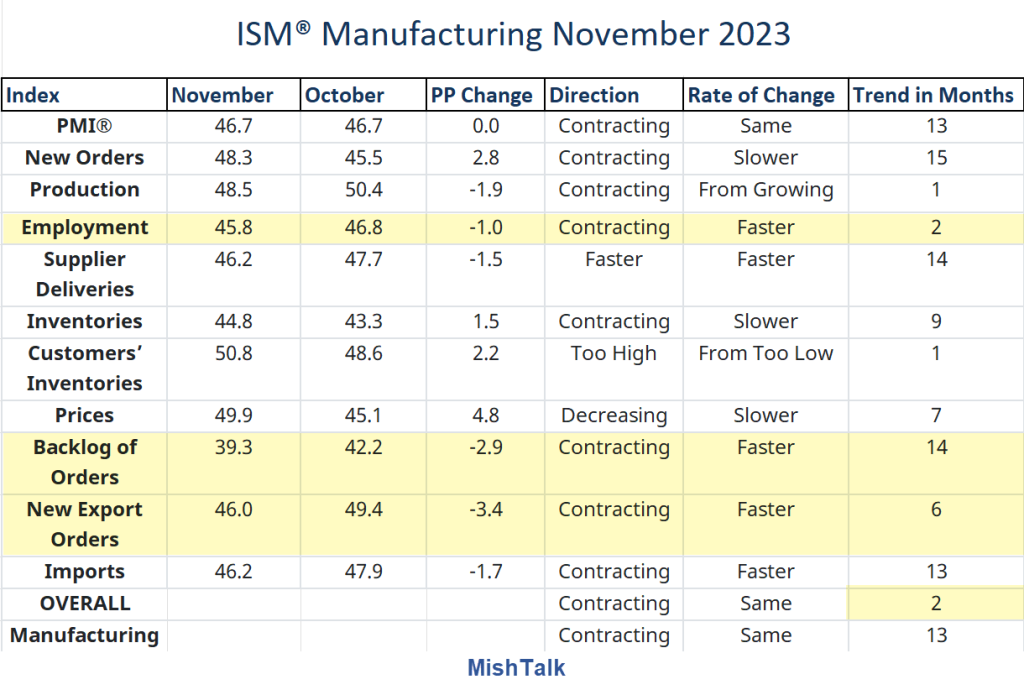

ISM Manufacturing Contracts For The 13th Consecutive Month, Order Backlogs Plunge

(Click on image to enlarge)

Image and excerpts by permission and courtesy of the Institute for Supply Management

Please consider the ISM Manufacturing Report for November 2023.

The U.S. manufacturing sector contracted in November, as the Manufacturing PMI® registered 46.7 percent, the same figure recorded in October. “This is the 13th month of contraction. All of the five subindexes that directly factor into the Manufacturing PMI® are in contraction territory, up from four in October. The New Orders Index logged its 15th month in contraction territory, but at a slower rate in November,” said Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management®.

A Manufacturing PMI® above 48.7 percent, over a period of time, generally indicates an expansion of the overall economy. Therefore, the November Manufacturing PMI® indicates the overall economy contracted for a second straight month after one month of growth preceded by nine consecutive months of contraction and 30 months of expansion from June 2020 to November 2022. “The past relationship between the Manufacturing PMI® and the overall economy indicates that the November reading (46.7 percent) corresponds to a change of minus-0.7 percent in real gross domestic product (GDP) on an annualized basis,” says Fiore.

Key Details

- Production: The Production Index dropped into contraction territory in November, registering 48.5 percent, 1.9 percentage points lower than the October reading of 50.4 percent. This follows two months of expansion preceded by one month of “unchanged” status and two months of contraction.

- New Orders: ISM®’s New Orders Index contracted for the 15th consecutive month in November, registering 48.3 percent, an increase of 2.8 percentage points compared to October’s reading of 45.5 percent.

- Employment: ISM®’s Employment Index registered 45.8 percent in November, 1 percentage point lower than the October reading of 46.8 percent. The index indicated employment contracted again in November after one month of expansion and three months of contraction before that. An Employment Index above 50.4 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

- Prices: The ISM® Prices Index registered 49.9 percent, 4.8 percentage points higher compared to the October reading of 45.1 percent, indicating raw materials prices decreased in November for the seventh consecutive month, though just barely and essentially flat month over month.

- Backlog of Orders: ISM®’s Backlog of Orders Index registered 39.3 percent, a 2.9-percentage point decrease compared to October’s reading of 42.2 percent, indicating order backlogs contracted for the 14th consecutive month (and at a faster rate in November) after a 27-month period of expansion. None of the six largest manufacturing sectors expanded order backlogs in November. The index recorded its lowest level since June 2023, when it registered 38.7 percent. “For the third straight month, the index remains in strong contraction as production rates and new order levels continue to have a negative effect on backlogs,” says Fiore.

- New Export Orders: ISM®’s New Export Orders Index registered 46 percent in November, 3.4 percentage points lower than the October reading of 49.4 percent. “The New Export Orders Index indicated that export orders contracted for the sixth consecutive month in November; the index has shown weak performance for the last 16 months. Comments continue to note overall weakness,” says Fiore.

Select Respondent Comments

- “Economy appears to be slowing dramatically. Customer orders are pushing out, and all efforts are being made to right-size inventory levels, both to mitigate carrying costs on pushed-out orders and to load up on inventory where costs are exploding, like cold-rolled steel.” [Computer & Electronic Products]

- “Starting to feel softening in the economy, with labor still a challenge to backfill critical roles. The 2024 forecast looks challenging, specially from a cost perspective.” [Chemical Products]

- “Nearly all microchip supply issues have been resolved, finally bringing an end to the three-year chip shortage. Material prices are remaining relatively flat. Supply chain issues continue in several areas, resulting from difficulties during the United Auto Workers (UAW) strike.” [Transportation Equipment]

- “Automotive sales still impacted by UAW strike. Still waiting for orders to come in, and we also need to work down inventory levels that increased during the strike period. This will most likely happen in December.” [Fabricated Metal Products]

- “Customer orders have pushed into the first quarter of 2024, resulting in inflated end-of-year inventory.” [Miscellaneous Manufacturing]

- “Elevated financing costs have dampened demand for residential investment. Our business has been negatively impacted through reduced new orders for our products and services. We are purchasing less for production and finished goods inventories.” [Wood Products]

There are more comments and many more details in the report.

Spotlight Employment and Backlogs

I put highlights on employment and backlogs because they are related.

Manufacturers are very reluctant to let workers go because it took them years to add to staff.

The manufacturers smooth out falling demand in new orders by working on backlogs. But the backlog index has plunged to 39.3 and has been declining rapidly.

Manufacturers will have a choice of reducing hours or cutting employees as the “Economy appears to be slowing dramatically.”

Biden Creates a New Economic Council on Supply Chains

Please consider my November 29, Hoot of the Day: Biden Creates a New Economic Council on Supply Chains

Perfect Timing!

What better time could there possibly be to create this task force adding over 20 individual agencies as co-chairs to an obviously critical mission than when supply chain pressures are at a record low of -1.74?

Today, we can add “Nearly all microchip supply issues have been resolved, finally bringing an end to the three-year chip shortage.”

Well done Mr. President.

More By This Author:

The Green Fantasy Ends Because Consumers Don’t Want To Pay For ItReal Income Jumps 0.3 Percent Thanks To No Reported Inflation

Hoot Of The Day: Biden Creates A New Economic Council On Supply Chains

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more