Is This A Recession?

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP fell at a 0.9% annual rate in the first quarter. That makes two quarters in a row of falling real GDP, which is one rule of thumb for declaring the economy to be in a recession. The current economic weakness could certainly develop into a recession. But the evidence isn’t convincing that a recession is already under way.

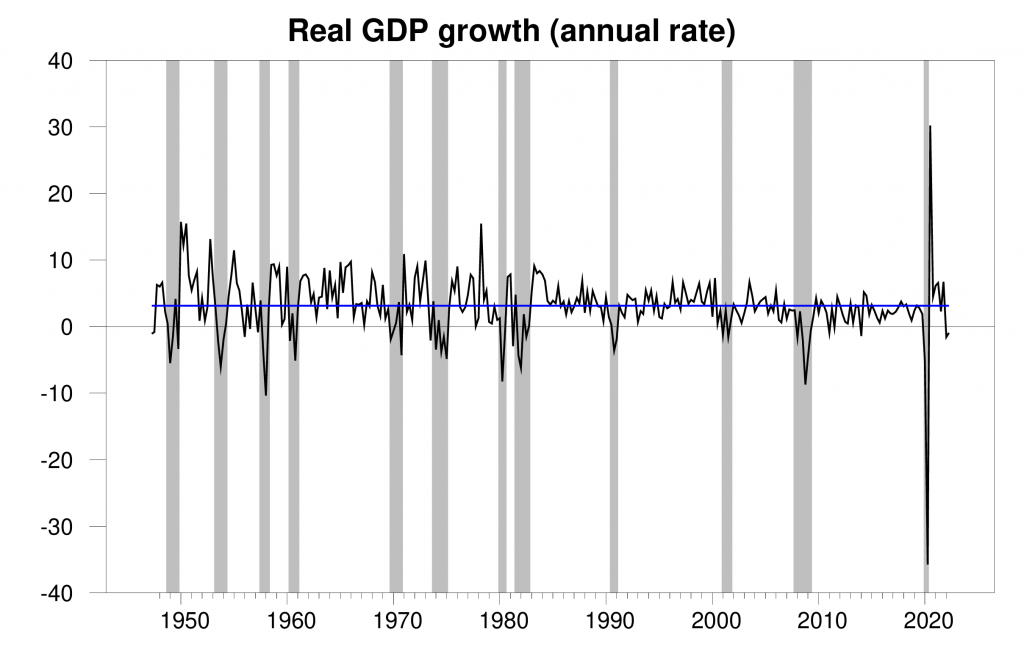

Real GDP growth at an annual rate, 1947:Q2-2022:Q2, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of GDP from the previous quarter.

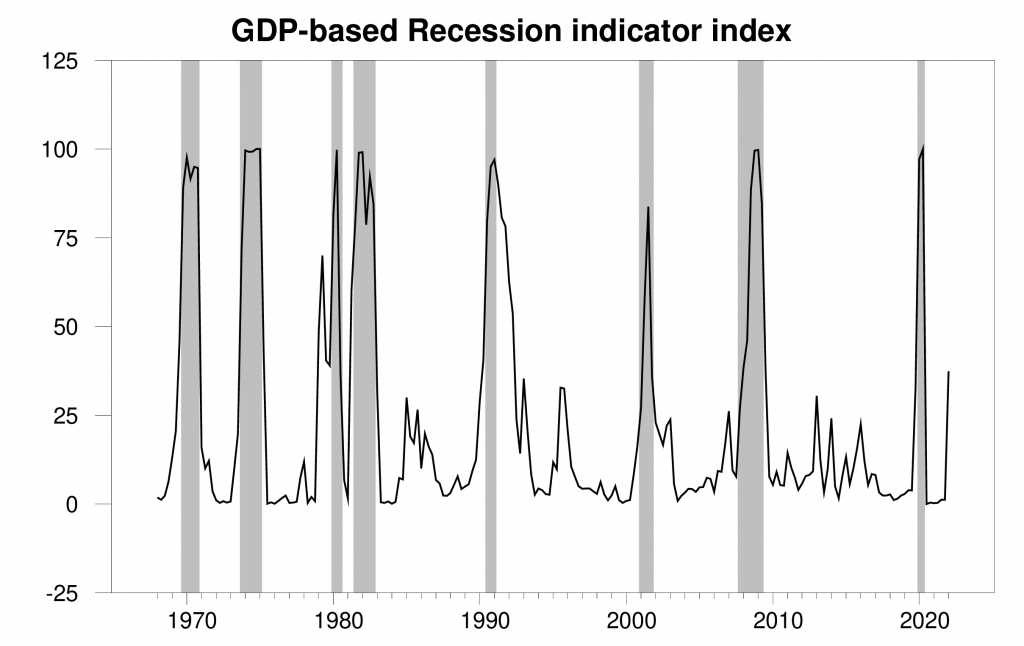

The new data raised the Econbrowser recession indicator index up to 37.4%, flashing a clear warning sign. This is an assessment of the situation of the economy in the previous quarter (namely 2022:Q1). The index takes into account the fact that we’ve now seen two consecutive quarters of falling GDP, but still finds the evidence inconclusive as to whether the U.S. economy started a recession in the first quarter. When Marcelle Chauvet and I first developed this index 17 years ago, we announced that we would only declare a recession to have started when the index rises to 65% (see pages 14-15 in our original paper). If the Q3 GDP report causes the index to rise above 65%, we would announce a recession at that time, and also use the full range of revised historical data available at that time to determine the date at which the recession likely started. Here at Econbrowser we’ve followed that procedure to the letter as the data unfolded in real time over the last 17 years, successfully dating in real time the beginning and end of the two recessions since we started this blog.

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2022:Q1 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

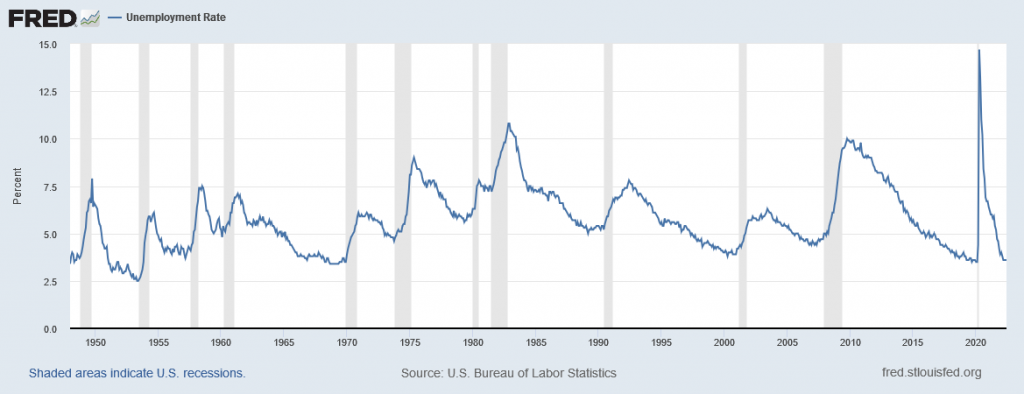

This index is based on the GDP data alone. But other indicators reinforce the conclusion that you can’t clearly say that a recession has already started. A sharp rise in the unemployment rate is one of the defining features of every historical recession. How could we be 6 months into a recession with the unemployment rate still at 3.6%?

Notwithstanding, a faithful reader reminds me that I haven’t been keeping the emoticon for our Little Econ Watcher up to date. This is a more subjective assessment of the overall message from a variety of economic indicators. I’m sad to report that he’s now turned decidedly  .

.

![]()

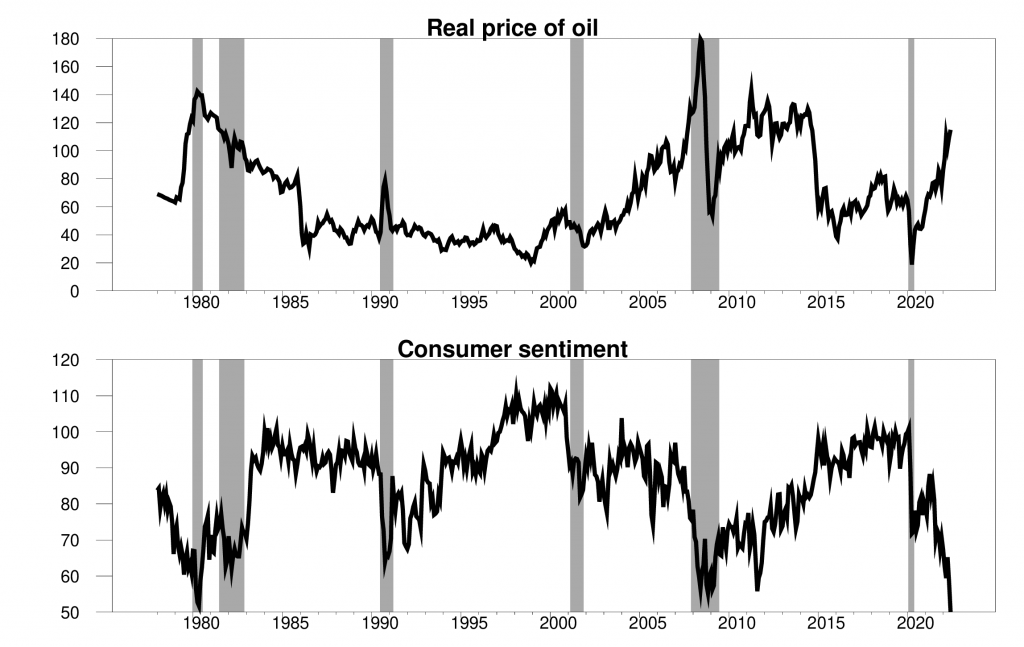

Ten out of the twelve recessions in the United States since World War II were preceded by a sharp spike up in the price of crude petroleum. If 2022 does develop into a full-blown recession, that will bring the count up to 11 out of 13. One of the mechanisms by which oil price spikes contributed to historical downturns was by causing a significant souring in consumer sentiment. That’s certainly been part of the story this time as well.

Top panel: real price of oil (WTI divided by CPI) in 2022 dollars. Bottom panel: University of Michigan survey of consumer sentiment. Monthly, 1978:M1 to 2022:M6.

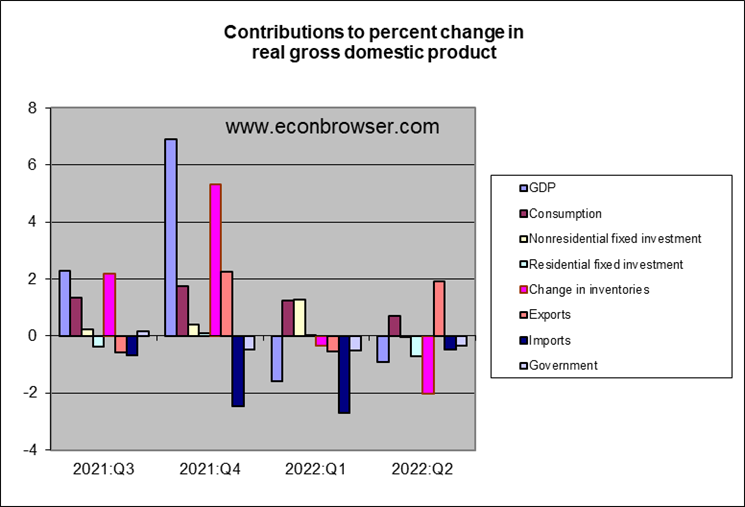

Worried consumers surely contributed to the weak growth in real consumption spending so far this year. But the biggest single factor in the negative GDP growth in Q2 was a drawdown in inventories. More goods were sold than produced. A build-up in inventories was a factor making 2021:Q4 growth look strong and the draw-down now is a factor making 2022:Q2 growth weak. Real final sales have been more stable over the last year than real GDP.

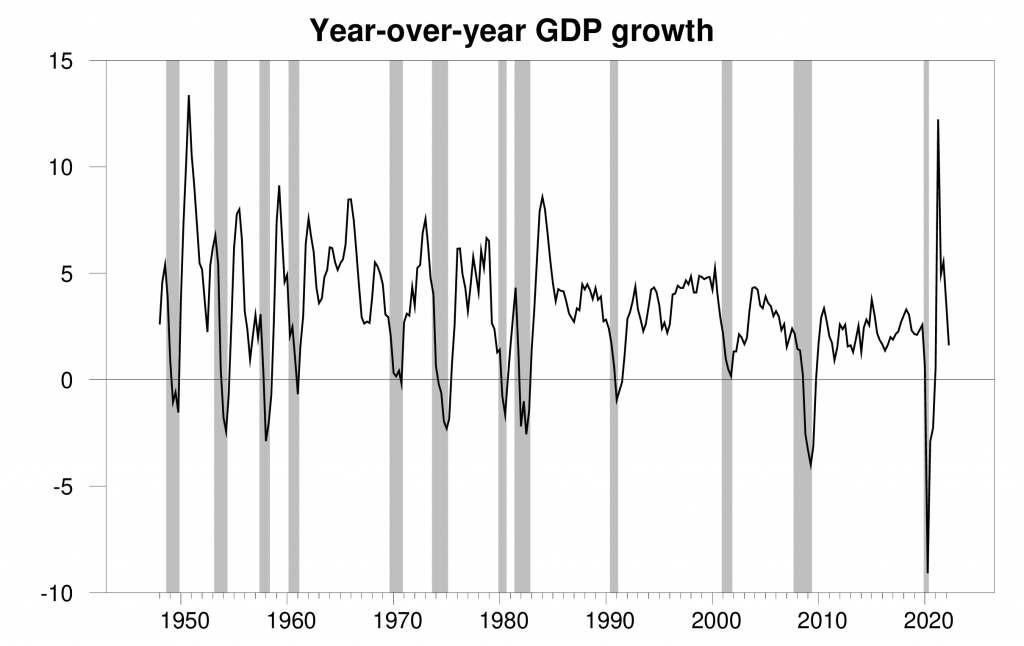

And year-over-year GDP growth is not quite so alarming.

A curious feature in the Q2 GDP numbers was seemingly strong exports. A fifth of the $100 B increase in real exports in Q2 was attributed to petroleum and petroleum products. But this just corrects an anomalous drop in petroleum exports in the Q1 report. Petroleum exports are now back where they were in Q4 of last year. My view is that quarter-to-quarter export growth was stronger than reported in Q1 and weaker than reported in Q2.

The big concern looking forward is housing. It’s too early for the Fed’s tightening cycle to show up in residential construction spending. But if the Fed continues to hike, eventually it surely will. And if the current economic slowdown does turn out to be the beginning of the 13th postwar recession, that will likely be the deciding factor.

Here’s the bottom line: no recession so far, but plenty to worry about  !

!

More By This Author:

Miscalculating potential GDPWhy Did U.S. Real GDP Fall?

Oil sanctions and recession

Disclosure: None.