Is This The Next Speed Bump For U.S. Markets In October?

Image source: Pixabay

I recently discussed the ongoing risks in China. Things aren’t going well for it. However, I don’t want to overlook a short-term risk in the United States. Something’s building in the financial sector -- and I just want you to know about it before the coming week.

Recent FDIC data shows that a giant riptide could soon form in the banking sector. The Federal Reserve will need to delicately balance this challenge. Come October, roughly $950 billion will become due in term deposits (see Certificate of Deposits or CDs) at U.S. banks.

Most banks have started communicating with their CD customers that they need to decide if they want to roll over the CD for the next six to 12 months. However, these rates are typically much lower than the current money market rate of 5%.

Customers might shop around with their money, preferring to move it from one bank to the next. Short-term rates are much higher than 12-month options.

According to author James White at Total Expert, the situation gets even wilder, as estimates put total CD maturation over the next 12 months at roughly $2.5 trillion. He’s calling this situation a “maturity tsunami.”

There’s a lot of money sloshing around, looking for homes. And with rate cuts coming, the calculus may change quickly for money markets and banking reserves. We’ll have to see how the game plays out.

But first, what are the risks here? There are four of them.

- Possible Liquidity Drain from Banks: As CDs mature, funds could move away from banks, leading to a liquidity drain. This may force banks to raise deposit rates or liquidate assets, affecting their financial stability and lending capacity. We already saw a spasm in March 2023, and banks are still struggling with balance sheets full of bonds that lost a steep amount of value due to rising rates. It’s not like interest rates are going anywhere near 2% soon. But let’s see if the Federal Reserve needs to get creative with its balance sheet again. The last time we had liquidity drains, the Fed opened up lending by accepting U.S. Treasuries and other liquid assets at par value despite declining asset valuations.

- Increased Reinvestment Risk: With lower interest rates on new CDs, savers may shift their money into higher-yielding, riskier investments, potentially inflating asset bubbles or increasing volatility in equity markets. We’ve seen this before, but it is less of a risk than any of the other three on this list.

- Pressure on Repo Markets: Banks may use the repo market to manage liquidity, driving up short-term borrowing costs. Increased repo rates can lead to tighter financial conditions, influencing the broader markets. We keep forgetting that the repo market has been a massive source of instability since 2018. Don’t discount the chance of waking up one morning to see a big spike in overnight lending rates.

- Impact on Reserves: Banks might face challenges managing their reserves, as the outflow of maturing CDs could force them to hold onto higher cash buffers, reducing their ability to extend credit. This can ripple into the equity markets, influencing company valuations and investor sentiment. Most people have argued that the central bank has been engaging in quantitative tightening over the last two years. However, the truth is that the banking system has been provided ample support at the reserve level, especially since the SVB Financial crisis that happened in 2023.

It could be nothing, or it could be the source of our next little spasm in the market. It’s good to have it on the radar because I want to stress that the whole thing will likely require some level of coordination from the Federal Reserve (and Treasury) if we see some pop in volatility.

As always, I'd say to keep a look out for high-quality blue chip stocks you may want to own for the long term. You'll likely want to be buyers if they take a bit of a punch.

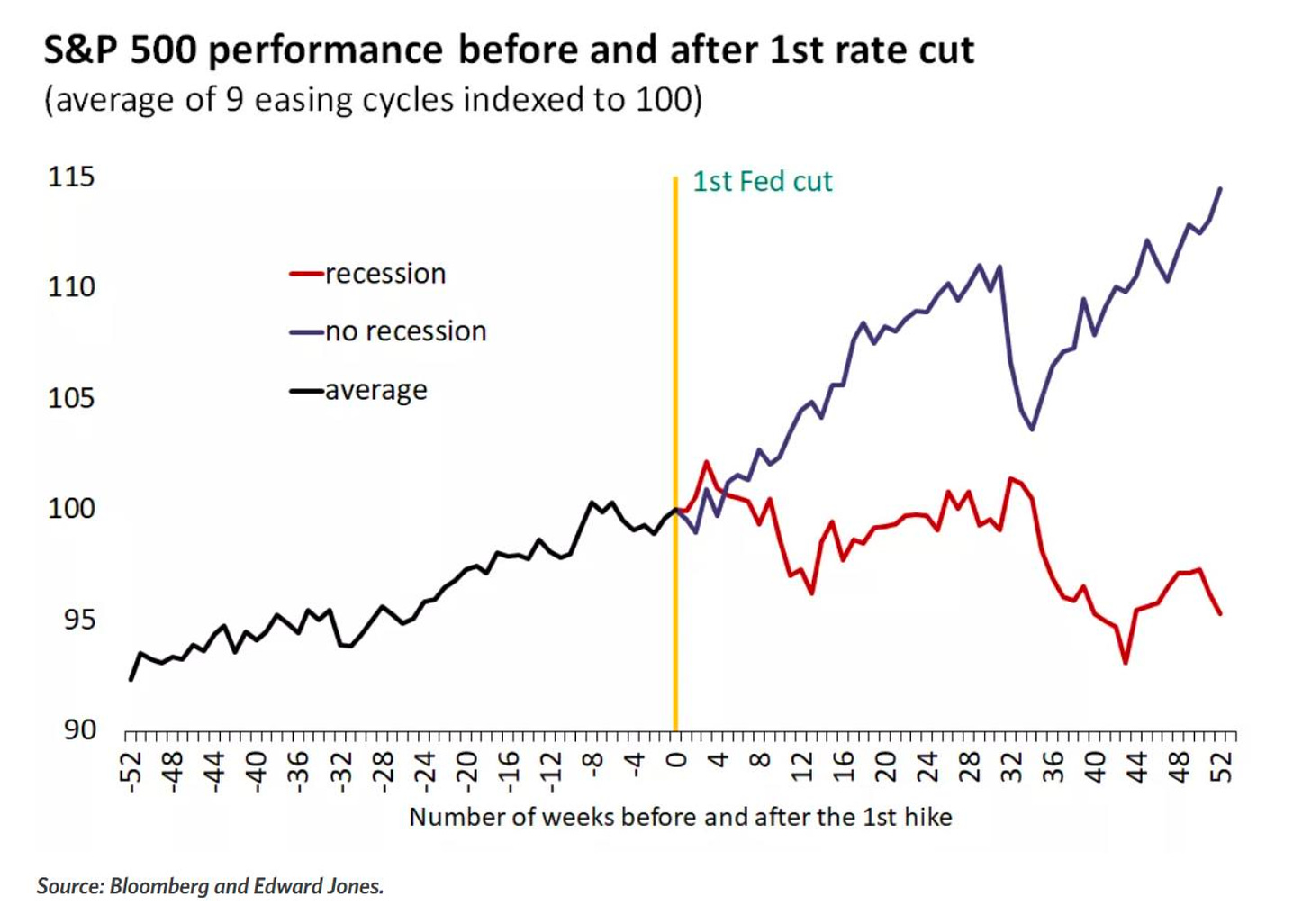

Meanwhile, the S&P 500 continues to barrel toward our 6,000 target, defying expectations in an environment where central banks are cutting balance sheets. The question is, what really happens to the U.S. economy? Can asset prices continue to prop up this economy, or will the weakening economic data and consumer spending catch up?

It largely comes down to the reaction of the economy to rate cuts.

There’s a lot of infrastructure stimulus coming online again next year. In late 2022, it was sales of oil exports that kept the economy out of recession. In 2024, it’s been wild Treasury activity that has offset the Fed’s QT plans.

So, what will they have up their sleeves next year? We’ll find out.

My reason for being bullish: When we continue to see massive levels of global debt and an ensuing expansion of global liquidity, we shouldn’t be shocked to see these moves higher. But that doesn’t mean we won’t see volatile markets in the near-term.

Now, let’s get to September, which is a period of historical volatility.

Monday, Sept. 2, 2024

- Event: U.S. Markets Closed for Labor Day Holiday

You can buy a mattress, a car, furniture, or find deals on Amazon Prime. Is this still considered a shopping holiday? And shouldn’t we measure those retail sales over the weekend on the same day, like we do for Black Friday or Amazon Prime Day?

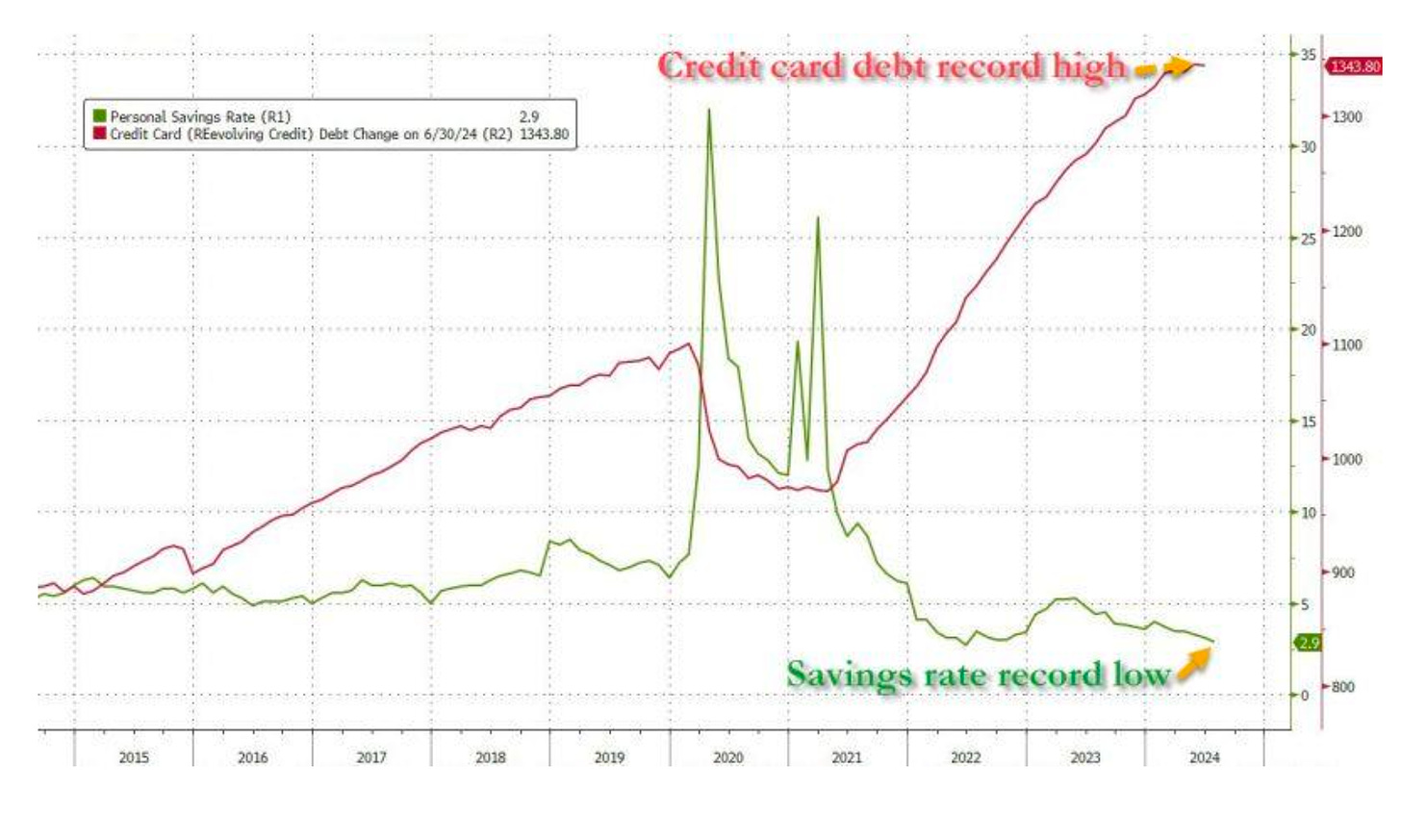

Image Source: Zerohedge

It seems like a good time to remind America that the U.S. consumer isn’t doing so well. Just look at the chart above, which combines the explosion in consumer credit usage and the collapse in savings.

Tuesday, Sept. 3, 2024

- Event: Intel (INTC) will host an event in Berlin, Germany, to celebrate the next generation of Intel Core Ultra processors.

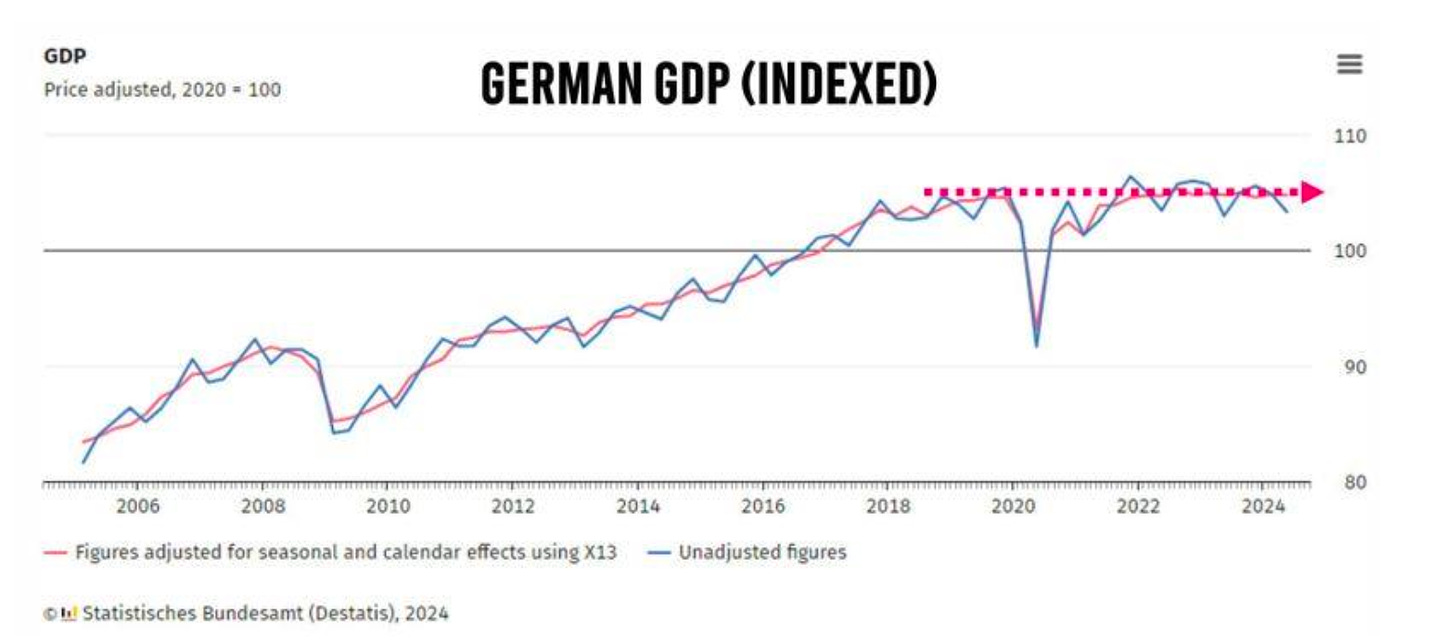

What better way to celebrate the next generation of your potentially collapsing technology company than to hold an event in a nation that has seen zero economic growth for six years?

Image Source: Michel A.Arouet & chart @jsblokland on X

(Click on image to enlarge)

It seems like the perfect metaphor for Intel, which has seen shares collapse in the last year, and its CEO throw money in some of the most reckless insider buying of the last few years.

The good news is that Intel seems to be stabilizing -- but only after news that it’s willing to sell part of its business. NVIDIA (NVDA) is absolutely crushing Intel, and it feels like two or three decades ago when Microsoft ran away from all of its competitors thanks to a superior product at scale.

Wednesday, Sept. 4, 2024

- Event: Dollar Tree Earnings (DLTR) earnings and SkyWest (SKYW) will appear at Deutsche Bank Airline Day

Dollar General (DG) took an absolute beating this week after announcing its earnings report and issuing weak guidance.

It’s a bad sign when Americans aren’t even shopping at the dollar store. As Syz Group said this weekend, Americans with assets are doing great, while Americans without assets live in Depression times.

Image Source: CNBC

Meanwhile, remember to always celebrate your winners.

SkyWest was our original Thanksgiving Dinner selection for 2023 at Flashpoint Trader last year. The recommendation for the stock came in at around $16.50. Shares have appreciated dramatically over the previous year.

Shares hit $77.54 on Friday.

Image Source: Google

This shows that it only takes one super-charged winner to carry your portfolio, allowing you to speculate on similar quantitative metrics and set stops. Let your winners run, and cut your losers.

It’ll pay off better in the long run. It’s one reason why we’re continuing to stick with so many capital-efficient shipping companies with little debt and a bright future due to what I expect to be a big boost from Chinese stimulus.

Thursday, Sept. 5, 2024

- Event: NFL Season Kicks Off

Get ready for a lot of speculation around sports gambling this week. That’s what we need more of. Here’s a question for this industry, why not just gamble instead? It’s the same thing.

I’d personally rather do a $20 parlay on the Chiefs +7, Xavier Worthy TD, and Travis Kelce TD than buy any of the following stocks: DraftKings (DKNG), Flutter Entertainment's (FLUT), ESPN Bet via Penn National (PENN), or BetMGM (MGM) (Note that is not gambling advice. Do not do this).

Friday, Sept. 6, 2024

- Event: The August Jobs Report

If we’re talking about a reversal event off the recent tops, this could be it. But it’s once again a question of whether bad news is bad news, or whether a weak jobs report confirms a 50-basis point cut by the Federal Reserve next month.

The Fed’s Jackson Hole event effectively claimed victory over inflation (it’s not over), and suggested the central bank will turn its attention to the other side of its dual mandate: The jobs market.

However, I have one core concern for the central bank. China’s ongoing debt deflation problem is globally deflationary.

So, if China does start to engage in open market operations and eventually needs to engage in widespread stimulus, what happens to inflation elsewhere in the world? The inflation battle is not over, and it would not shock me if the Fed needs to keep rates above 4.5% for a longer period.

More By This Author:

They Think We're DumbPostcards: The Week Ahead And The Trap Behind Me

Distractions, Selloff Worries, And The Week Ahead

Disclosure: None.