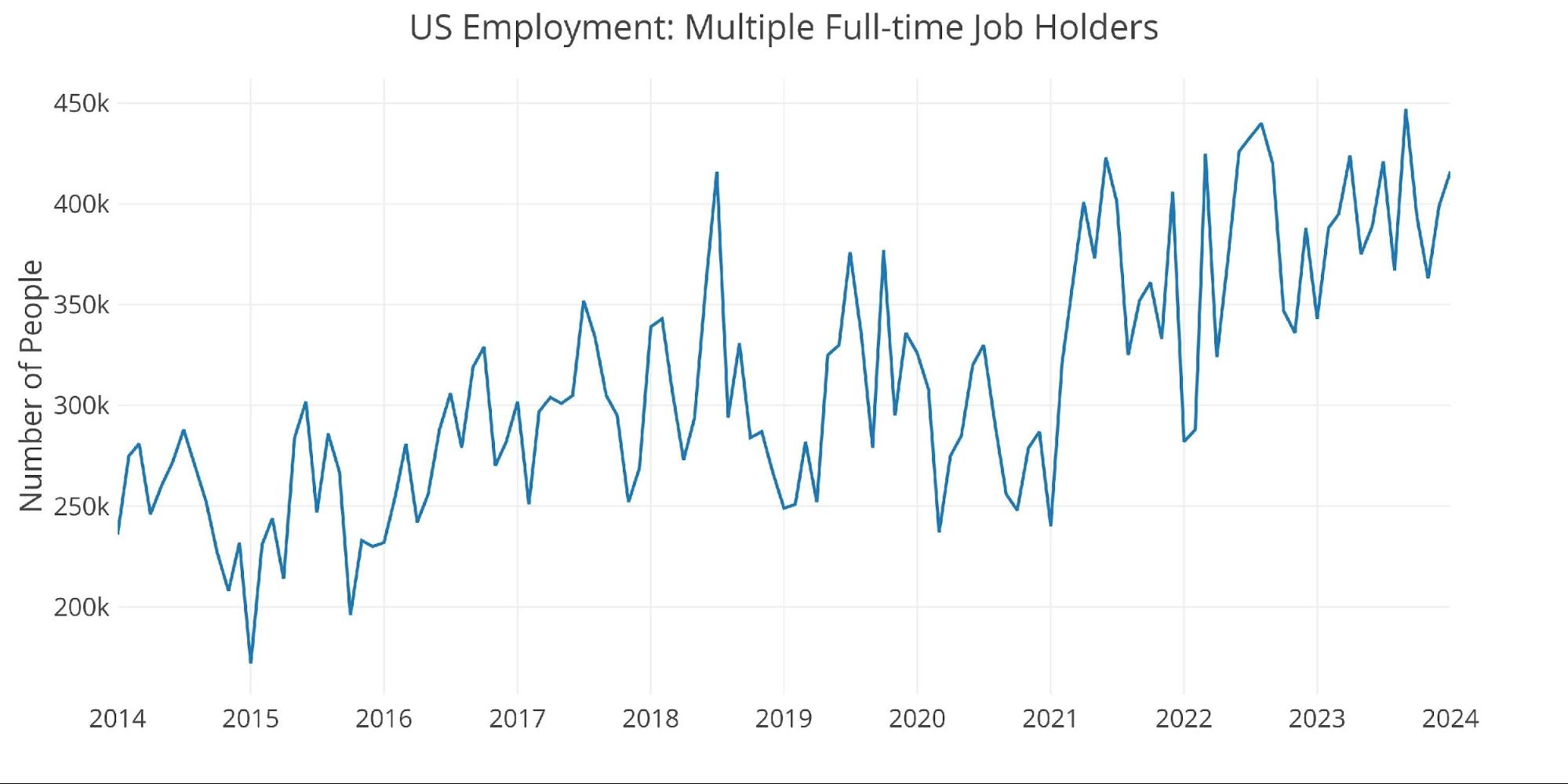

Meanwhile, the number of multiple job holders has climbed again.

(Click on image to enlarge)

Figure: 5 Multiple Full-Time Employees

Jobs by Category

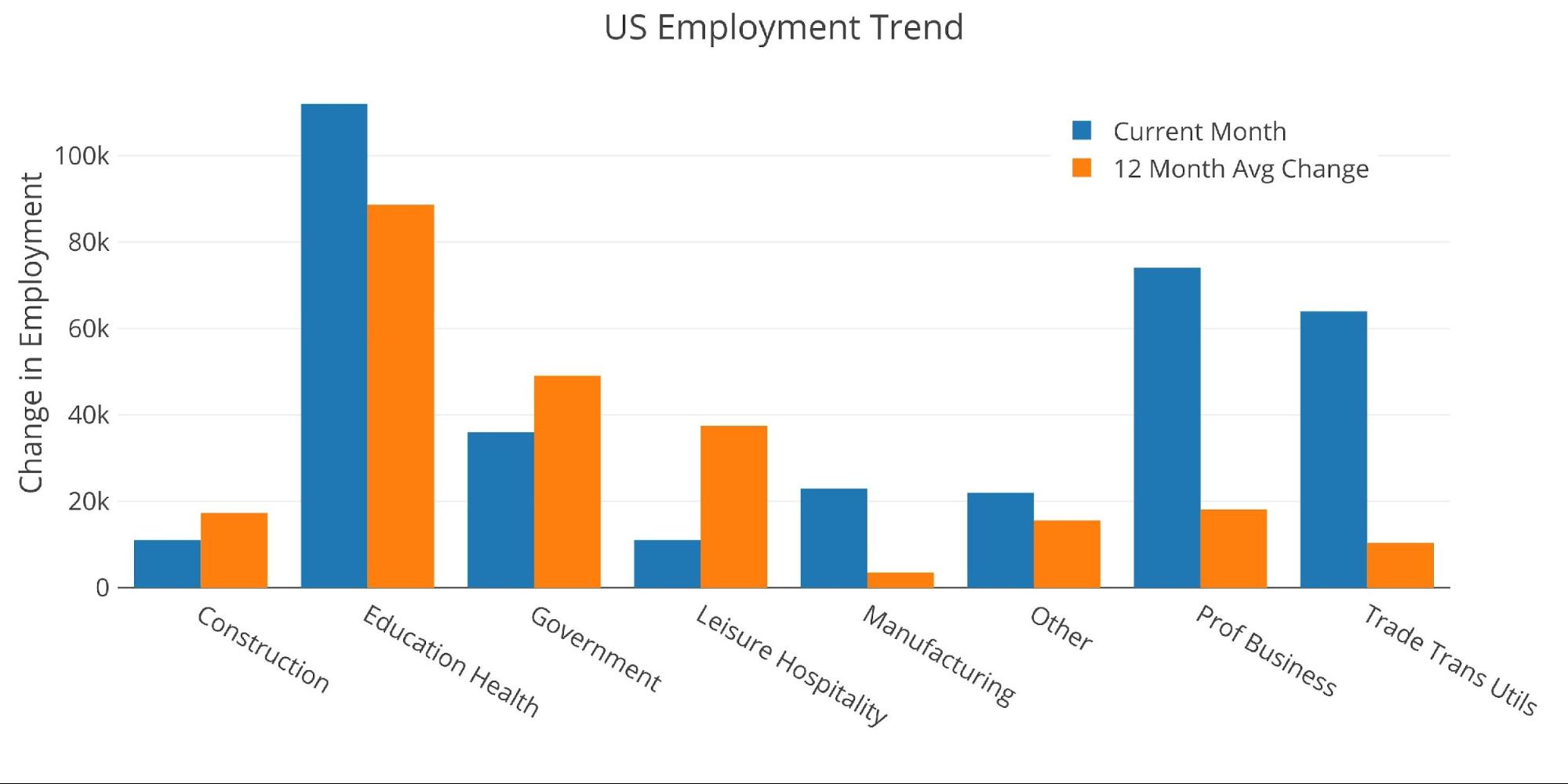

With the unexpectedly strong report, 5 of the 8 employment categories were actually above the 12-month trend, with some towering well above (Professional Business and Trade/Transport).

(Click on image to enlarge)

Figure: 6 Current vs TTM

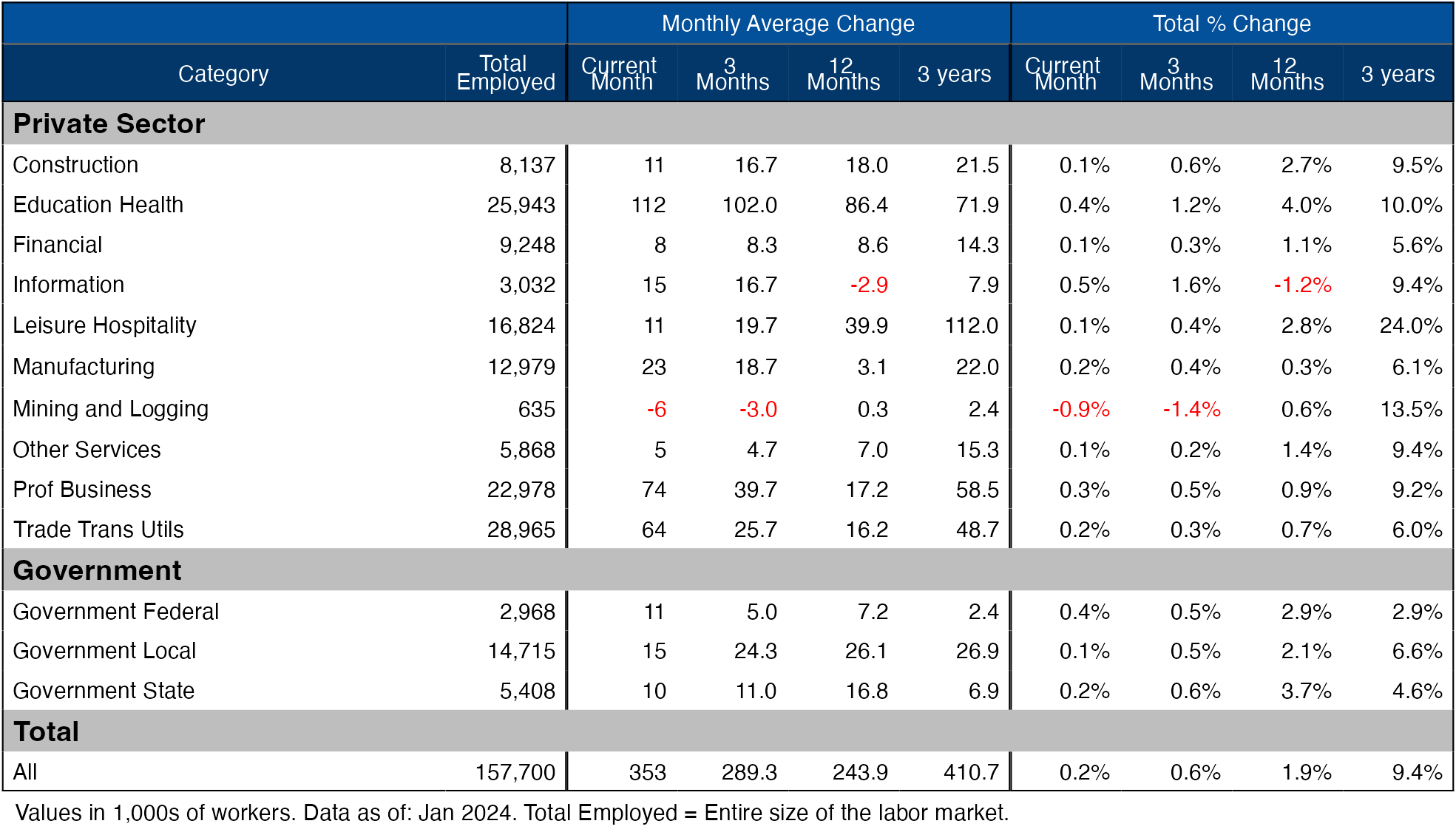

The table below shows a detailed breakdown of the numbers.

(Click on image to enlarge)

Figure: 7 Labor Market Detail

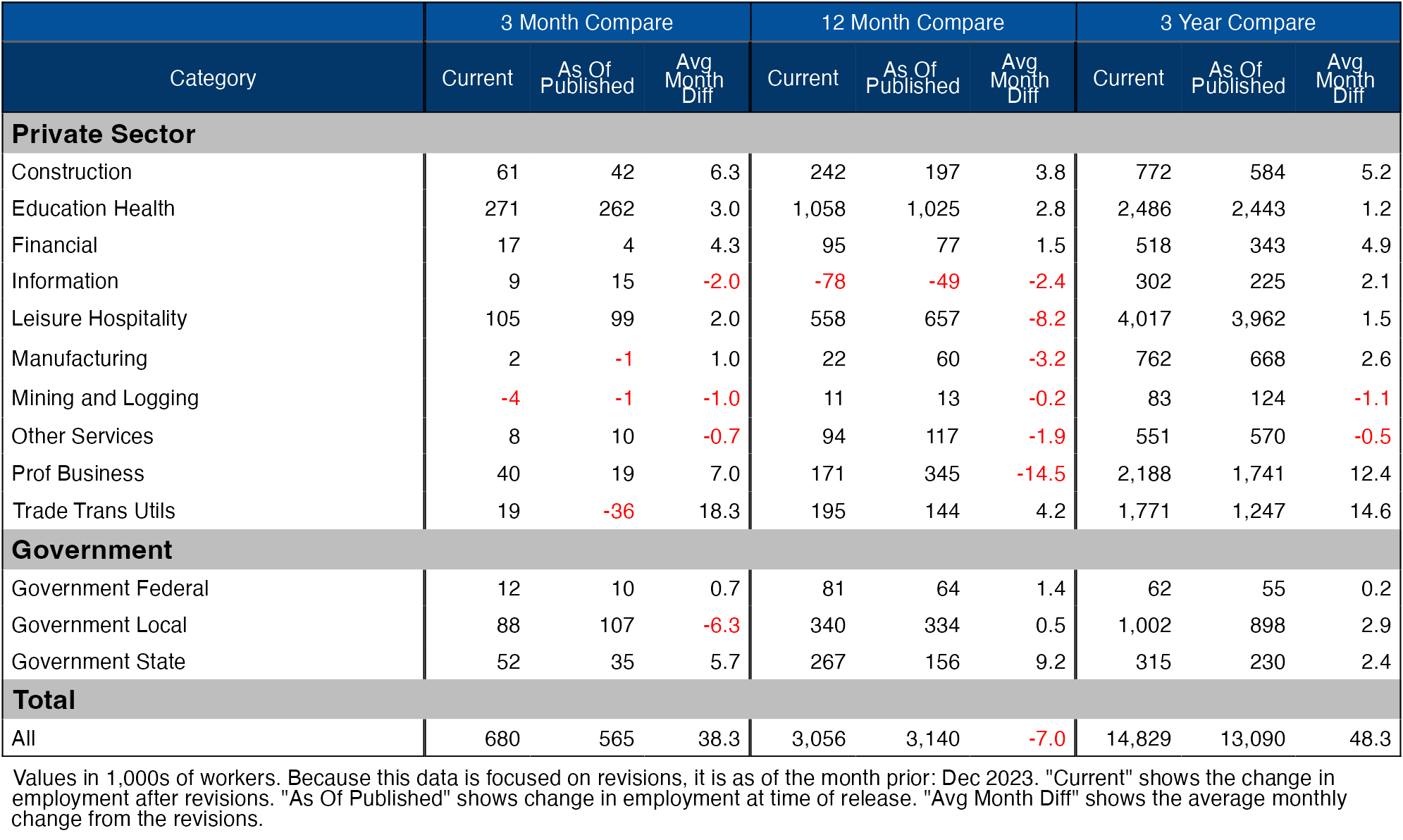

Revisions

Another data point to highlight is the number of revisions. Over the last three months, the numbers have actually been revised up.

(Click on image to enlarge)

Figure: 8 Revisions

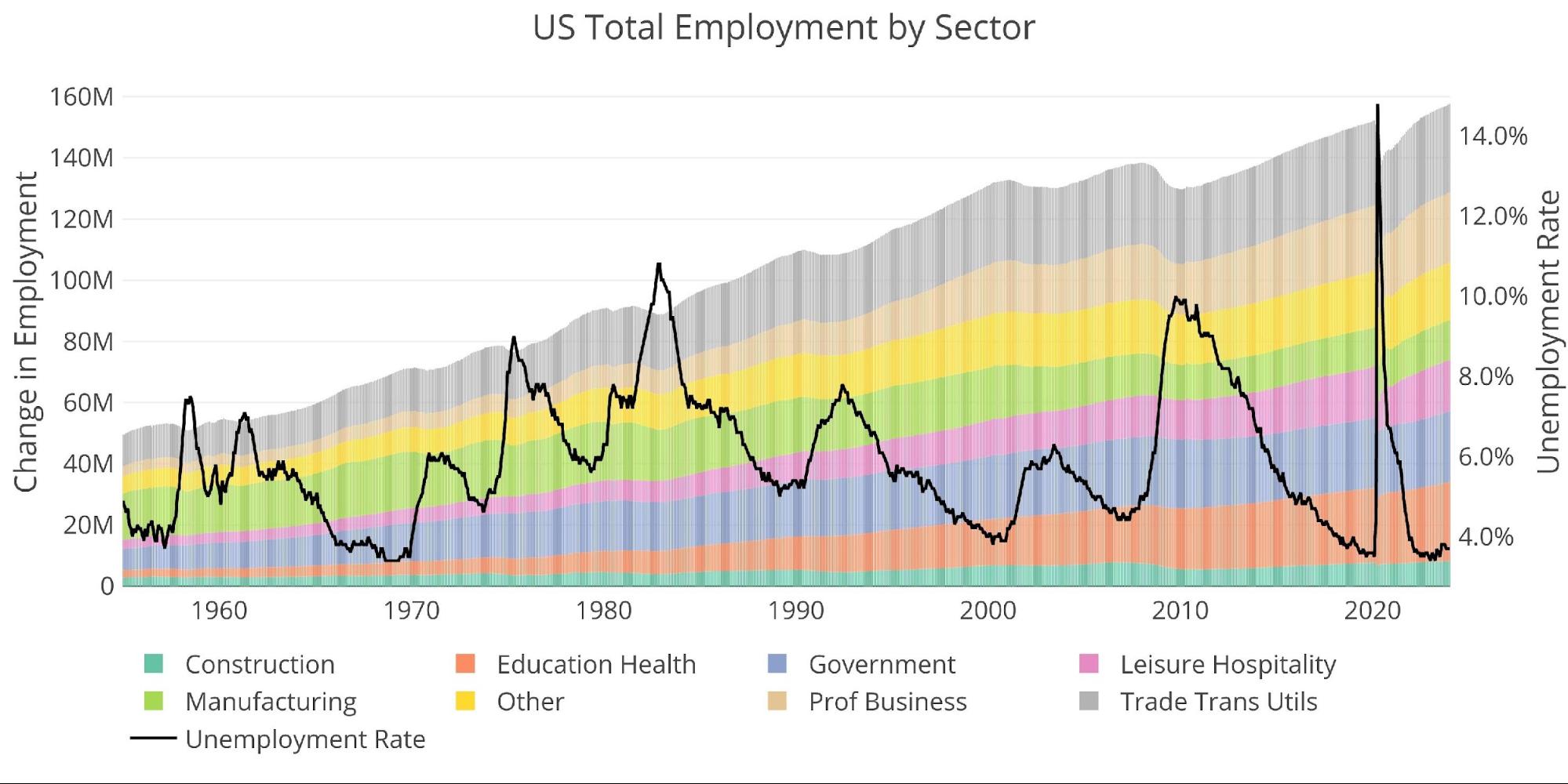

Historical Perspective

The chart below shows data going back to 1955.

(Click on image to enlarge)

Figure: 9 Historical Labor Market

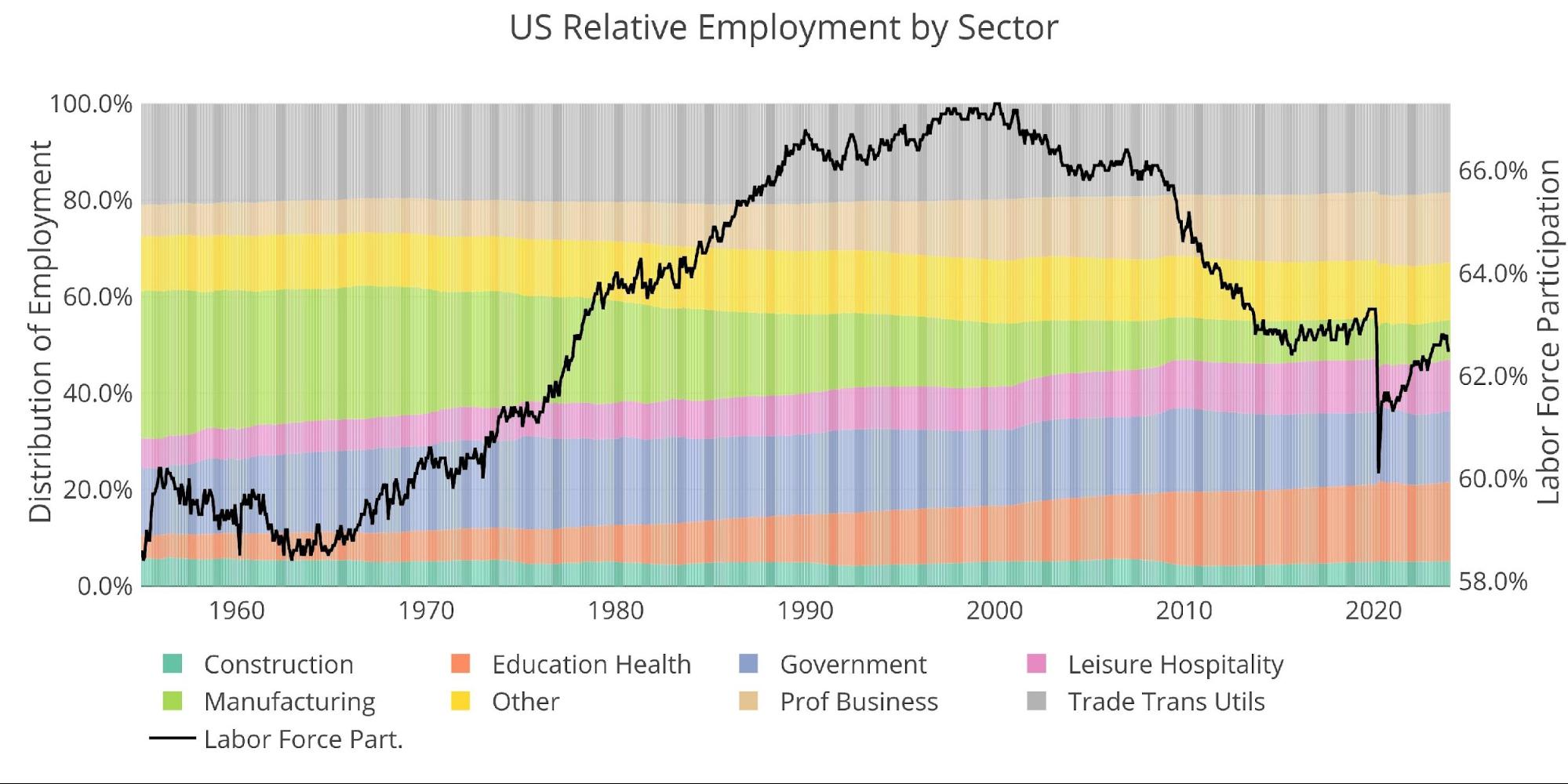

The labor force participation rate is still well below the highs before the Global Financial Crisis.

(Click on image to enlarge)

Figure: 10 Labor Market Distribution

More By This Author:

Fed Game Risks Replaying 2008

VIX – The Calm Before The Storm

Getting Physical: Why Bullion Has Outperformed Gold Stocks

- Data Source: https://fred.stlouisfed.org/series/PAYEMS and also series CIVPART

- Data Updated: ... more