ISM Services Report: Faster Growth In July

The Institute of Supply Management (ISM) has now released the July Services Purchasing Managers' Index (PMI). The headline Composite Index is at 56.7 percent after two months of contraction and is up 1.4 from 55.3 last month. Today's number came in above the Investing.com forecast of 53.5 percent.

Here is the report summary:

(Tempe, Arizona) — Economic activity in the services sector grew in July for the 26th month in a row — with the Services PMI® registering 56.7 percent — say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®.

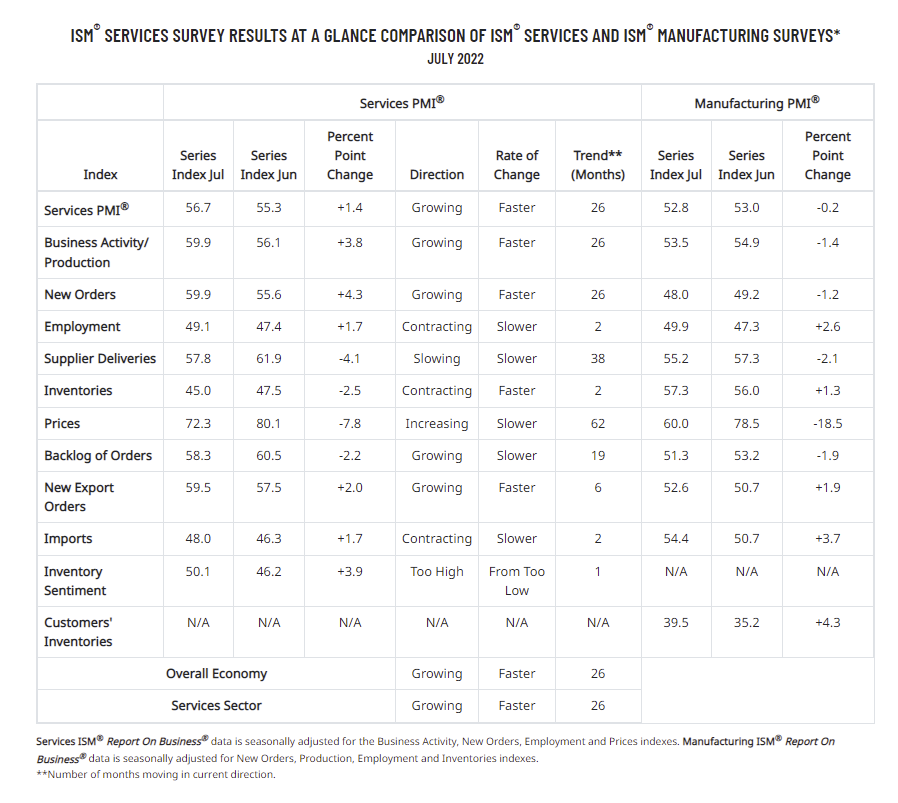

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In July, the Services PMI® registered 56.7 percent, 1.4 percentage points higher than June’s reading of 55.3 percent. The Business Activity Index registered 59.9 percent, an increase of 3.8 percentage points compared to the reading of 56.1 percent in June. The New Orders Index figure of 59.9 percent is 4.3 percentage points higher than the June reading of 55.6 percent.

“The Supplier Deliveries Index registered 57.8 percent, 4.1 percentage points lower than the 61.9 percent reported in June. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.)

“The Prices Index decreased for the third consecutive month in July, down 7.8 percentage points to 72.3 percent. Services businesses continue to struggle to replenish inventories, as the Inventories Index contracted for the second consecutive month; the reading of 45 percent is down 2.5 percentage points from June’s figure of 47.5 percent. The Inventory Sentiment Index (50.1 percent, up 3.9 percentage points from June’s reading of 46.2 percent) moved into expansion territory in July after four consecutive months of contraction.”

Nieves continues, “According to the Services PMI®, 13 industries reported growth. The composite index indicated growth for the 26th consecutive month after a two-month contraction in April and May 2020. Growth continues — at a faster rate — for the services sector, which has expanded for all but two of the last 150 months. The slight increase in services sector growth was due to an increase in business activity and new orders. The Employment Index (49.1 percent) contracted for the second consecutive month, and the Backlog of Orders Index decreased 2.2 percentage points, to 58.3 percent. Availability issues with overland trucking, a restricted labor pool, various material shortages and inflation continue to be impediments for the services sector.” [Source]

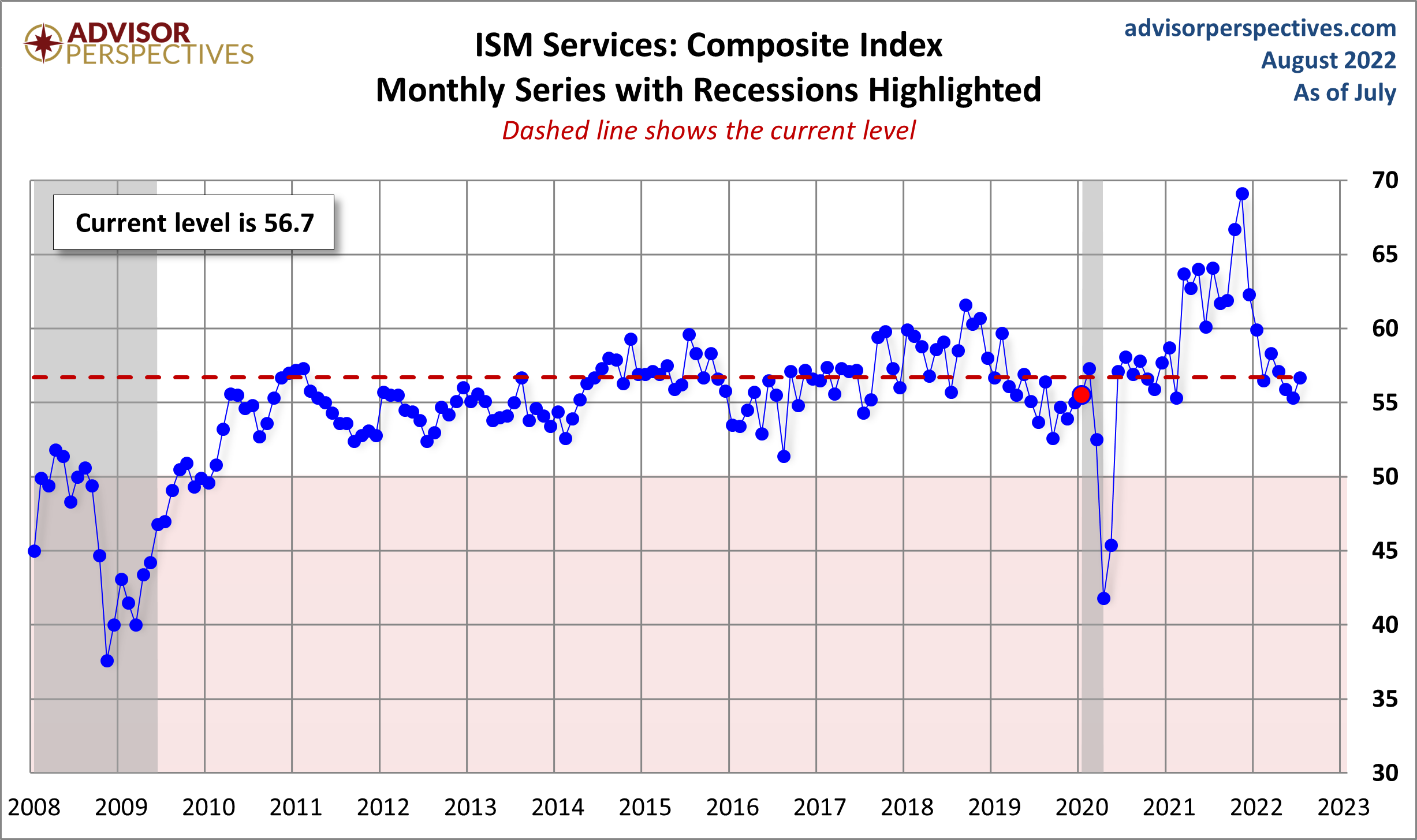

Unlike its much older kin, the ISM Manufacturing Series, there is relatively little history for ISM's Non-Manufacturing data, especially for the headline Composite Index, which dates from 2008. The chart below shows the Non-Manufacturing Composite.

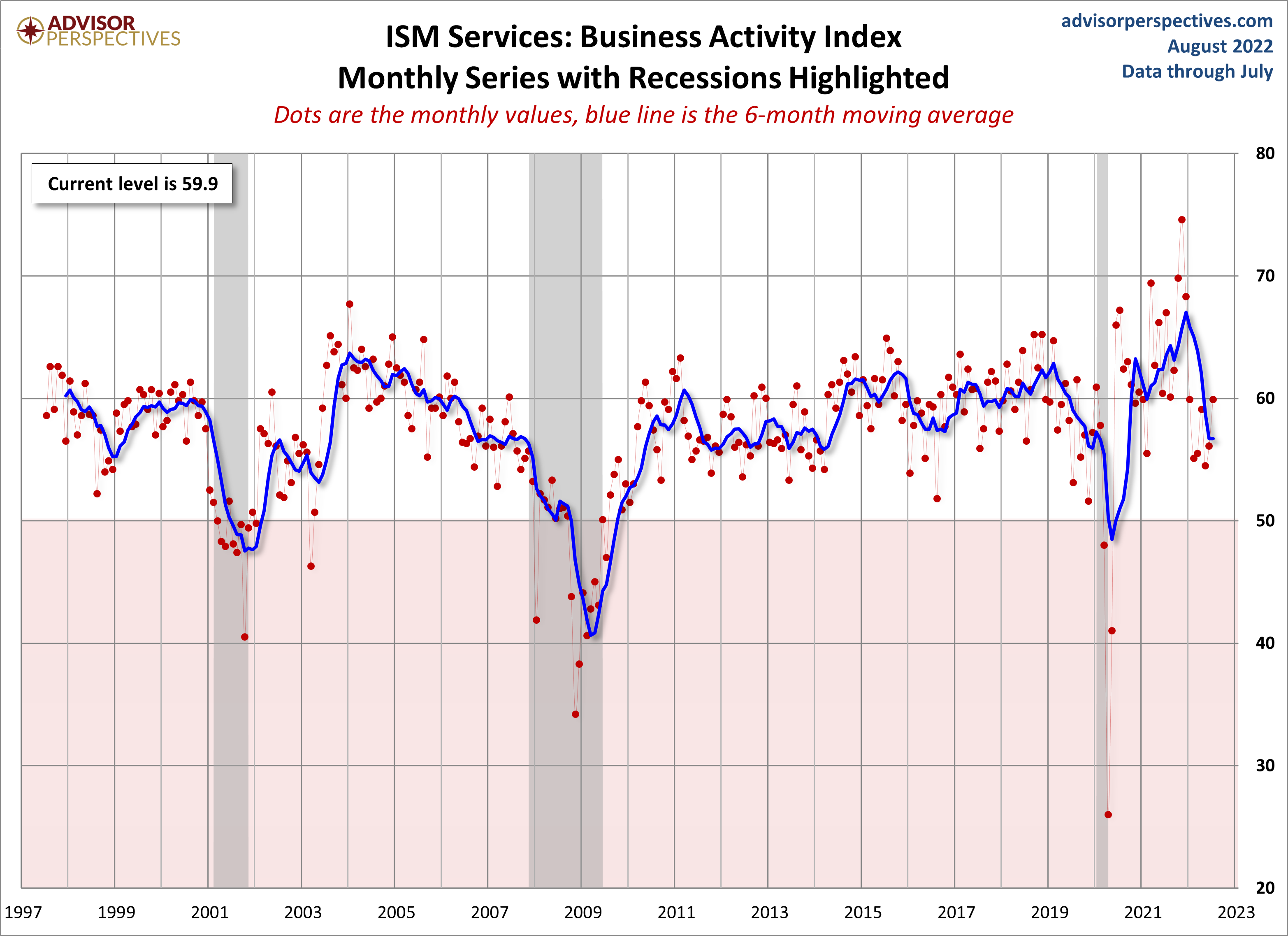

The more interesting and useful subcomponent is the Non-Manufacturing Business Activity Index. The latest data point at 59.9 percent is up 3.8 from a seasonally adjusted 56.1 the previous month.

(Click on image to enlarge)

For a diffusion index, this can be an extremely volatile indicator, hence the addition of a six-month moving average to help us visualize the short-term trends.

Theoretically, this indicator should become more useful as the time frame of its coverage expands. Manufacturing may be a more sensitive barometer than Non-Manufacturing activity, but we are increasingly a services-oriented economy, which explains our intention to keep this series on the radar.

Here is a table showing the trend in the underlying components.

(Click on image to enlarge)

Here is a link to our coverage of the latest ISM Manufacturing report.

More By This Author:

Weekly Gasoline Prices: Regular Down 14 CentsAn Inside Look At The GDP Q2 Advance Estimate - Tuesday, Aug. 2

A Perspective On Secular Bull And Bear Markets - Tuesday, Aug. 2