Investors Cheer Upbeat Inflation, Consumer Sentiment Data

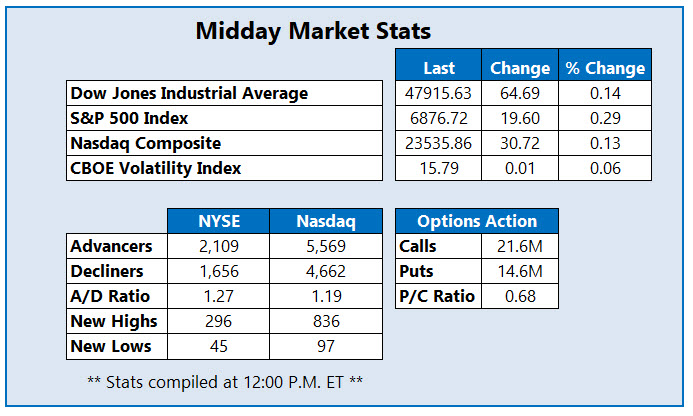

Just as predicted, stocks picked up momentum as the onslaught of data was released. The Dow Jones Industrial Average (DJIA) is modestly higher, enjoying a boost from the delayed core personal consumption expenditures (PCE) price index for September, which read at 2.8%, lower than the 2.9% estimate. Investors are hoping the recent slew of jobs and economic data will be enough evidence to support a rate cut from the Fed at next week's meeting.

The S&P 500 and Nasdaq are confidently higher midday as well, the former a chip shot from record highs and a fourth-straight win. Investors are also buzzing after University of Michigan's consumer sentiment report came in better than forecasted. All three major indexes are headed for comfortably weekly wins.

Software name Samsara Inc (NYSE: IOT) options traders are loading up after the tech company's third-quarter earnings and revenue beat. At last check, 24,000 calls have changed hands, volume that's nine times the average intraday amount and more than triple the number of puts exchanged. The December 50 call is notable, while new positions are opening at the weekly 12/5 48-strike call -- set to expire later today. IOT is up 13.8% to trade at $46.35, testing June highs around $48 and now up 5% on the year.

Ulta Beauty Inc (Nasdaq: ULTA) is one of the best stocks on the Street today -- living up to its name as one of the best stocks to own in December. Last seen up 14.4% to trade at $609.26, the cosmetics retailer reported a top-line beat for the third quarter and hiked its annual profit and sales forecasts, prompting a price-target hike from UBS to $690 from $680. ULTA earlier hit a record high of $611.89 and is now up roughly 40% in 2025.

Paramount Skydance Corp (Nasdaq: PSKY) stock is weighing on the Nasdaq today, down 7.1% to trade at $13.77. The streaming entity is lower after Netflix (NFLX) won the vaunted Warner Bros Discovery (WBD) bidding war, despite a $30/share offer outbidding Netflix. PSKY remains up 31% year to date, and is testing support at its 200-day moving average today.

(Click on image to enlarge)

More By This Author:

Markets Close Lackluster Session On Either Side Of The AisleStocks Mixed As Market-Moving Catalysts Dry Up

Blue-Chip Index Pops As Interest Rate Cut Anticipation Grows