Jobs: Household Report Jumps But QCEW Shows Job Market Is Not As Strong

The analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on.

Current Trends

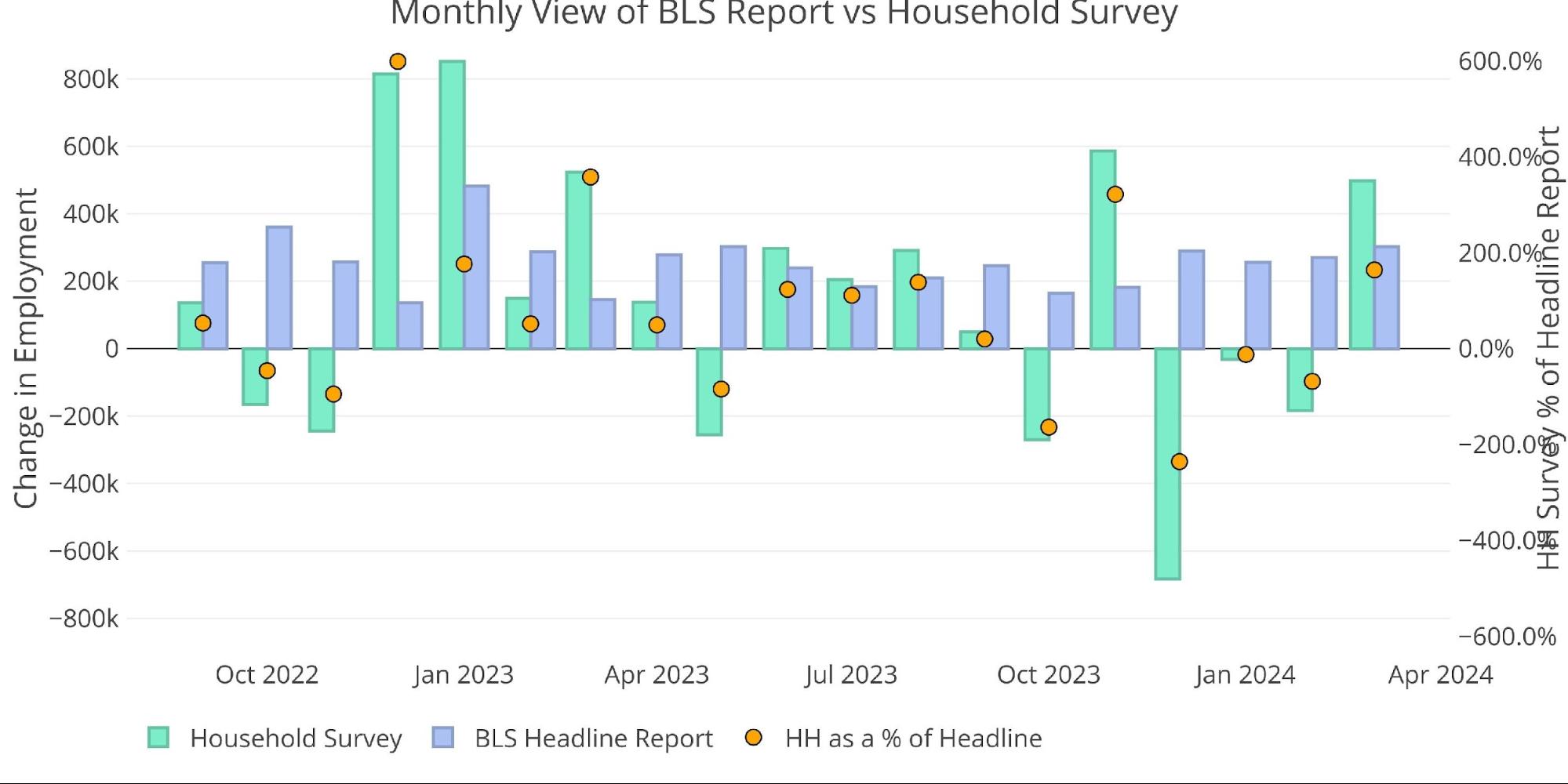

The BLS reported a gain of 303k jobs. This exceeded expectations of about 200k. The Household Survey, which had been trailing the headline number, saw a blowout gain of 498k.

(Click on image to enlarge)

Figure: 1 Primary Report vs Household Survey – Monthly

Despite the massive Household blowout, for the year, the Household still trails the Headline report by the widest margin ever. The Household report is showing 34% of the Headline number for the year (283k vs 829k).

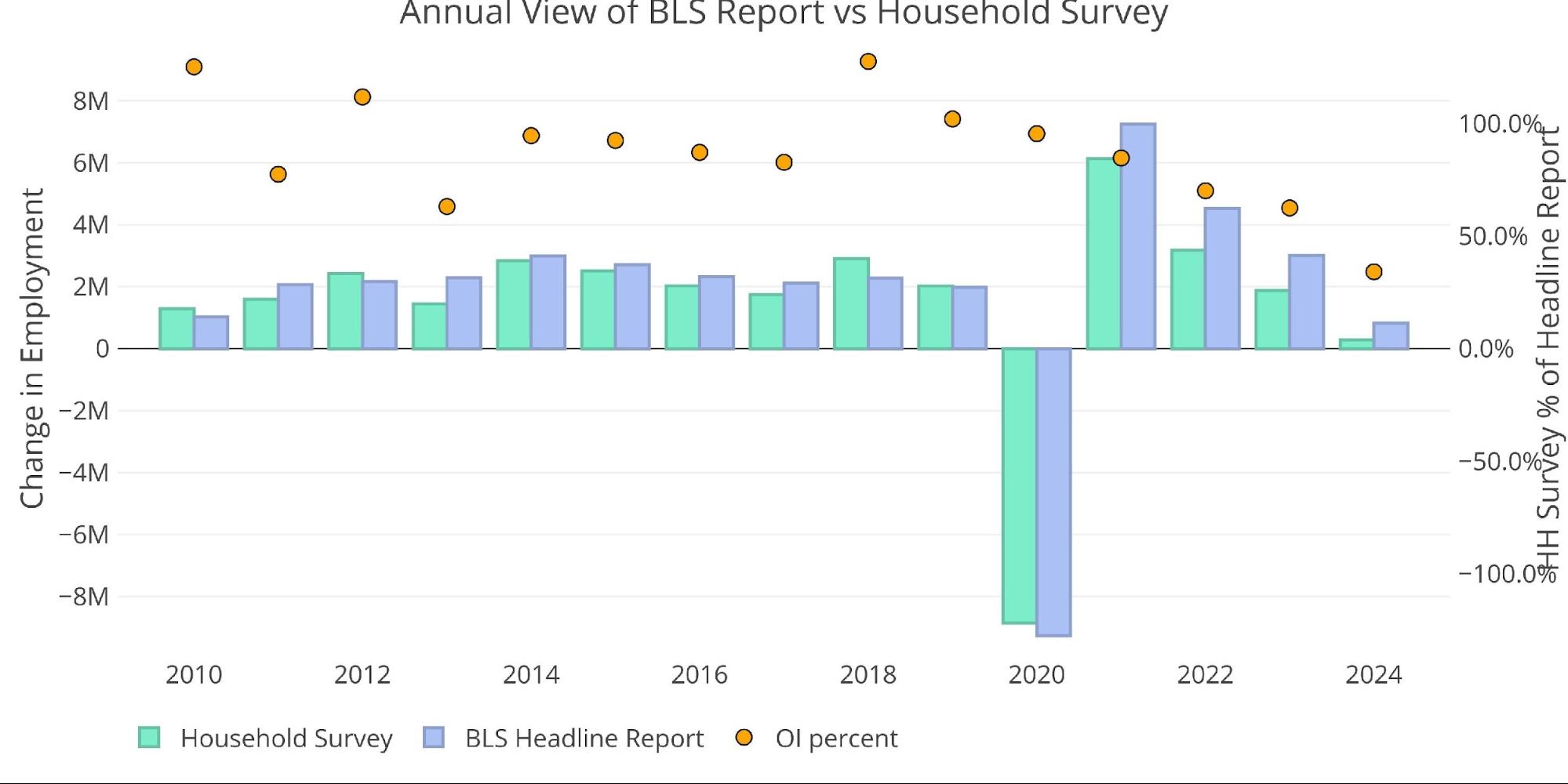

(Click on image to enlarge)

Figure: 2 Primary Report vs Household Survey – Annual

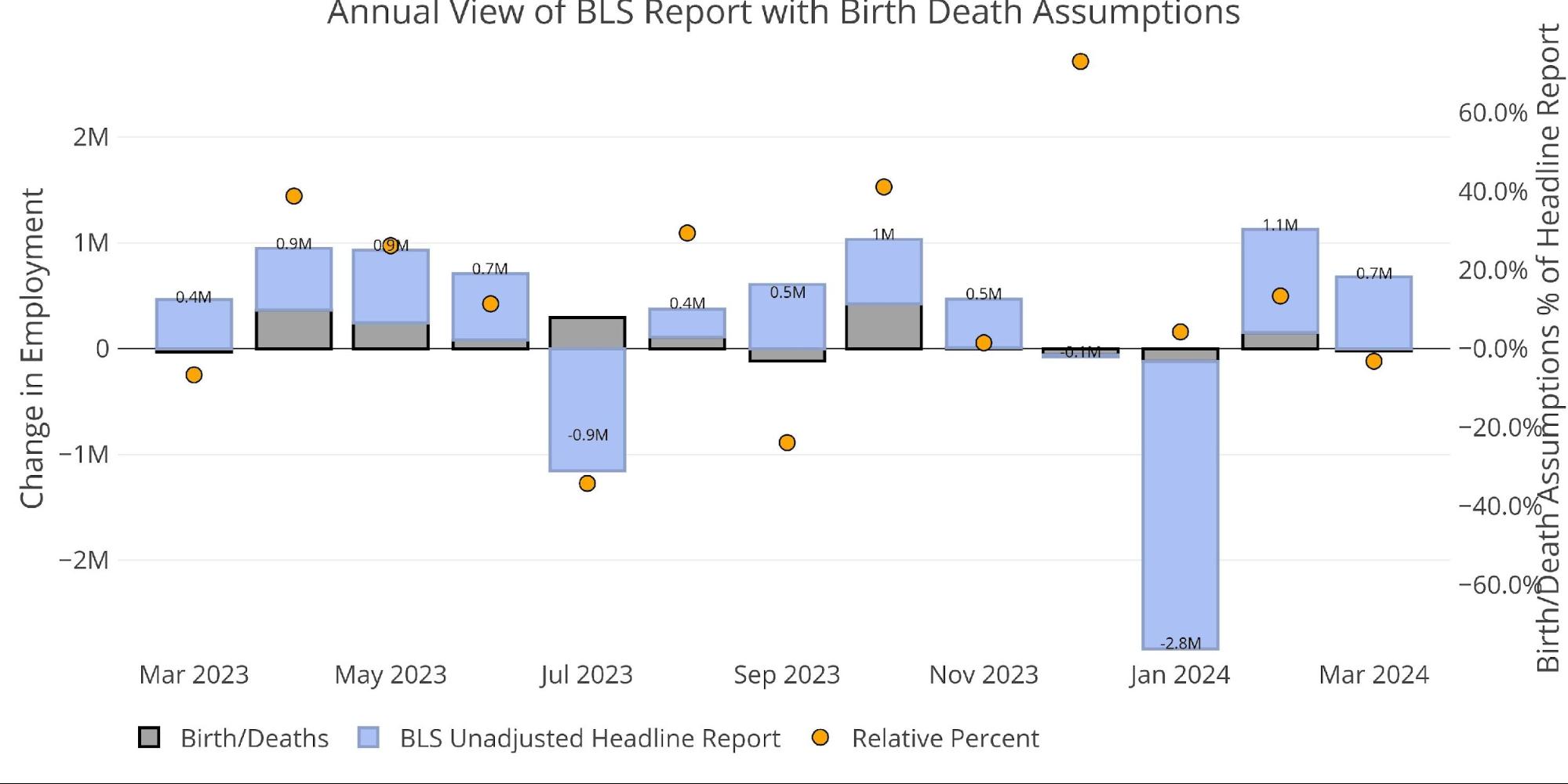

The BLS also publishes the data behind their Birth/Death assumptions (formation of new business). In March, the BLS actually assumed a job loss in their birth/death assumptions.

(Click on image to enlarge)

Figure: 3 Primary Unadjusted Report With Birth Death Assumptions – Monthly

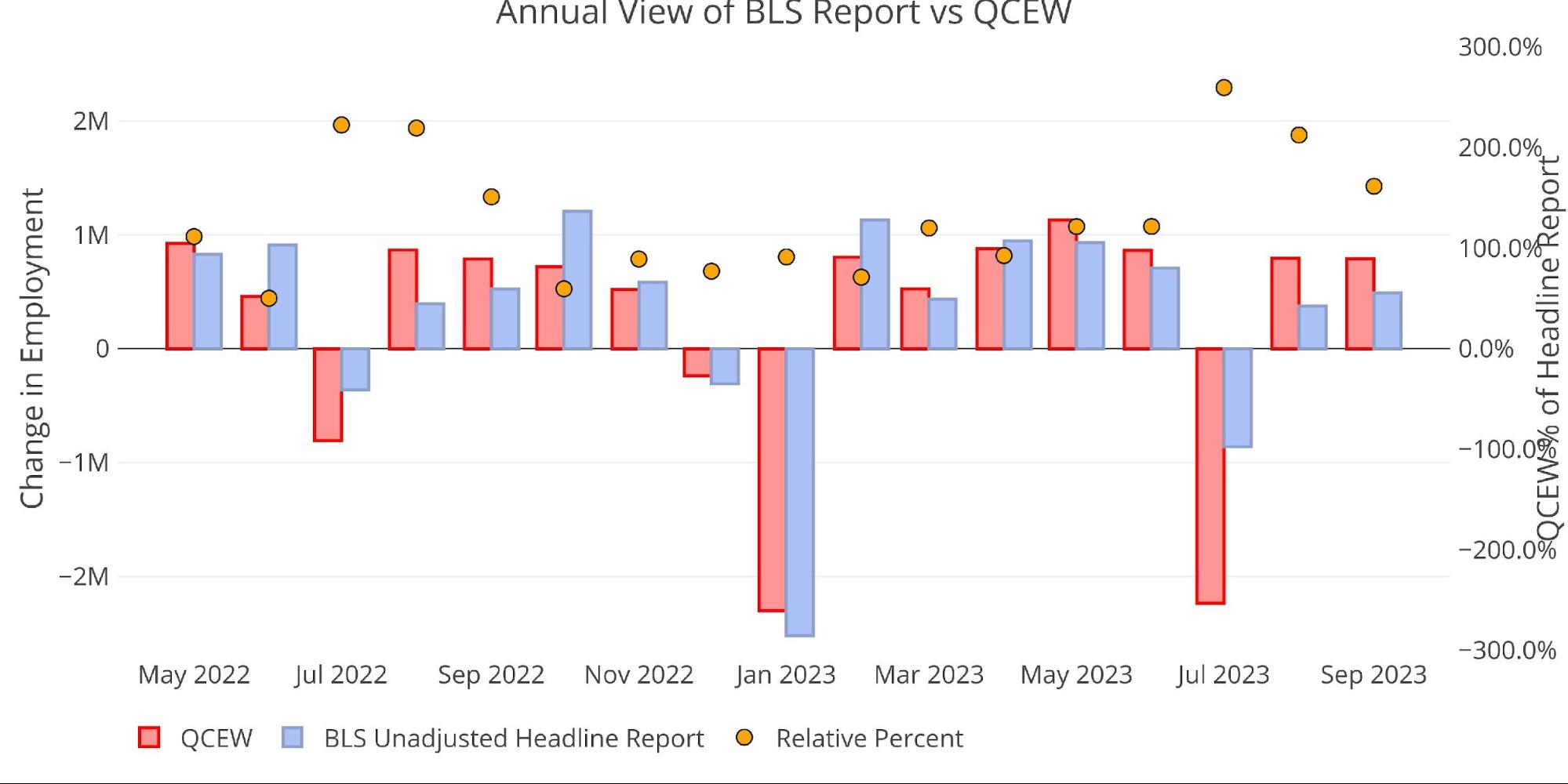

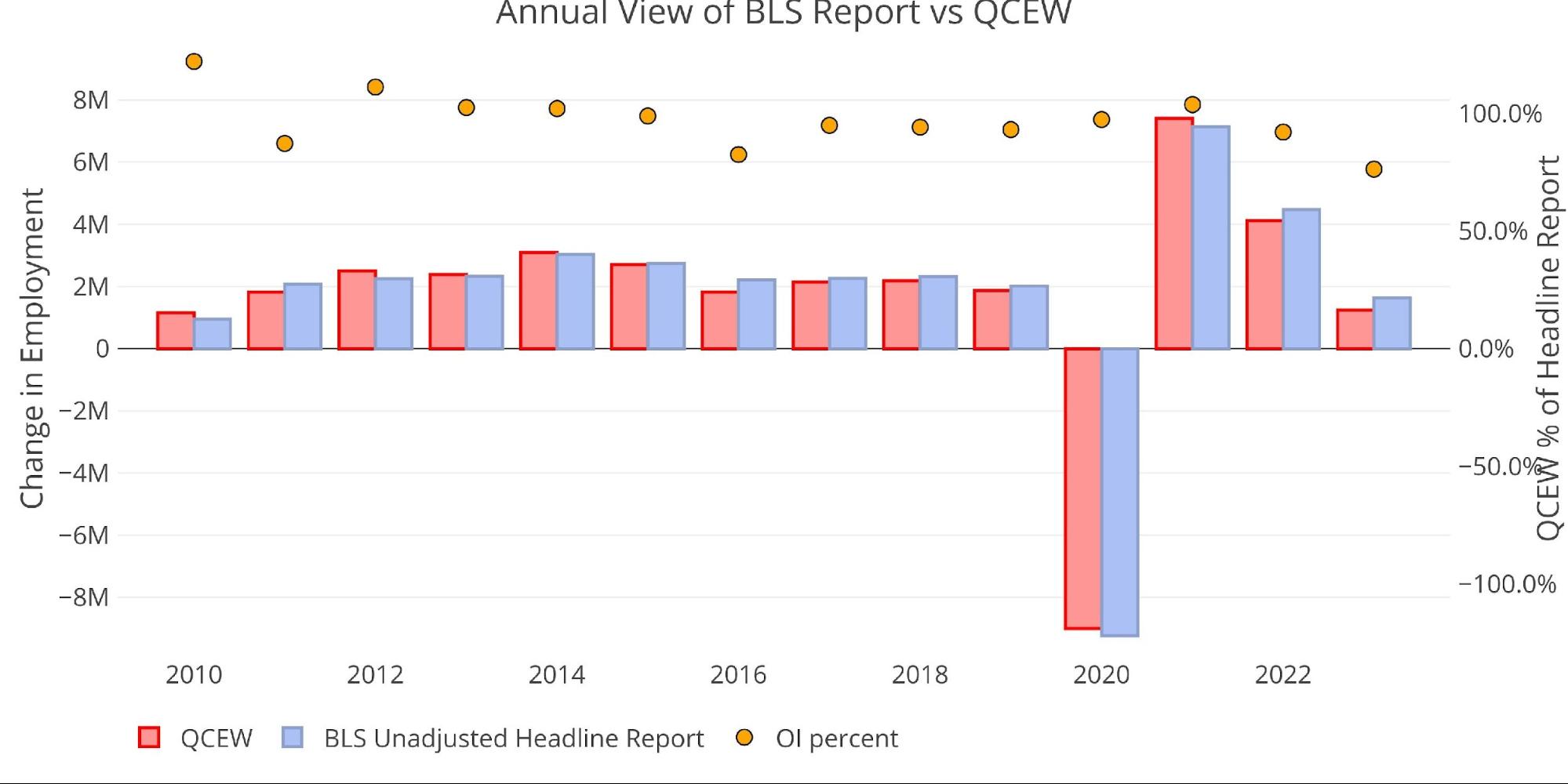

There is another report published by the BLS called the Quarterly Census of Employment and Wages (QECW). According to the BLS, this is a far more accurate and rigorous report covering 95% of jobs available at a highly detailed level. Due to the rigor, the report is released quarterly on a 7-month lag. The latest report was published at the end of February to show Q3 2023.

Similar to the Household Report, the QECW has been over the headline number in recent periods but still trails on a yearly basis. Below are the monthly numbers.

(Click on image to enlarge)

Figure: 4 Primary Report vs QCEW – Yearly

On an annual basis, you can see that the QCEW trails the Headline number representing 92% and 76% for 2023 and 2024.

(Click on image to enlarge)

Figure: 5 Primary Report vs QCEW – Yearly

Digging Into the Report

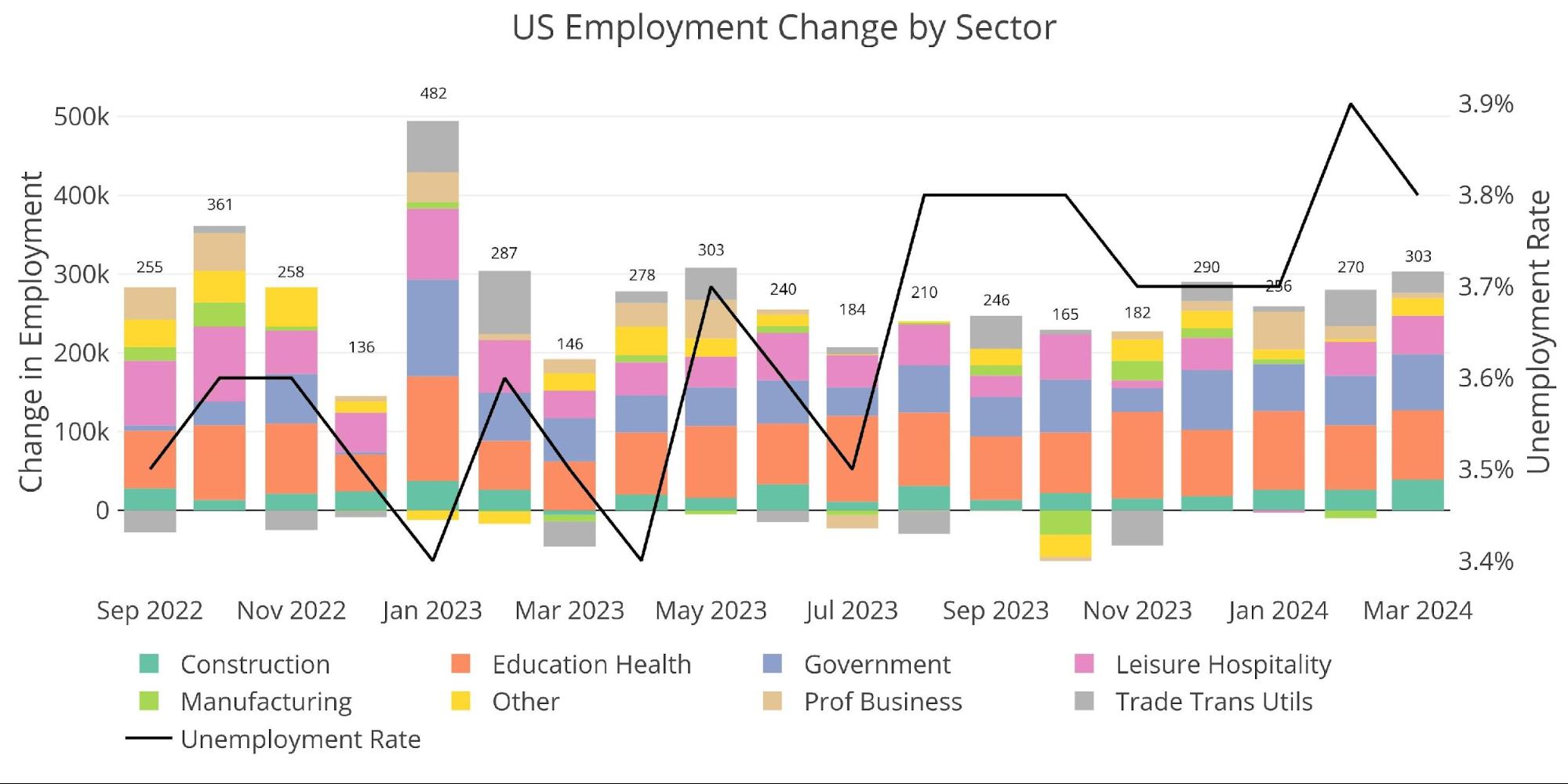

The 303k jobs surprised to the upside with the unemployment rate dropping slightly from the near-term high last month.

(Click on image to enlarge)

Figure: 6 Change by sector

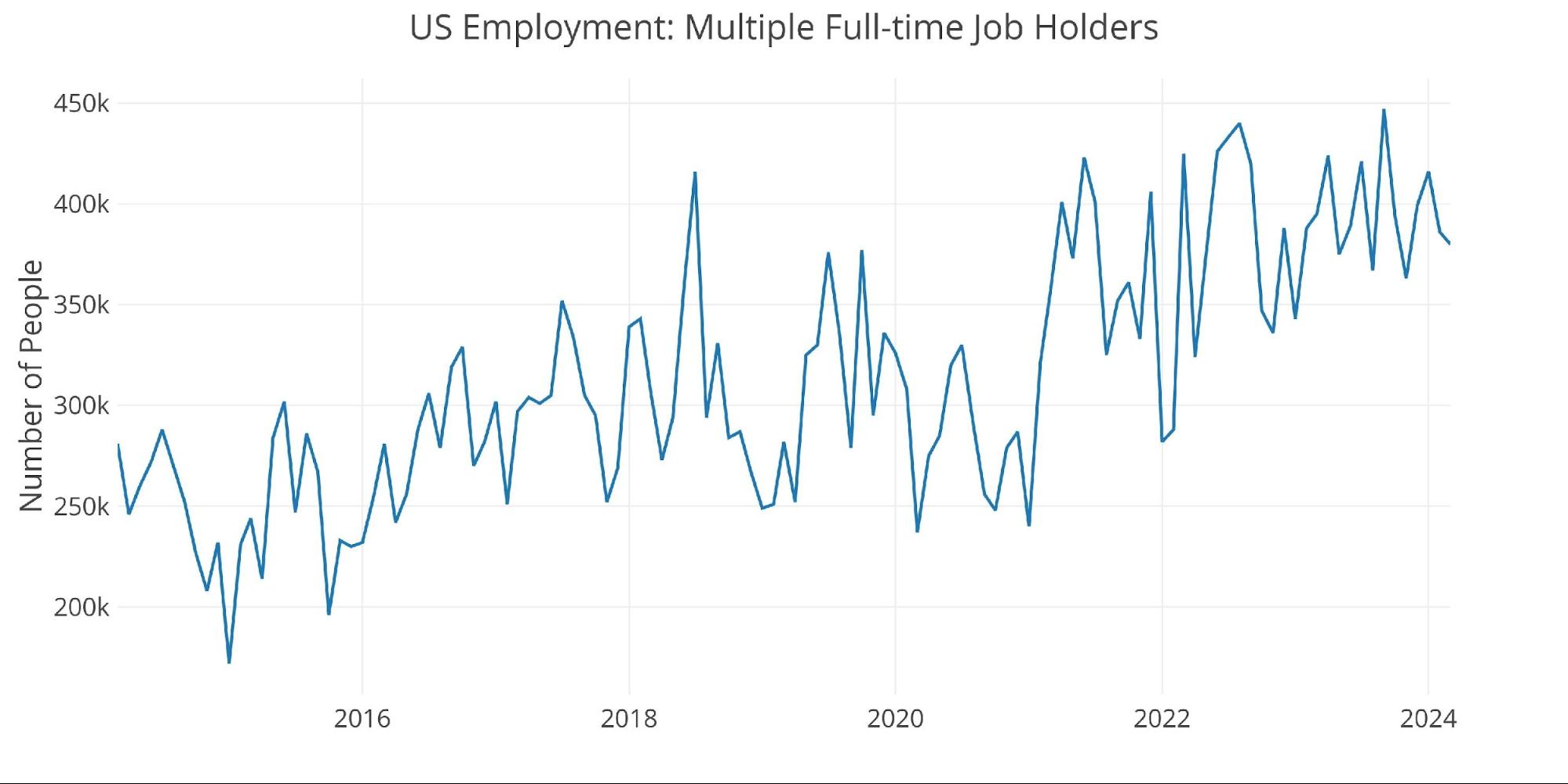

The number of multiple job holders dropped again this month.

(Click on image to enlarge)

Figure: 7 Multiple Full-Time Employees

Jobs by Category

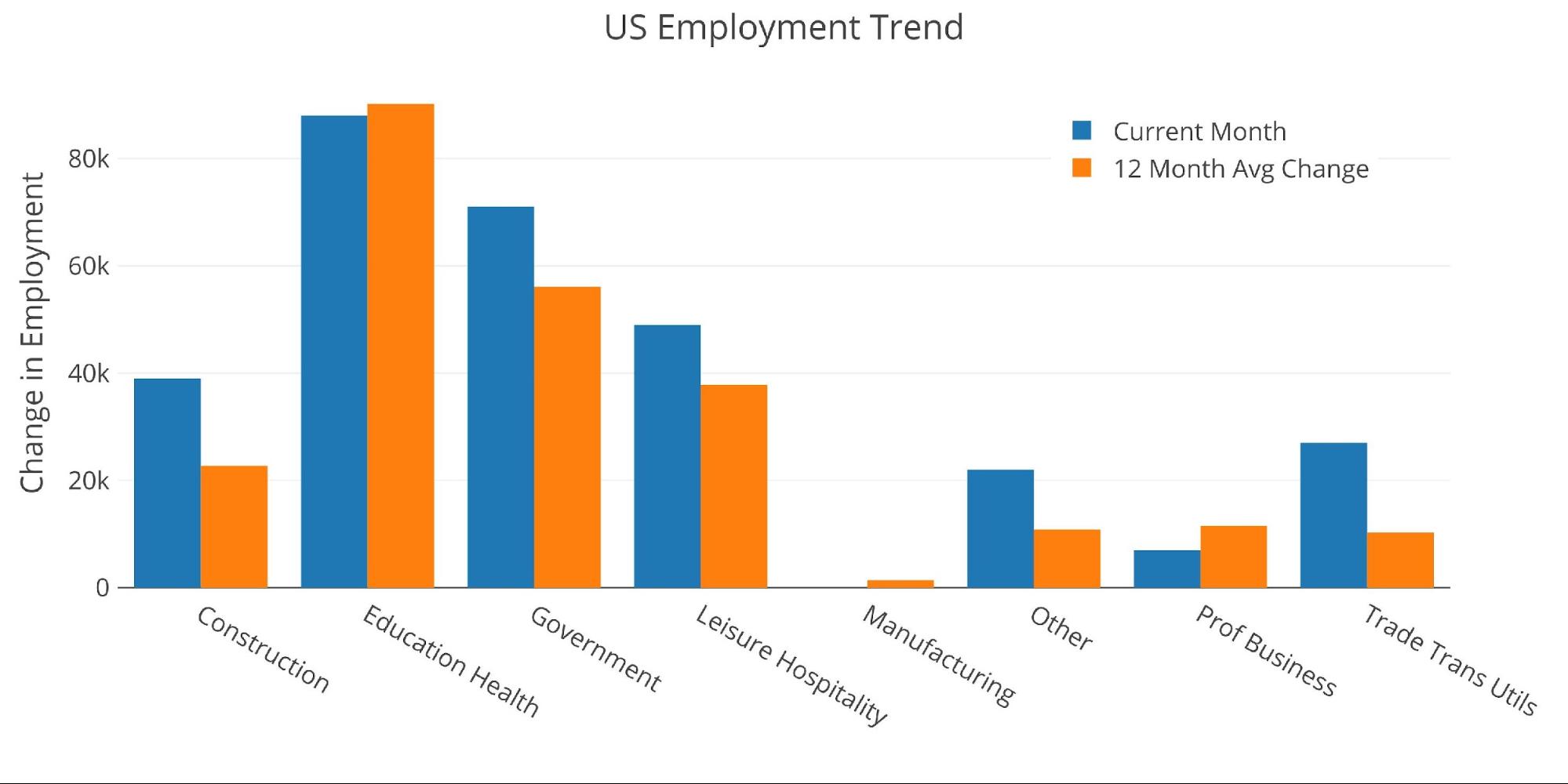

Several categories saw some large gains, with only three categories below the 12-month trend (Education, Prof business, and Manufacturing).

(Click on image to enlarge)

Figure: 8 Current vs TTM

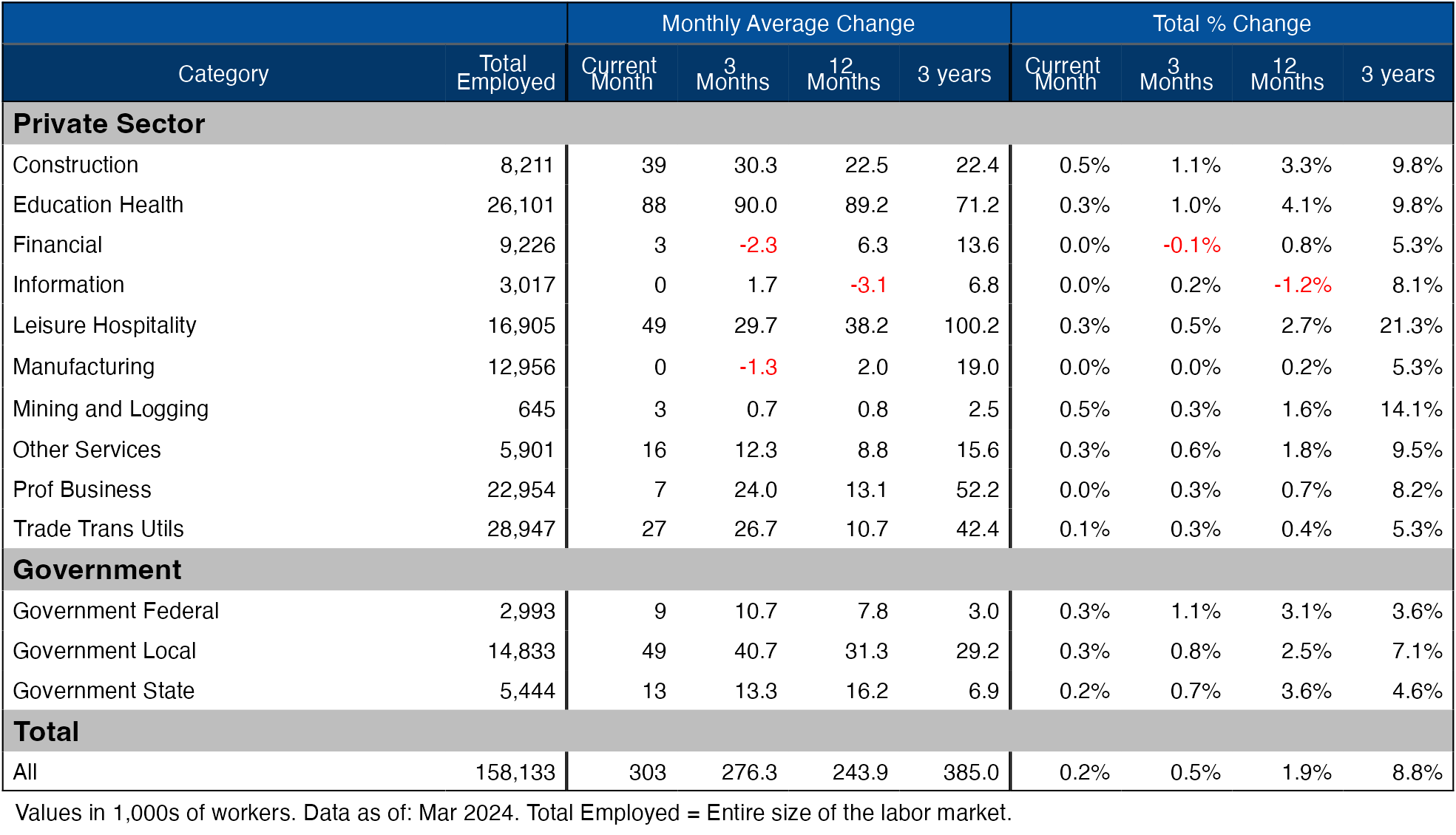

The table below shows a detailed breakdown of the numbers.

(Click on image to enlarge)

Figure: 9 Labor Market Detail

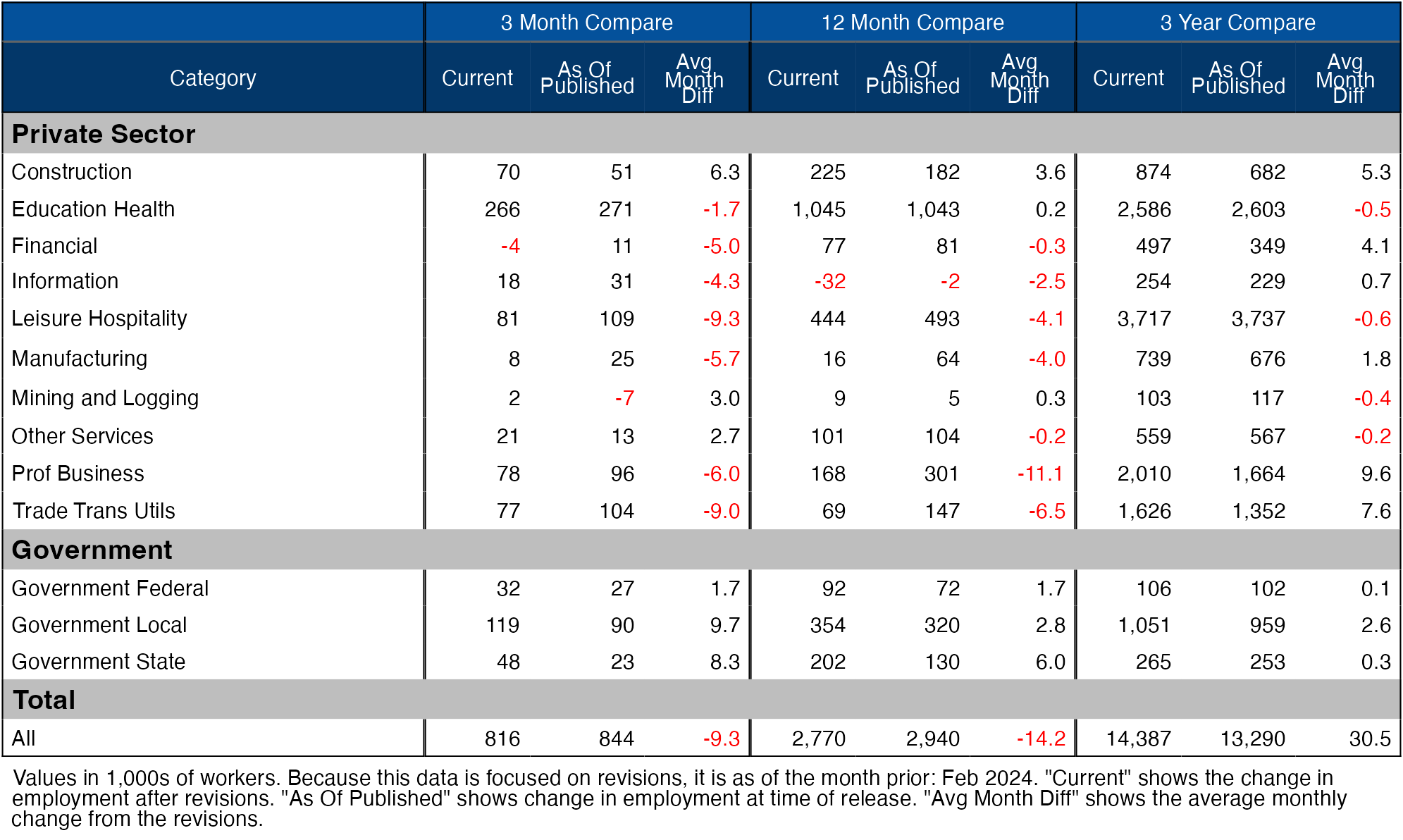

Revisions

Over the last three months, the data has been revised down by an average of 9.3k per month and 14.2k over 12 months.

(Click on image to enlarge)

Figure: 10 Revisions

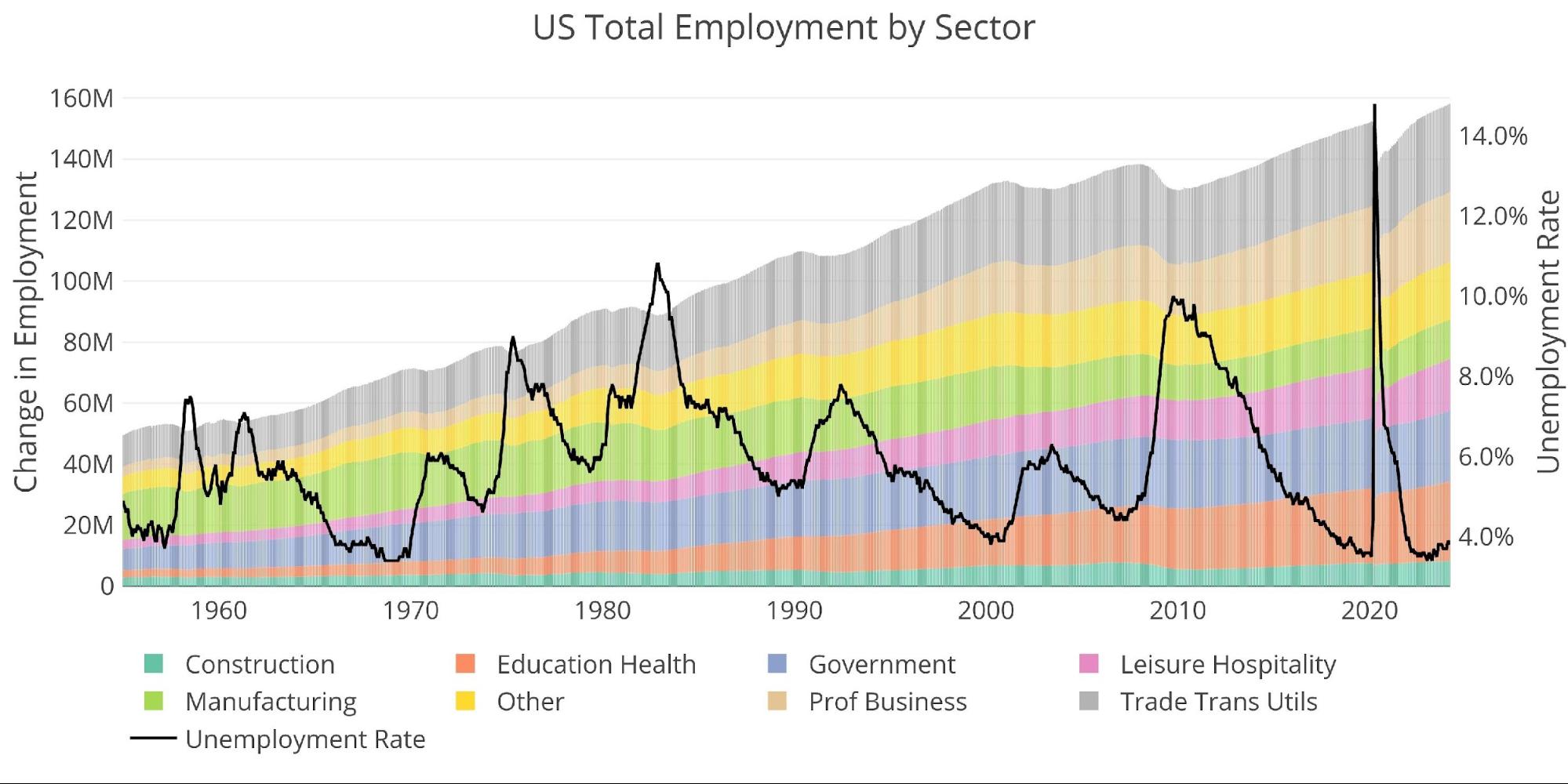

Historical Perspective

The chart below shows data going back to 1955.

(Click on image to enlarge)

Figure: 11 Historical Labor Market

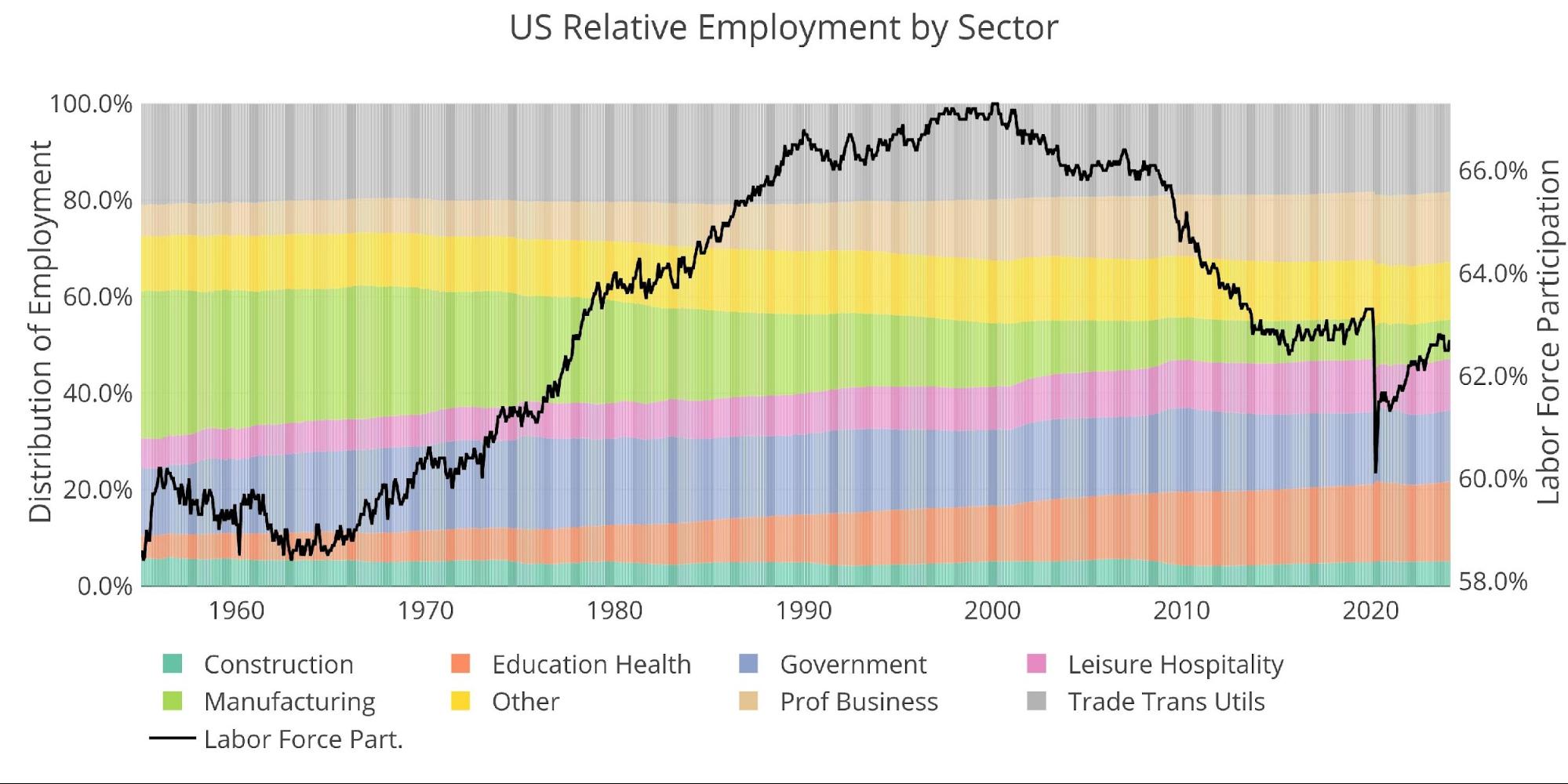

The labor force participation rate is still well below the highs before the Global Financial Crisis. This month it climbed to 62.7%.

(Click on image to enlarge)

Figure: 12 Labor Market Distribution

Data Source: https://fred.stlouisfed.org/series/PAYEMS and also series CIVPART

Data Updated: Monthly on first Friday of the month

Last Updated: Mar 2024

Interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

More By This Author:

Yellen Continues Betting On Interest Rate Declines

Too Hot To Handle: Gold Due For A Correction?

“Urban Doom Loop” Of Vacant Offices: How Far Will It Go?