Is Tech The Canary In The Coal-Mine For The Coming Inflationary Crisis?

The Tech Boom appears to be over.

From the March 2020 lows, Tech was a major leader in the markets. This makes a lot of sense as Tech was one of the few areas of the economy that continued to operate on a relatively normal basis during the COVID-19 shutdowns.

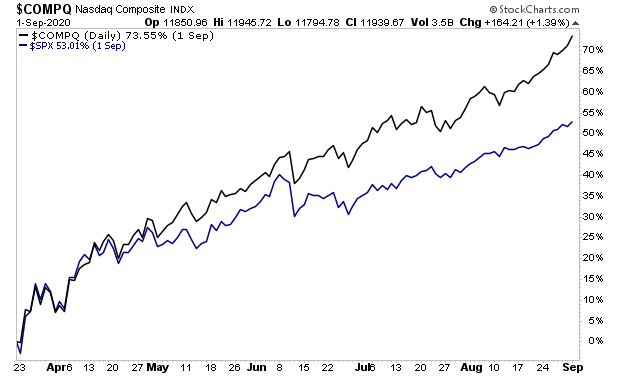

From March 23, 2020 bottom until August, Tech, as represented by the Nasdaq index outperformed the broader S&P 500 by a wide margin.

However, since that time, Tech has struggled, moving roughly in line with the S&P 500 with the occasional bout of underperformance. This situation has worsened in 2021 with the S&P 500 taking the lead, leaving the Nasdaq in the dust.

What’s going on?

What’s going on is that Tech is HIGHLY sensitive to inflation. And starting in August/ September 2020, inflation began to appear in the financial system courtesy of the Fed printing over $3 trillion while the U.S. government spent over $3 trillion in the stimulus.

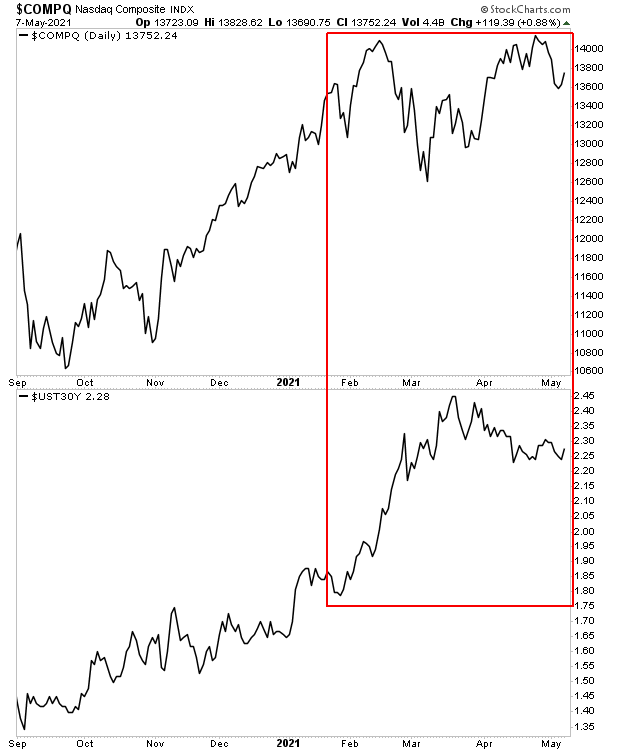

You can see this in the below chart. As soon as inflation began to accelerate in 2021, the yield on the 30-Year Treasury began to spike higher. And that’s when Tech started to tumble (red rectangle).

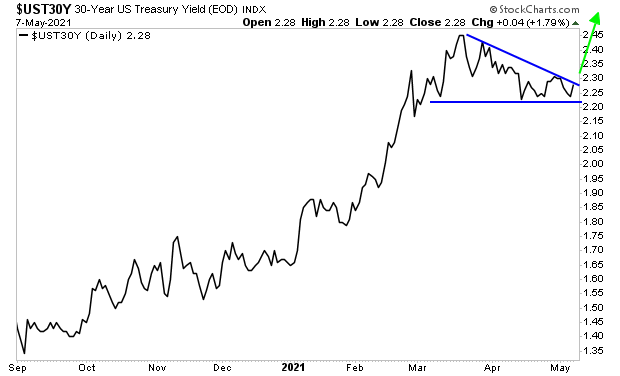

I wish that was the worst news, but it’s not. Yields continue to rise on Treasuries as inflation gets stronger in the financial system. By the look of things, the yield on the 30-year Treasury is about to break out to new highs in the next few weeks.

This is going to put a LOT of pressure on Tech, particularly high-beta momentum stocks like Tesla (TSLA), Shopify (SHOP), Square (SQ), and the like.

But what about the broader market? Will it collapse too? I’ll answer that in tomorrow’s article.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.