Is The Long-Awaited U.S. Dollar Collapse About To Begin?

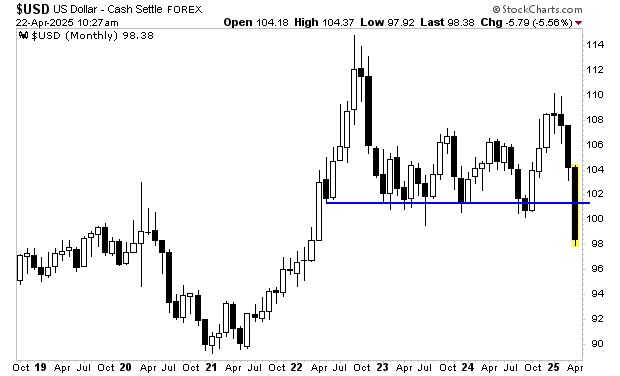

The $USD is in a free-fall.

The greenback has collapsed over 10% in the last two months. The driving factor has been investors fleeing the U.S. and its currency in response to the Trump administration introducing an aggressive trade war.

Those who take the long-term view here will be asking, “what’s the big deal? The $USD traded lower that this back in 2020… and that turned out fine.”

The U.S. has added over $10 trillion in debt since that time. It’s now sporting a Debt to GDP of 120%. And it will need to roll over some $9 trillion in debt in the next 12 months.

This is a time when you want money FLOWING INTO the U.S., not out of it. How will the U.S. manage to roll over all that debt with foreign investors fleeing the $USD and $USD-denominated assets?

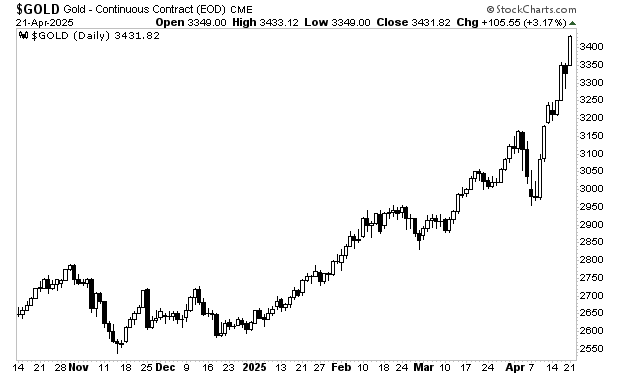

Gold has figured out what’s coming. The precious metal has been on a tear, ripping from $2,950 per ounce to $3,433 per ounce in the last two months alone.

And what do you think happens to stocks if the $USD collapses?

This is an extremely dangerous situation. The odds of a stock market crash are now higher than at any point since the pandemic.

Indeed, our proprietary Crash Trigger is now on red alert. This trigger went off before the 1987 Crash, the Tech Crash, and the 2008 Great Financial Crisis.

We detail this trigger, how it works, and what it’s saying about the market today in a Special Investment Report titled How to Predict a Crash.

Normally this report is only available to our paying clients, but in light of what’s happening in the markets today, we are making just 99 copies available to the general public.

More By This Author:

Is The Fed Trying To Crash Stocks?If They’re Not Careful, The Markets Will Crash

The U.S. Is Approaching A Funding Crisis