Is The Weak Housing Market A Warning Sign For The US Economy?

Today’s US economic releases – housing starts and business survey data for the manufacturing sector – suggest that the macro headwinds are increasing. It’s premature to dismiss the numbers du jour, but the previously released reports in recent weeks – payrolls, retail sales, and industrial production – offer a sharply positive counterpoint. For the moment, the big picture for the US still looks encouraging, albeit slightly tarnished relative to what we knew 24 hours earlier. But before we consider the reasoning for maintaining a positive outlook on the US economy, let’s briefly review the latest figures and then move on to considering if today’s news add up to a genuine warning for the business cycle.

Let’s begin with today’s update on November residential construction. Housing starts fell a bit short of expectations, running at a seasonally adjusted annual rate of 1,028,000 last month, the Census Bureau reports. November’s total fell 1.6% vs. the previous month, although it’s worth pointing out that October’s data was revised up by a modest degree. Meanwhile, newly issued building permits slumped last month as well, dipping 5.2% on a monthly basis. More troubling: the annual change, which looks worrisome on both counts. Starts fell 7% last month vs. the year-earlier level, the biggest annual decline in three years. Permits were more or less were flat in November in annual terms, but there’s no getting around the fact that these two indicators overall are reflecting the weakest conditions for the housing trend since 2011.

There are other ways to measure the health of the housing sector, of course, such as sales. But on this front too there are hints of trouble – existing home sales, for instance, have been sliding on a year-over-year basis, although the annual comparison turned mildly positive in October (for the first time this year). Bottom line, the housing trend overall is flat to negative at the moment, contributing limited support for the US economy relative to the recent past.

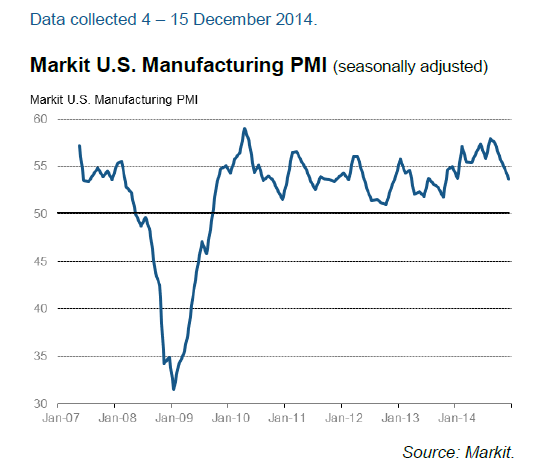

Today’s flash estimate of business activity in the manufacturing sector offers a brighter profile, albeit one that’s suffering from deceleration lately. Output in this cyclically sensitive sector is still rising at a solid pace, but Markit’s purchasing managers index (PMI) for manufacturing has been slowing in recent months and today’s estimate for December reflects the smallest gain since January. Markit’s chief economist, Chris Williamson, advises that “softer output and employment numbers merely represent a cooling in the pace of expansion from unusually strong rates earlier in the year, but also send a warning light to policymakers that the fourth quarter is likely to see a weakening in the pace of economic growth, which is starting to hit hiring.”

The wobbly numbers around the world only add to the case for managing expectations down. But it’s premature to argue that the US is destined to suffer a fatal blow. Why? Several reasons. For starters, the ISM Manufacturing Index for November suggests that the sector’s growth rate is quite a bit stronger than implied in Markit’s data. It’s hard to know which index is a better gauge of activity — or if the ISM numbers will hold up when the December update arrives early next month. Meantime, accepting the numbers from both benchmarks at face value suggests that manufacturing’s expansion is moderately stronger than the Markit figures alone indicate.

There’s also the recent trio of surprisingly strong November results to consider viapayrolls, retail sales, and industrial production. It’s hard to argue that the latest results for all three major indicators are a fluke. At the very least, these numbers suggest that the US has a strong degree of momentum that will help the economy withstand any bearish forces washing in from abroad.

“All the conditions for stronger residential investment are in place for 2015,”predicts Ryan Sweet, a senior economist at Mody’s Analytics. “An improving job market is going to do wonders for the housing market.”

Nonetheless, today’s PMI and housing data remind that the US economy is vulnerable. Exactly how vulnerable is unclear. For now, the risk looks modest. The broad trend for macro still points to growth. Last month’s economic profile looked quite encouraging and the update that will appear later this week will deliver similar news. Housing suggests otherwise, but there’s a reason why analyzing business cycle risk is more reliable when monitoring a diversified set of indicators – any one or two benchmark alone may be misleading us, a glitch that history suggests is more than a trivial problem. That’s not to say that there’s no risk on the horizon, or that housing’s warning sign is meaningless. But let’s not forget that it’s never clear in real time which indicators are the genuine article (or not) for estimating the trend. The next best thing is looking at wide spectrum of numbers.

By that standard, the positives still outweigh the negatives for the US economy, and by a wide margin. That can change, of course, but there’s still a persuasive case for arguing that growth, until further notice, has the upper hand in the US. Yes, the weak housing market may turn out to be an early warning. But until there’s compelling evidence that this corner of the economy is infecting the broad trend, assuming the worst draws minimal support from the data.

Disclosure: None.