Is Stagflation A Serious Market Risk?

Fundamentals

It has been difficult to trade the market based on fundamentals since the pandemic struck. We appear to have several new black swans on the horizon to further muddy the application of fundamentals. We have the debt limit looming. The Fed is facing the issue of tapering and whether to raise interest rates. If you look at economic growth globally, there is a slowdown, so there is no way on earth that central bankers are going to raise interest rates. They can’t raise rates with debt exceeding 100% of GDP globally.

Source: Investing.com

“The suggestion that interest rates are going to be raised is farfetched and is off the table,” Equity Management Academy CEO, Patrick MontesDeOca said. "This is going to put pressure on central bankers to maintain basically negative interest rates.”

Demand is strong with people wanting to return to the movies, restaurants and a normal life. There is a lot of pent-up demand coming into the market in the face of a shortage of just about everything imaginable.

“That suggests to me that we are in a form of stagflation,” MontesDeOca said. “Hopefully it is a short-term situation.”

Is Stagflation a Serious Market Risk?

Two major holidays are coming up soon and it is difficult to have a normal life with all the shortages. Demand may push prices up very high. The labor force is demanding higher wages, which will lead to inflation that will not go away in the future. It is difficult to cut wages, so once raises enter the system, they tend to stay for the long term.

The debt ceiling will have to be raised, since more stimulus is going to have to come into the market. The economy needs more help because it is not where it should be.

On top of all of these issues, we have the China Evergrande and Fantasia development companies on the verge of defaulting on billions in loans and obligations. Both may affect the international system. One major issue with China is that China has never been terribly transparent about their data, so we never really know how bad things are when they announce an issue.

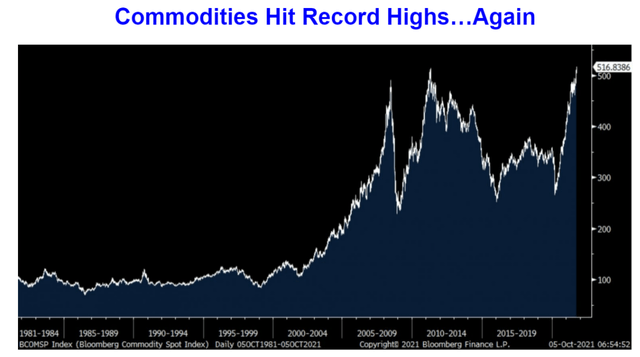

The precious metals markets appear to be trading entirely based on technicals, not the fundamentals. If anything, commodities overall are rising fast, ignoring all the possibly dire fundamental news that keeps coming in. We appear to be recalibrating the economic system as current values are recalculated based on supply and demand.

Source: Bloomberg

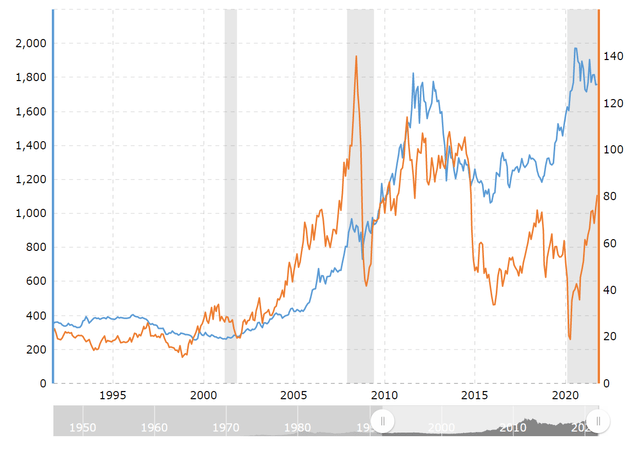

Gold and silver are real monetary assets and with them trading at fairly low levels, it is an excellent time to build a position in precious metals. As governments print more and more paper currency, the currency is devalued and it leads to inflation -- which will make hard assets, such as gold and silver, worth far more than they are presently priced. Gold and silver are undervalued against other hard assets, such as crude oil. Crude oil is rising, which is also not good for the economy, since it is like a tax.

Gold Prices vs Oil Prices - Historical Relationship

Source: Macrotrends

“We may be on the verge of another recession,” MontesDeOca said. “But with gold and silver down where they are, it is a great opportunity to increase your holdings of precious metals. The US dollar is going to accelerate to the downside more and more. It is happening already, with prices in real estate and other assets that are exploding because they are priced in devalued US dollars.”

Low interest rates have created a tremendous leveraged bubble, which we won’t know the extent of until it bursts. We are just seeing how over-leveraged China Evergrande was, and there are bound to be countless other firms that are equally over-leveraged. With money so cheap, it is extremely tempting to borrow money to invest, which leads to over-leveraging.

At some point, the system will have to be allowed to find the real prices of various assets without major government intervention. We have to end the highly leveraged system in which we are in and, sooner or later, that system is going to collapse. We are already seeing signs that it is ending, such as with China Evergrande and Fantasia. When the system resets, precious metals are going to be an excellent hedge against such a system change.

Disclosure: I/we have a beneficial long position in the shares of NUGT either through stock ownership, options, or other derivatives.

To learn more about how the VC PMI works and receive ...

more