Is It Time To Sell Volatility Again?

The short volatility trade was THE TRADE of 2017, but it blew up spectacularly in February 2018. At the time, we saw the biggest ever one day spike in VIX, with the index shooting up over 100%.

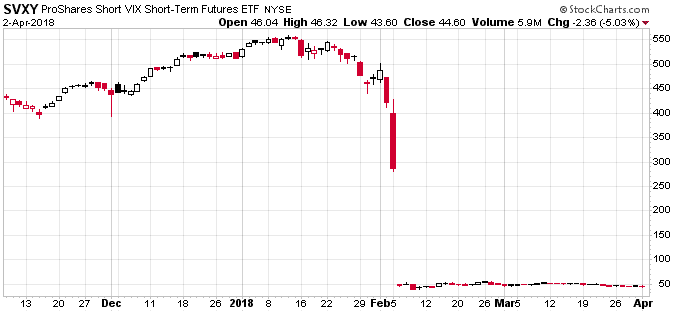

A couple of prominent VIX related products in XIV and SVXY were hit incredibly hard, with the former closing down as it became essentially worthless.

Here is a not so fun chart of SVXY to illustrate my point. If you weren’t involved in the markets back then, trust me, it was spectacular.

Unfortunately, I personally know one trader who lost his entire account during this time and looking at a chart like that you have to wonder if the short volatility trade is dead and buried.

When trading short volatility, risk management is crucial, something my friend learned the hard way.

The reason the short volatility trade worked so well through 2016 and 2017 was because there was nothing going on. Markets were unusually quiet and traders were able to accrue massive profits during that time.

2018 has not been as quite with a couple of violent drawdowns. This year there has been a lot more to worry about with trade wars, rising rates and a slow down in Europe. That’s has meant much higher volatility this year.

Last week, I talked about a strategy for trading VXX and VXXB. It’s a risk defined strategy, so you always know what your worst case scenario is. I prefer that when it comes to these volatility instruments and would never recommend naked or high-risk strategies.

With the recent spike in volatility and subsequent rise in VXX and VXXB, perhaps now is the time to start selling volatility again?

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more