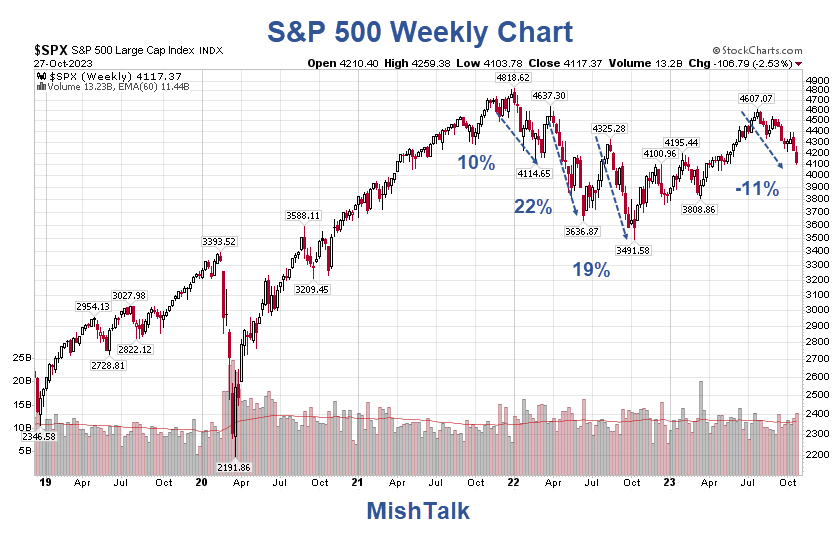

Is This A Stock Market Correction Or A Resumption Of The Bear Market?

Image Source: Unsplash

I’m seeing a lot of chatter about a stock market correction today. What’s going on?

Ten Percent Correction

The S&P 500 has now corrected 10% from its July 31 peak. This is the first such correction since the market bottomed on October 12, 2022.

— Jim Bianco (@biancoresearch) October 27, 2023

I'm surprised I see no screaming red headlines about this. It tells me it is not viewed as a big deal.

Then ... the decline will continue… pic.twitter.com/R2HjEPHnJD

Official Correction

BREAKING: The S&P 500 has officially entered correction territory, now down 10% from its July high.

— The Kobeissi Letter (@KobeissiLetter) October 27, 2023

This means that the market is now down 10% from the exact date the Fed removed a recession from their forecast.

The S&P 500 has lost over $4 trillion in market cap since July.… pic.twitter.com/QYT4800B4x

I see lots of headlines including the Wall Street Journal.

S&P 500 and Nasdaq

Market Update:

— Genevieve Roch-Decter, CFA (@GRDecter) October 27, 2023

1. S&P 500 and NASDAQ both officially enter correction territory.

2. 2/3 of S&P 500 stocks trading below 200-day moving averages.

3. MSFT, AMZN, META, GOOG all beat earnings expectations.

4. Q3 U.S GDP soars +4.9%, twice expectations.

5. Cathie Wood says…

Jim Bianco says “I’m surprised I see no screaming red headlines about this. It tells me it is not viewed as a big deal.”

I am not sure if this is screaming, but a Wall Street Journal headline reads Stock Market News, Oct. 27, 2023: S&P 500 Ends Lower, Enters a Correction.

The position on the WSJ was #2.

The S&P 500 follows the Nasdaq, which ended in a correction earlier this week.

The week was marked with even bigger swings under the surface for everything from technology heavyweights to oil giants.

Alphabet’s earnings disappointed investors, sending the stock down almost 10% for the week, the worst showing since November. Chevron shares lost more than 13%, the worst weekly decline in more than a year, after the company reported quarterly earnings that were sharply lower than a year earlier.

JPMorgan shares fell after Chief Executive Jamie Dimon announced plans to make his first substantial sale of the bank’s shares since taking over nearly two decades ago.

Correction of Resumption of the Bear Market?

A widely-used definition of a correction is a 10 percent decline from a recent high, but to me, that seems more fitting for a bull market or a correction higher in a bear market.

Correction Chart

S&P 500 chart courtesy of StockCharts.Com, Annotations by Mish

Is that the right way of viewing things or is the lead chart?

Correction should mean counter-trend but the trend is down. Thus, I propose the correction was the rally.

I suggest we had a 32 percent bear market correction higher and the bear market has resumed.

Rallies of 50 percent or even 100% are common in long bear markets. Until a new high is set it’s a mistake to assume a new bull market has started.

Yellen Says Higher Yields Reflect Strength of the Economy

Please note that Yellen Says Higher Yields Reflect Strength of the Economy and IRA Success, Not the Deficit

Is this correction just another reflection of the strength of the US economy?

Gold and Bitcoin Surge with Treasuries Hammered, What’s Going On?

Also note Gold and Bitcoin Surge with Treasuries Hammered, What’s Going On?

The bond market is getting hammered along with stocks but gold and bitcoin are on a tear and have been acting mostly together for months.

You can cheer along with Yellen if you like, but I don’t think the economy is all that great. Inflation sure is. And so is deficit spending helping create an artificial boom.

More By This Author:

Real Disposable Personal Income Drops For The Third Month But Spending JumpsBlowout 4.9 Percent Increase In GDP But Real Disposable Income Declines 1.0 Percent

After 22 Days The House Finally Has A Speaker, Meet Mike Johnson

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more