Is China A Buy After A Year Of Troubles?

The once-bulletproof argument that investors could do no wrong by owning China stocks has suffered a reversal of fortunes in 2021. Cue up the contrarians, who are wondering if the correction in the country’s equity market this year, in sharp contrast with much of the rest of the world, hints at a buying opportunity.

Berkshire Hathaway’s Charlie Munger, partner to uber-investor Warren Buffett, certainly smells opportunity. Recent filings indicate that Munger has a growing stake in Alibaba Group (BABA), the biggest company in China’s e-commerce industry. The shares are down 28% year to date (through Oct. 14), although a recent bounce has cut the slide from a 40% slide earlier in October.

Looking at China through an ETF lens shows plenty of red ink that may get value-oriented investors’ hearts racing. But these are probably still early days as China’s regulatory crackdown on the tech industry, which appears to be spilling out to the wider economy via marching orders from President Xi, evolves. The question is whether Beijing will go too far in biting the hand that fuels its economy?

“I worry a lot about China because to some extent they’re attacking the basis of their growth so far,” says Raghuram Rajan, a former chief economist of the International Monetary Fund and previous head of India’s central bank. “At some point they have to abandon that method of growth and go to a new one. The question is: Are they trying to do it too quickly, and in the process, leaving less to support growth.”

It doesn’t help that China has become increasingly bellicose lately regarding Taiwan, which Beijing regards as a renegade province. Although war is thought to be a low risk for now, the recent saber rattling is stoking fears that trouble is brewing.

And if that’s not bad enough, China is facing an energy crisis, which is taking a toll on the near-term outlook for the world’s second-largest economy.

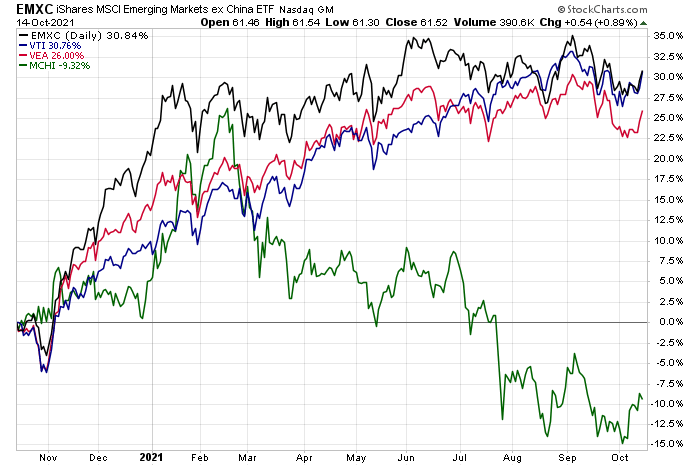

Unsurprisingly, China’s equities have taken a hit this year, in absolute and relative terms. The iShares MSCI China ETF (MCHI) has lost more than 9% so far in 2021. By comparison, emerging markets stocks ex-China (EMXC), US shares (VTI) and developed markets ex-US (VEA) are posting strong gains year to date.

Parsing China’s markets on a more granular level reveals a more nuanced profile of returns, although the general trend is still bearish, with at least two exceptions. China’s bond market (CBON) continues to post a moderate gain this year, in part due to higher yields offered vs. fixed-income markets in the West. Note, too, that small-cap stocks in China (ECNS), although trading near the lowest levels of the year, continue to hold on to a modest rise for 2021. By contrast, mainland-listed A shares (ASHR), a broad measure of China’s largest firms (MCHI), and the country’s formerly soaring internet sector (CQQQ) remain firmly in the red this year.

On paper, the weakness is starting to look intriguing. But given the uncertainty of political risk swirling through China, the potential for a new leg down can’t be ruled out. China continues to harbor enormous opportunities, but there are many facets to the country economic and political upheaval this year that leaves plenty of room for doubt about what comes next.

Disclosures: None.

Ifone wonders how far those chnges inChina will go, look back at Chairman Mao's cultural revolution, and all the college students sent to work on farms. WE really don't hear much about how that played out, do we???

So there is no valid guess as to how far it can go.