Is Gold Breaking Above $1,300 Per Ounce?

Higher prices of gold and silver should attract investors but it is not always the case. Look at this chart:

(Click on image to enlarge)

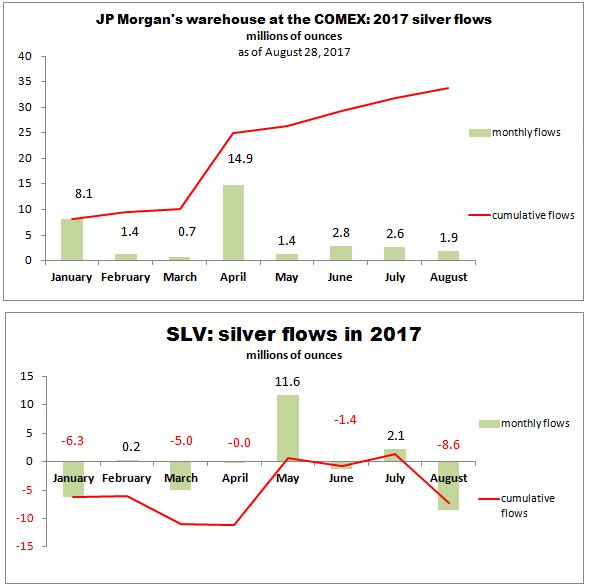

Interestingly, this month, despite a 3.6% increase in silver prices, as many as 8.6 million ounces of silver were withdrawn from SLV vaults (and the 2017 cumulative flow is still negative - look at the lower panel of the chart).

However, JPM Morgan warehouse still reports silver inflows and since the beginning of 2017 as many as 33.7 million ounces of silver were added to the bank's vaults. It is a huge amount of silver. For example, Fresnillo plc, the largest world's primary silver producer delivers around 55 million ounces of silver in annual production.

On the other hand, in August two gold trusts, GLD and IAU, added big amounts of gold to their vaults (look at the row indicated by the red arrow on the chart below):

(Click on image to enlarge)

So, generally, August should be a good month for gold bugs. Particularly, this day (August 29) seems to be very interesting for precious metals investors - it looks like gold is breaking above its very strong resistance.

However, in my opinion, to get let reliable confirmation of this move we should wait for a few days...

Disclaimer: This article is not an investment advice. I am not a registered investment advisor. Under no circumstances should any content from here be used or interpreted as a recommendation for ...

more

I also remember there was a highly publicized visit by CNBC's Bob Pisani to GLD's gold vault. This visit was organized by GLD's management to prove the existence of GLD's gold but the gold bar held up by Mr. Pisani had the serial number ZJ6752 which did not appear on the most recent bar list at that time. It was later discovered that this "GLD" bar was actually owned by ETF Securities.

Simple I always see you making claims on GLD's gold holdings but I still have not seen any verifiable evidence to support any of it. How reliable are GLD's holding reports? GLD does not give retail investors the right to redeem for any of its mystery physical gold holdings. This fact alone ensures the GLD shares to be nothing more than paper at the end of the day. GLD also has a glaring audit loophole in their prospectus that states they have no right to audit subcustodial gold holdings. To this day, I have not heard of a single good reason for the existence of this backdoor to the fund.