Is Energy’s Pop A Warning?

Image Source: Pixabay

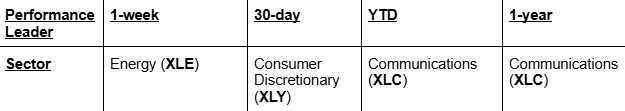

Despite the mid-week turbulence and holiday trading last week, stocks managed to squeeze out a modest gain. However, there are some interesting details to note in last week's market activity.

First, the bullish news - the Nasdaq outperformed the other indices (S&P 500 and Dow), which is typically a strong sign.

However, interestingly, the top-performing sector last week was energy. Does this spell trouble for the market, or is it merely another rotation?

Is the Goldilocks Setup in Peril?

A few weeks ago, Don and I discussed the setup for a Goldilocks economy in 2025. This scenario centers around lower energy prices and lower interest rates for most of next year.

Currently, I view this energy rally as a one-off anomaly. We're seeing natural gas prices surge in anticipation of a cold freeze expected to hit the heartland of the United States in a couple of weeks.

To be clear - while energy will have its day in the sun and experience a strong period of outperformance, the conditions haven't yet been met for that.

Typically, energy is a late-cycle outperformer for equities, so if we see its strength continue beyond this week, it could be a warning sign for stocks heading into January.

More By This Author:

The Bear Is Back And It’s Hungry

The Seven Days Of Christmas: Understanding The Santa Claus Rally

Finding The Best Stocks For All Kinds Of Markets

Disclaimer: This article is republished from The Conversation under a Creative Commons license.