Jeb Handwerger: Fed Interest Rate Increase Could Be Best Thing To Happen To Gold

A true contrarian knows that when everyone says an interest rate hike by the Federal Reserve would kill stocks, that is the best time to double down on junior mining names. In this interview with The Gold Report, Gold Stock Trades author Jeb Handwerger shares the names of the companies he thinks could do well through the drill bit or by acquisition regardless of when the inevitable turnaround comes.

The Gold Report: Common wisdom says that when the U.S. Federal Reserve raises interest rates later this year, it will prove negative for gold. Do you agree?

Jeb Handwerger: I think it'll be the opposite. Money printing and easy credit has fueled the stock market rally and beaten down commodities. Investors flocked to dividend-paying stocks, and became speculative in tech, which has led to huge overvaluations similar to the late 1990s dot-com debacle. We've had a four-year parabolic rise in the Dow without a meaningful correction. Most investors who have been in this business for a while know that every four years you get a bear market with about a 30–50% correction. Rising interest rates may be the catalyst that causes investors to flee the general stock market, which has proven attractive in a low rate environment. Higher interest rates concurrent with a pickup in inflation could result in a rush to a safe haven in commodities and wealth from the earth—natural resources and precious metals, which is historically a hedge against a pickup in inflation.

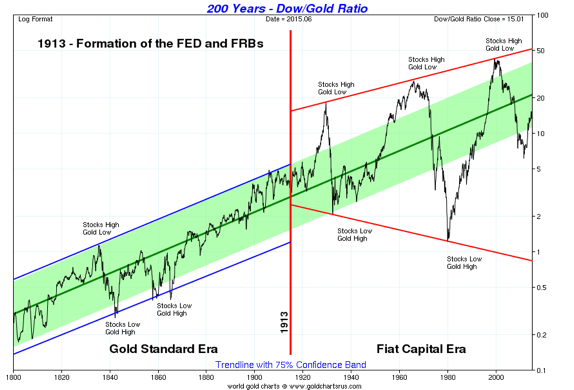

The Dow-gold ratio is a critical tool to see the inverse relationship between stocks and gold. When stocks move higher investors abandon gold and vice versa. Notice the pattern since 1913 when the Federal Reserve was created. The stock booms and busts are much more dramatic. In the 20th century we saw the Dow-gold ratio move close to parity during the Great Depression and in 1980 when interest rates soared to record territory.

Notice in the 1970s there was a much more severe decline than in the 1930s as money printing and debt soared after gold was completely abandoned during the Nixon Administration. Eventually this will revert back to 1:1 or possibly lower sometime in the next 10–20 years. Investors must be prepared for such a scenario as the supply of global fiat money is much higher than in the past. It may not occur as fast as people expect it to, but over the next four to five years, we could eventually see the Dow-gold ratio correct.

Notice the recent uptick in favor of the Dow. It looks quite similar to what happened in the 1970s when investors were suckered back into stocks only to witness a major parabolic move in gold from the sidelines. This move higher in the Dow could be a suckers' rally and that is what we're preparing for. The balancing will probably come from a combination of a real spike in gold prices after underinvesting in resource exploration constricts gold supplies and the popping of our current stock market bubble, 2000 dot-com style. It has to happen eventually.

The broad overvaluation in banking and technology is not supported by fundamentals. Mobile app companies are getting billion-dollar valuations with no revenues; that's a sign that we're near a market top. Quantitative easing and negative interest rates are some of the causes of the inflated market prices. Once rates start moving back up again, that's when we'll see precious metals start moving again as in the 1970s. Gold will top again as it did in the 1980s with record high interest rates, not negative interest rates. Rising rates might be the catalyst for investors to rotate into the commodities, particularly into precious metals.

TGR: We are also in the middle of an annual summer seasonal low. How are you positioning yourself to take advantage of the opportunities you're seeing right now?

JH: There are two periods where you get bargains in the junior mining sector: December tax-loss selling and the summer doldrums, characterized by a lack of market activity due to investors being on summer vacation. But summer is actually one of the best times to buy because that's when explorers and developers, especially the ones in the snowy north with a limited work year, have the most news flow. Investors who buy now and then wait until September or October can see huge upside.

This is bargain time for the junior mining sector. If you're a contrarian investor, this is a great opportunity to take at least some of your profits from the overblown markets and wade into the beaten down junior mining sector where the best opportunities live.

TGR: Despite these overall trends, some companies did well last year. What were the traits these winners shared?

JH: In 2014, something very interesting happened. Despite the bear market in the junior sector, two mining companies, which I'm a shareholder of and which I spoke about numerous times in 2014, led the entire OTCQX. No. 1 was Western Lithium USA Corp. (WLC:TSX; WLCDF:OTCQX). No. 2 was NioCorp Developments Ltd. (NB:TSX). Western Lithium had a 2,566% increase in daily trading volume in 2014. NioCorp gained 394% in market cap. They were the top two of the best 50 OTCQX® companies. See the full list here.

Picking the top 2 out of 10,000 public companies from all over the world during the worst bear market in mining history and an unprecedented stock market bubble has been a great blessing. This is why investors are attracted to the junior mining sector. If you do your homework and pick the stories that have exceptional fundamentals, you can realize exceptional gains. Two gains like that can offset a lot of losses.

TGR: Both of those companies have moved down from their highs at the beginning of this year. Was there a common event that pushed them up and then down again?

JH: Sometimes things overshoot to the upside, and they come back to the mean. That's what happened with NioCorp. When things are going parabolic, that is not the time to buy but the time to be careful and possibly take partial profits especially after making a double, triple or grand slam tenbagger. Stocks go through periods of undervaluation and overvaluation. We have to be careful about being on margin or in debt in this rising rate environment. Right now, the overvaluation is in the general equity markets, which are definitely in need of a significant correction after going straight up for four years artificially from an extremely accommodating Fed.

TGR: What are some companies in the junior resource sector going against the trend this year?

JH: One of our best performing gold equities has been Integra Gold Corp. (ICG:TSX.V; ICGQF:OTCQX). It has outperformed the junior mining index by a significant margin, and it may be just beginning to break out into new highs. The company recently announced results from the compilation of 75 years of historical mine data, and it identified a major exploration target. Integra is in the center of Val-d'Or, Quebec, which is one of the best mining jurisdictions in the world. It has infrastructure, a permitted mill on site, and development potential. It is a world-class asset with a lot of working capital.

Company management has done an excellent job of building new shareholders. Integra is probably one of the most aggressive explorers and developers in the entire junior mining industry. This is a story that has performed very well for me in a challenging bear market in junior gold miners.

TGR: In a recent report, the company identified 8–20 million tons grading 5.5–6.5 grams per ton (5.5–6.5 g/t) at the Sigma-Lamaque project. Was that enough to get investors excited about it?

JH: I think that's why the market is reacting so positively, and that's why it's going to new highs. Everyone knew that this project was high grade. Everyone knew this was economic. What they wanted to see was the size. Now, Integra is beginning to show the market that there's size, there's growth and there's even more potential here. The company recently released its 75-year proprietary data on the mine to the public and offered a $1 million ($1M) prize to the best prospector who identifies the next big target. This is similar to what Goldcorp Inc. (G:TSX; GG:NYSE) did when Rob McEwen was running it and it turned out to be a great success. Integra is outperforming the Market Vectors Junior Gold Miners ETF and hitting new highs, when many of these junior gold miners are hitting new lows.

Integra is continuing to drill test, and there should be continuing news. There is going to be an aggressive summer and fall for this company.

TGR: What is another company that has been creating excitement with the drill bit?

JH: Another one that has done well for us in 2015 is NuLegacy Gold Corporation (NUG:TSX.V; NULGF:OTCPK). It has been drilling in Nevada's Cortez Trend next to Barrick Gold Corp.'s (ABX:TSX; ABX:NYSE) Goldrush discovery and made some impressive results. The company has an experienced technical management team led by Dr. Roger Steininger, who discovered the Pipeline deposit for Royal Gold Inc. (RGL:TSX; RGLD:NASDAQ) in 1989, which eventually came into production through Barrick. Needless to say, he has a great relationship with Barrick. He's very well respected.

In late May, NuLegacy drillers intersected two gold-bearing zones with extremely high assay results of around 25 g/t over 4 meters (4m) within over 40m of 4 g/t material. One of NuLegacy's directors, Alex Davidson, the former Barrick executive vice president of acquisitions, said that this result might indicate that the Iceberg gold deposit, which NuLegacy owns, is a very robust Carlin-type gold system and significantly expands its exploration potential.

TGR: Does NuLegacy have enough funds to realize its earn-in with Barrick?

JH: The company just raised over $2M, so it has enough funds to make it to the end of 2015 when it will earn in and Barrick will have to make a decision about spending $15M and bringing the project to feasibility with NuLegacy as a 30% carried interest. Recent drill results make us think there is a very good chance that that happens. Nevada is where Barrick's lowest cost, most economic and most profitable mines are located. The major has had to write down a bunch of assets in risky jurisdictions and will need to find the next source for low-cost resource growth in a stable jurisdiction. Barrick may just say it wants 100% and buy NuLegacy outright.

TGR: What is another one that has been doing well?

JH: Another gold company that I think should be on the radar of junior mining investors is Pershing Gold Corp. (PGLCD:OTCBB). The company just announced a share consolidation and introduced two new board members. This is setting it up for a better listing. Pershing has some of the strongest shareholders in the U.S.—Dr. Phillip Frost and Barry Honig. It's run by transaction attorney CEO Stephen Alfers, who has been around the gold mining sector for years, most notably with Franco-Nevada Corp. (FNV:TSX; FNV:NYSE). Pershing could get into near-term production at Relief Canyon, which has shown some incredibly high grades and has a permitted mill. Plus, it could make more accretive acquisitions. Pershing might be a vehicle for some of these top shareholders to pick up high-quality assets at bargain basement prices.

TGR: Are you looking at that as a mergers and acquisitions (M&A) play?

JH: Yes, but the uplisting from the OTC is key to raising capital from institutions. That would make it an exciting story in H2/15.

Canada has had a lot of M&A activity because of the relative value of the Canadian dollar. The Alamos Gold Inc. (AGI:TSX; AGI:NYSE)-AuRico Gold Inc. (AUQ:TSX; AUQ:NYSE) deal was partly the result of Alamos looking to expand into Canada. AuRico has great Canadian prospects, particularly with Carlisle Goldfields Ltd. (CGJ:TSX; CGJCF:OTCQX), which is developing the Lynn Lake gold project in Manitoba where AuRico is a partner. Manitoba is quite exciting now that Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE) has acquired Mega Precious Metals Inc. (MGP:TSX.V). That takeover could make Carlisle the next takeout target because low power costs make the province one of the lowest operating expenditure cost regions in the world

TGR: What are some other junior names that could be buyout prospects this year?

JH: Red Eagle Mining Corp. (RD:TSX.V), which is coming close to production in Colombia with an incredibly high economic project, could be a target. It is fully permitted and fully in construction of a very high-grade gold mine. It is also in acquisition mode. Next week, CB Gold Inc. (CBJ:TSX.V) shareholders will vote on an all-share offer Red Eagle made to merge those two companies.

Corvus Gold Inc. (KOR:TSX) just announced an extremely economic preliminary economic assessment and a new resource from the high-grade YellowJacket discovery in Nevada. This could be the start of a new district in Nevada and could make Corvus a target for one of the majors.

One that really has tenbagger potential if there is a black swan that takes gold back above $1,500 per ounce is International Tower Hill Mines Ltd. (ITH:TSX; THM:NYSE.MKT), which is owned by AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE), Tocqueville Asset Management L.P. and Paulson & Company Inc. This company has a huge amount of leverage in case gold jumps. It's trading at pennies on the dollar. It has 20 million ounces of gold, but it needs a much higher gold price.

That's my short list of companies that I'm betting are going to see some sort of transaction. There are more I discuss in my newsletter.

TGR: Please debunk one myth in the gold space that could hold resource investors back.

JH: One of the myths that you always hear is that gold is going to be sold off if interest rates rise. If interest rates rise, that means the powers that be are worried about inflation. Why do we invest in gold? To hedge against inflation.

The real myth, especially in the U.S., is that hyperinflation can never come to America. It can happen in Argentina. It can happen in Greece. It can happen in Europe. It can happen in Japan. But it will never happen in the U.S. because the dollar is king. That myth could cost people their fortunes. We have had cheap prices since the 1970s. The greatest misconception is that it will stay like that. But trends change direction. It's wrong to think that just because we've seen a trend in lower interest rates and low inflation that there can't be higher interest rates and higher inflation down the road.

That is what we're prepared for at Gold Stock Trades, and that is why subscribers continue to read and stick with junior mining investments. Those might not be their whole portfolios, but they maintain a percentage of their wealth in gold because they're concerned that hyperinflation could happen anywhere. The greatest concern I have right now for U.S. investors is that they've become complacent. They think that everything is hunky dory. Unemployment is going down. There's no inflation. But there really are issues. We're seeing riots, drought, increased conflict in Syria and Iraq. The euro is collapsing. What happens if interest rates rise while oil companies are sitting on huge amounts of debt in the U.S.? The greatest danger, I think, is complacency.

TGR: Thank you for sharing.

Jeb Handwerger is an author, speaker and founder of Gold Stock Trades. He studied engineering and mathematics at University of Buffalo and earned a master's degree at Nova Southeastern University. After teaching technical analysis to professionals in South Florida for over seven years, Handwerger began a daily newsletter, which grew to include thousands of readers from over 40 nations.

Disclosure: JT Long conducted this interview for Streetwise Reports LLC, publisher of The ...

more