Japanese Yen Under Additional Pressure By ‘Leading Indicators’ (USD/JPY)

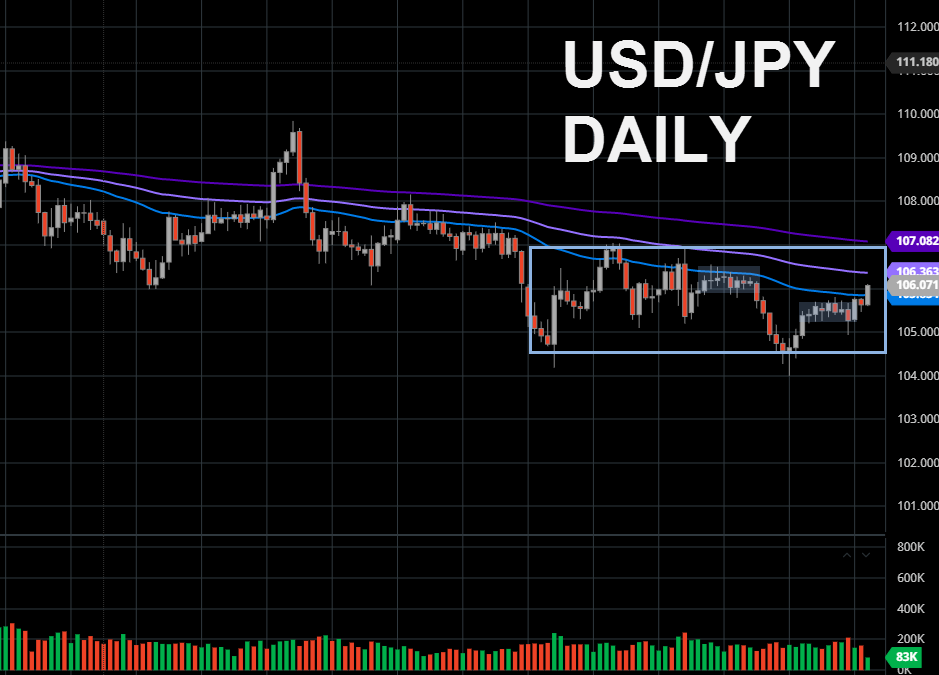

The Japanese yen weakened against the majors additionally by the lower-than-expected change of the ‘Leading Indicators’, the composite index based on 11 economic indicators, towards 88.8% with a forecast of 89.2%. The yen fell against the dollar by about 0.4% and the Australian dollar about 0.7% in the European trading session. The daily perspective of the USD/JPY rate broke out of the balance area which occurred for several days.

The weekly perspective found USD buyers around the area which is supportive for about 2 years. The daily periodicity broke out higher and above the EMA50, testing the prior price/rate distribution back from early September for Yen buyers. Hourly is trending higher, therefore traders might wait for patterns to establish or for rotational behavior to conclude scenarios that may favor the yen.

(Click on image to enlarge)

Visit our trading community to read more market insights and to learn the more indepth analysis process with various tools such as ...

more