It’s True. Quality Leads Market Returns In Narrow Breadth Markets

It takes time to find great investment ideas.

I know I have to pass on at least eight ideas before two become research worthy, but it still doesn’t guarantee that those two ideas are investment worthy.

Unless you are a full-time investor, it’s difficult to dedicate the hours you need into searching, analyzing and learning at the speed that you’d like.

The whole investing process is a funnel. You start with the search, casting a net wide and far. Then let it trickle down the spout.

The Traditional Investment Funnel

Here’s an example of an investing and search funnel that I found a while back.

This funnel is pretty detailed and will take you a while to go through it.

Graham and Walter Schloss did something similar back in the day by hand so it’s a tried and tested method.

He [Graham] and Walter collected numbers from the Moody’s Manuals and filled out hundreds of the simple forms that Graham-Newman used to make decisions – pg 185 Snowball

A Narrow Market Could Reduce Your Returns

But here’s something to think about trying to everything by hand.

There are thousands of stocks. Include OTC companies and there are over 10,000 public companies.

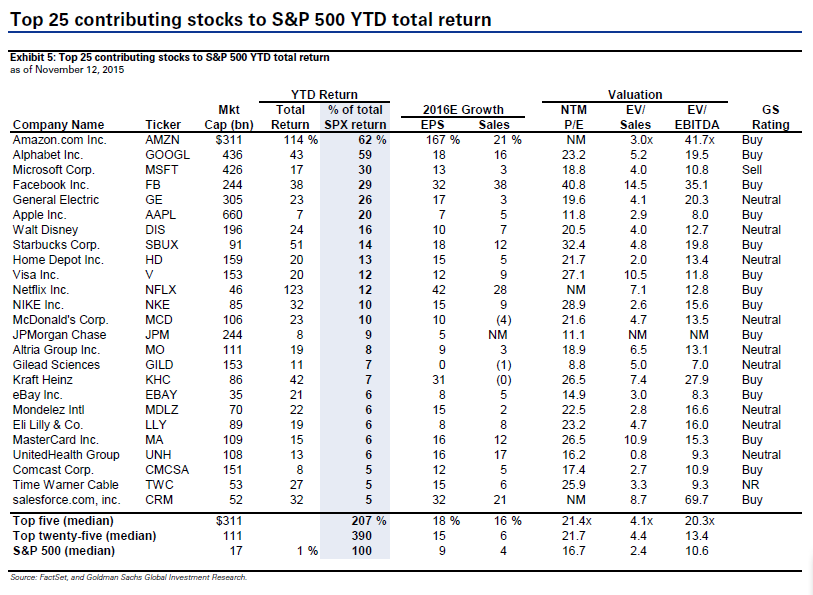

In Nov 2015, Goldman Sachs released their Breadth Index (GSBI) which shows how only a handful of stocks really contributed to the market returns.

(Click on image to enlarge)

Top 25 Contributing Stocks to S&P500 Returns

Out of 500 stocks in the S&P, 25 made up most of the performance. They call this a narrow breadth market.

In other words, 475 or 95% of the stocks in the S&P500 were either market performers or duds.

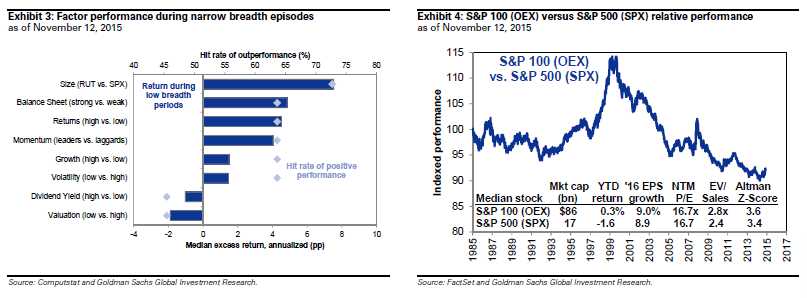

When the market breadth is narrow like this, it’s more important to focus on quality as this image shows.

(Click on image to enlarge)

Valuation is at the bottom on the left chart, but that’s misleading because the study was done by analyzing 6 month returns. Might as well have left out valuation.

But what you can’t ignore is that quality matters and how you can find them quickly without getting bogged down int he 95% that could diminish your returns?

Simple.

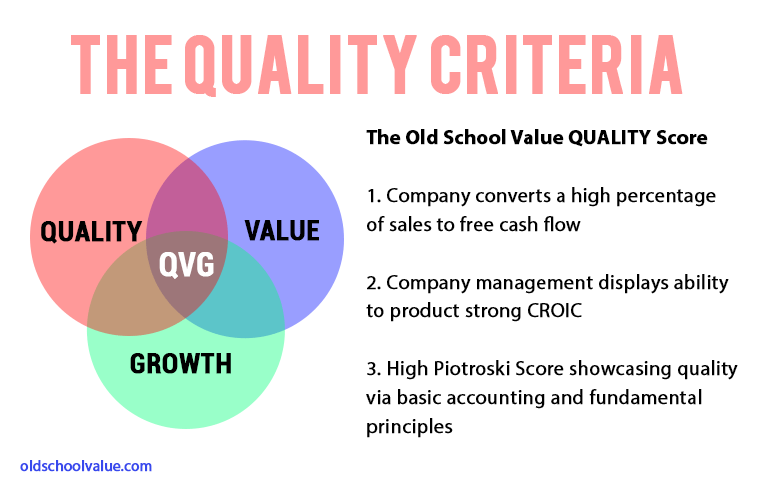

Sit down and really think about what quality factors are important for you.

Here’s how I define my quality filter.

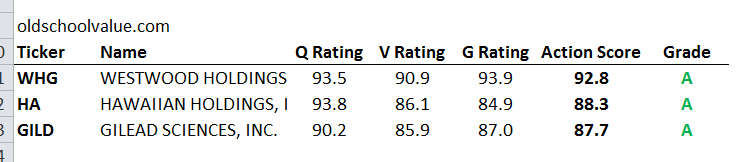

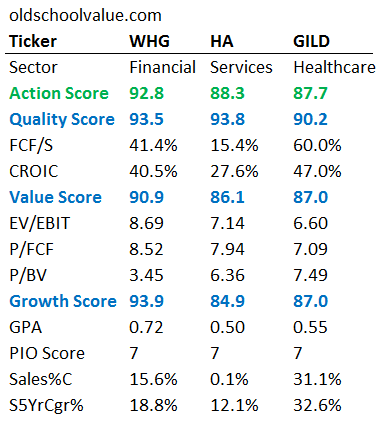

And 3 stocks that I’m sharing this week worth taking “Action” on are:

3 High Quality and High Action Score Stocks

Action Score Details of 3 Stocks

No. 1: Westwood Holdings Group (WHG)

Operates in the financial sector. Company manages investment assets and provides investment advisory services related to retirement plans, endowments, foundations and more.

Basic stats

- Price: $58.78 per share.

- Market cap: $513 million.

- Enterprise value: $372.8 million.

- Forward div. yield: 4.02%.

Action score: Grade A (score of 92.8)

- Quality score: 93.5.

- Value score: 90.9.

- Growth score: 93.9.

Key highlights

- Piotroski score of 7 shows fundamental strength.

- Excellent FCF generation ability and achieves a high return on the cash it invests.

- Cheap valuation with EV/EBIT of 9 and P/FCF of 8.8.

- Solid revenue growth in TTM and 5 year CAGR.

- No debt.

No. 2: Hawaiian Holdings (HA)

Operates Hawaiian Airlines and one of the best performers in the Action Score list year to date.

Basic stats

- Price: $47.64 per share.

- Market cap: $2.5 billion.

- Enterprise value: $2.7 billion.

Action score: Grade A (score of 88.3)

- Quality score: 93.8.

- Value score: 86.1.

- Growth score: 84.9.

Key highlights

- Airline that is growing the top and bottom line.

- Able to generate 27 cents in cash for every $1 the company invests.

- Making better use of its assets with a Gross Profit to Asset (GPA) of 0.5 and room to improve.

No. 3: Gilead Sciences (GILD)

Wrote about Gilead before (Is GILD worth $100 or not?).

Gilead is just too high quality of a company with good valuations to pass by. Lots of noise related to Gilead with all the political headlines, but headlines often make for a great reason to buy.

Basic stats

- Price: $92.35 per share.

- Market cap: $125.6 billion.

- Enterprise value: $133.6 billion.

- Forward div. yield: 1.88%.

Action score: Grade A (score of 88.5)

- Quality score: 90.2.

- Value score: 85.9.

- Growth score: 87.0.

Key highlights

- Piotroski score of 7 shows fundamental strength.

- Fundamentals are excellent with a strong balance sheet.

- Cheap valuation with EV/EBIT of 6.7. Mostly all valuation numbers are on the low end.

- No risk of default or financial difficulties even if it were to lose additional battles in court.

Key lowlights

- Lost patent case to Merck and will pay $200 million in damages.

- Competition building up in the HBV space.

Summary

Quality is a broad term so define what quality is to you because it works. It could be as simple as my P/FCF, CROIC and Piotroski factors.

Just don’t ignore quality when the market is narrow and limited opportunities. While people chase stock returns in rising markets, include quality into your investment decision.

Check out the 3 stocks above and let me know what you think.

Disclosure: Long GILD.

Excellent.