It's Treasury Vs The Fed: With Fed Sidelined, Bessent Unleashes Record $10 Billion Bond Buyback

Back on April 14 when bond yields were soaring in the aftermath of Trump's liberation day amid speculation that China or Japan were selling some of their US paper to stabilize their currency, a selloff which was compounded by the concurrent unwind of the massive $2 trillion basis trade, Treasury Secretary Steve Bessent appeared on Bloomberg TV to ease fears of a wholesale unwind of the US bond market. In the interview, among other things, Bessent revealed that he has breakfast with Powell every week, and also said that if the Fed does nothing, he might take matters in his own hands, and since the Treasury has a "big toolkit" one of the things it could do is "up the Treasury buybacks" (to prop up Treasuries, in lieu of QE).

Six weeks later, with the Fed sidelined and unwilling to do anything to ease the plight of US treasuries which continue to trade at dangerous levels - the 30Y is flirting with a 5% level - it appears this is what Bessent has done.

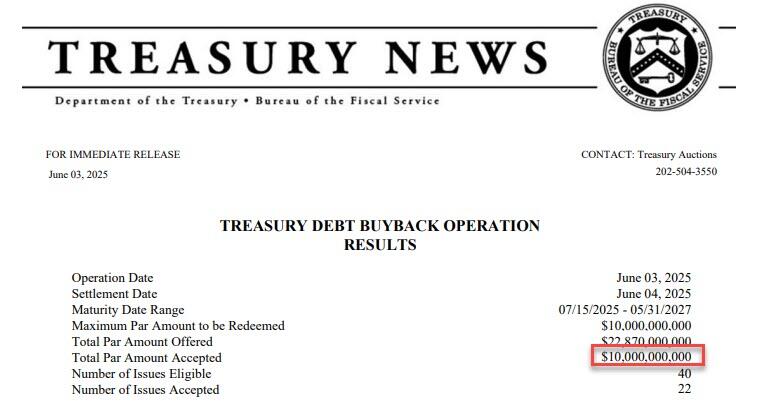

At 2pm on Tuesday afternoon, the Treasury announced the results of its latest Treasury buyback operation (which some had likened to a QE lite because it effectively monetizes Treasuries in the open market, similar to the Fed's POMO operations, and similar to stock buybacks). While the operation itself was not remarkable - the Treasury had been holding these more or less weekly since April 2024 - the size of it was: at $10 billion, this was the largest Treasury buyback operation in history.

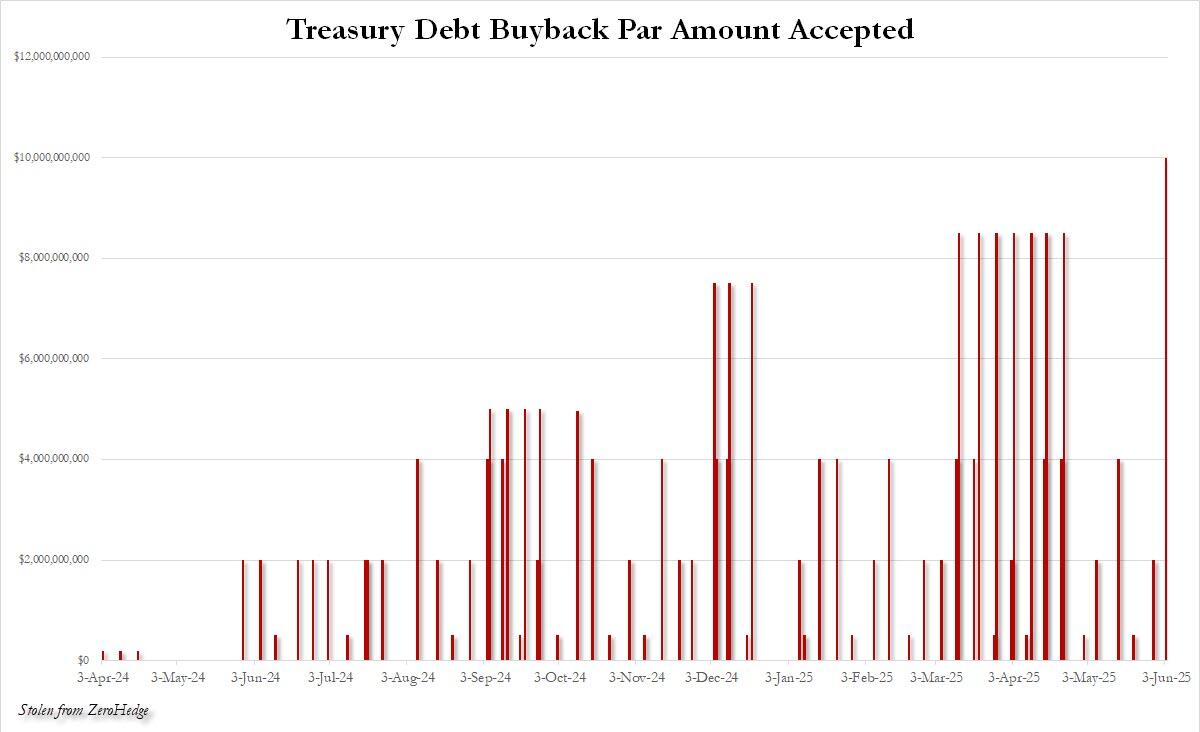

Here is a snapshot of all historical Treasury buybacks in the past year: the trajectory is clear.

And while the maturity range of the cusips accepted for buyback was of low duration, in the interval between July 15, 2025 and May 31, 2027, we are about to see sizable increases in the total buyback size of longer duration treasuries.

Sure enough, tomorrow at 2pm, the Treasury will complete a buyback focusing on Treasuries maturing in the 2036-2045 interval, i.e., 10-20 year paper, and the maximum amount to be redeemed will be $2 billion, up 100% from the last such buyback on May 6, when the maximum amount to be redeemed was $1 billion. In fact, the last time there was a treasury buyback anywhere close to today's amount was in mid/late April when Treasuries were tumbling and when someone had to step in and cushion their fall since Powell was nowhere to be found.

Which begs the question: with the political Federal Reserve - which had no qualms cutting rates two months before the election but refuses to do so now that core PCE has slumped to the lowest level since the covid crash, is Bessent finally stepping in to rein in the Treasury market, and is Yellen's Activist Treasury Issuance strategy which dominated bond buying for much of 2023-2024, about to be replaced with Bessent's Activist Treasury Buyback strategy until such time as the Fed finally does something.

More By This Author:

Global Tobacco Use Is Steadily Declining

Used Rolex Demand Soars On Tariff Uncertainty

OPEC+ Hikes Output For Third Time By 411Kbpd, Despite Reservations From Russia

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more