Job Openings Rise In December But Quits Tell The Real Story

(Click on image to enlarge)

Data from BLS, chart by Mish

Three Key Ideas

- Quits and hires are actual events (within the bounds of BLS accuracy).

- Hires and separations (layoffs and quits) are hard data, in contrast to openings that may not be real.

- Quits reflect the propensity to job hop looking for better offers but also retirement. Quits have fallen to pre-pandemic levels.

Headlines that Miss the Key Idea

Compare the Bloomberg headline “Job Openings Rise to Highest in Three months.”

So what? The openings blip does not even register on the lead chart and it’s well into the realm of normal noise.

Openings Changed Little

According to the Job Openings and Labor Turnover Survey News Release “The number of job openings changed little at 9.0 million on the last business day of December. Over the month, the number of hires and total separations were little changed at 5.6 million and 5.4 million, respectively.”

Job Listings Abound, but Many Are Fake

Openings are down from a record 11.755 million to a still very elevated 9.026 million.

The Wall Street Journal reports Job Listings Abound, but Many Are Fake

A mystery permeates the job market: You apply for a job and hear nothing, but the ad stays online for months. If you inquire, the company tells you it isn’t really hiring.

Not all job ads are attached to actual jobs, it turns out.

Too many analysts rely on job openings as a sign of labor market strength. That WSJ article was from March of 2023. It’s undoubtedly still true.

Job Quits by Sector in Thousands

(Click on image to enlarge)

Quits in the four big drivers of job growth, Leisure and hospitality, Accommodation and Food Service, education and Health Services, and Retail Trade are all back to pre-pandemic levels.

Labor Leverage Ratio

(Click on image to enlarge)

The Labor Leverage Ratio (LLR) is the number of quits divided by the number of discharges, firings, and layoffs initiated by employers.

The BLS notes “the quits rate can serve as a measure of workers’ willingness or ability to leave jobs.” The LLR is a refinement to the quits rate.

There is no cost to posting ghost jobs. And the benefits are obvious: Employers can placate overworked employees, keep them motivated, give an impression of growth, and just in case.

Openings are not real. Quits and the Labor Leverage Ratio provide a much more compelling story.

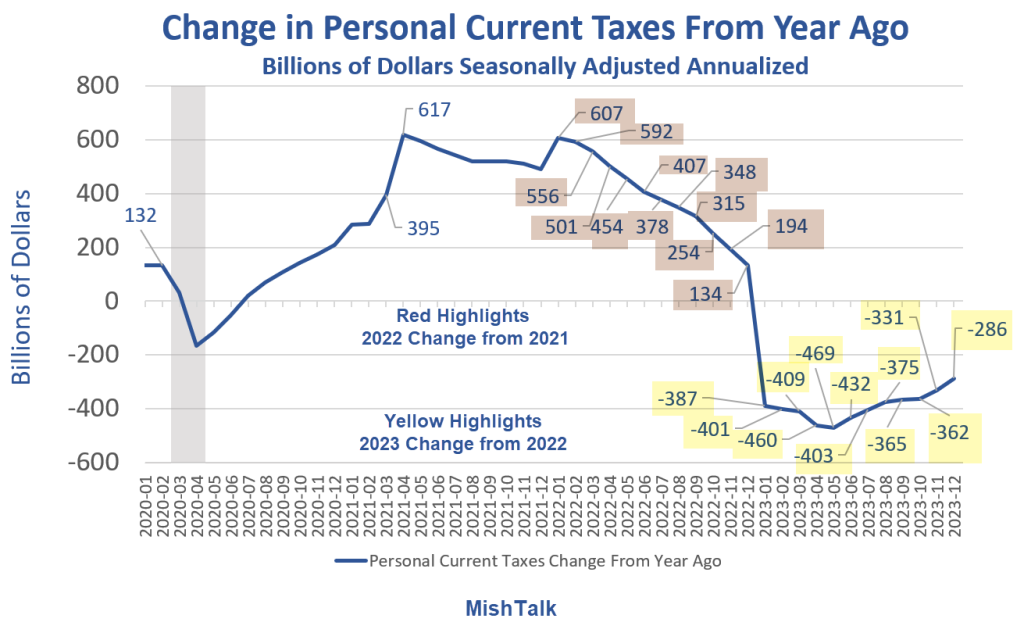

Tax Cuts, Not Bidenomics Explains Surge in Consumer Spending in 2023

On January 1, 2023, 38 states had noteworthy tax changes. 37 of the changes put extra money in people’s pockets. Here’s the result in pictures.

(Click on image to enlarge)

Tax data from the BEA, chart by Mish

In case you are wondering about the strength of the economy please see Tax Cuts, Not Bidenomics Explains Surge in Consumer Spending in 2023

On January 1, 2023, 38 states had noteworthy tax changes. 37 of the changes put extra money in people’s pockets.

On January 25, I noted 4th Quarter GDP Blows Past Consensus, Up a Strong 3.3 Percent

Moral of the Story

If you tax less, people will spend more.

Now, if Congress can just do something about massive deficit spending and $34 trillion in debt.

Debt Soaring Out of Sight

GDP is fueled by both consumer debt and government debt. Regarding government debt, Republicans are in on the deal.

For example, The GOP Supports a Child Tax Credit Boost and Affordable Housing Expansion

Without passing anything but continuing resolutions, we went from a House Speake Kevin McCarthy’s proposal of $1.471 trillion bill to Mike Johnson’s $1.66 trillion bill that does not include, Ukraine, Israel, or the US border with Mexico.

And not only did consumers spend their tax cuts, they also racked up credit card debt.

Consumer Credit Hits Record $5 Trillion

For discussion, please see Retail Sales Surge 0.6 Percent, Beating Economist’s Expectations

Consumers keep spending more and more, and much of that spending is online.

Also see How Did Covid Change Your Propensity to Buy Things Online?

So, if you were at all inclined to think Bidenomics is to credit, please think again.

More By This Author:

Dealers Beg GM for Hybrid Vehicles, Can GM Do Anything Right?Texas Manufacturing Index Plunges To Lowest Level Since The Pandemic

Tax Cuts, Not Bidenomics Explains Surge In Consumer Spending In 2023

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more