Invest In The Market’s Second Most Hated Sector, And Win

Homebuilders are some of the most disliked investments in the market right now and with good reason as the housing market has had many recent stops and starts over the past few years. This indecisiveness has not bode well for share prices as of late, and some homebuilder stocks are trading at attractive valuations in a market that seems to continually be pushing new highs.

However, I am getting more optimistic about the housing market in recent months. With the decline in interest rates and yields so far this year, mortgage rates are very low by historical standards. The domestic economy is also moving along, even if not at the pace we need, should help buyer confidence. So, if you’re a value investor looking for a good stock at great price look no further.

Another enticing piece of information is household formation has been consistently higher than new home builds since the financial crisis which should trigger pent up demand once the economy emerges from its post crisis funk boosting sales for homebuilders. Even with the recent improvement, housing starts are less than half what they were before the housing market crashed. Given these recent positives, I am stepping out and adding a homebuilder to our Small Cap Gems portfolio.

Beazer Homes USA Inc. (NYSE: BZH) is a top ten homebuilder by sales and has a market capitalization right now of just under $500 million. Its enterprise value is just over $1.8 billion. The company has been around for 35 years and has built some 170,000 homes since coming public in 1994.

Beazer is well diversified builder with just over 140 active communities in over a dozen states. Most of its locations are in the Southeast and the West which continue to see faster population growth than the nation as a whole.

Growth Drivers:

Beazer posted an over $1.00 a share loss in FY2013 but is tracking towards a profit of 45 to 50 cents a share in FY2014 on approximately $1.4 billion in revenue. The consensus calls for the homebuilder to earn anywhere from a $1.00 to $1.80 a share in FY2015. I believe Beazer will come in towards the higher end of that wide range. The company recently instituted a well thought out strategic plan to grow annual revenues to $2 billion annually over the next two to three years while improving profitability.

The company is targeting a 10% EBITDA margin within this strategic plan. I believe this may prove to be a conservative target given how this margin has improved as the company has ramped up sales over the past couple of years.

In addition, Beazer’s goal of an average selling price of $300,000 per home seems very conservative and is likely to be achieved some time in 2015.

The company plans to go from just over 140 active communities to around 175 active communities over the next couple of years. Given the company’s approximate 30,000 lot inventory and increases in average selling prices, the goal of $2 billion in annual sales seem imminently achievable.

Balance Sheet Considerations:

Beazer Homes has an improving balance sheet. The company has a solid amount of cash on hand and no significant debt maturities until 2016.

In April Beazer successfully refinanced their 9.8% senior notes due 2018, with 5.75% unsecured, senior notes due 2019 and reduced their annual cash interest expense by over $8 million. The company should have similar opportunities as higher interest rate debt becomes callable over the next year. Beazer is starting to see a “virtuous” credit cycle. Increasing earnings and low historical interest rates overall allows it to refinance long term debit at much lower rates. This results in higher earnings and better credit ratings allowing this cycle to continue. Given the amount of overall debt on Beazer’s balance sheet, this is important emerging positive catalyst.

Beazer took significant losses during and immediately following the financial crisis, like most homebuilders. This has resulted in a significant but little remarked on asset, almost $480 million in tax loss deferrals. As Beazer starts to increase profits, these deferrals will greatly boost reported earnings as Beazer actions this considerable tax benefit.

Given the top United States corporate tax rate is 35%, even applying a significant discount rate as these deferrals will be used over several years; these assets should have a net present value of $100 million to $150 million in additional earnings power.

Summary:

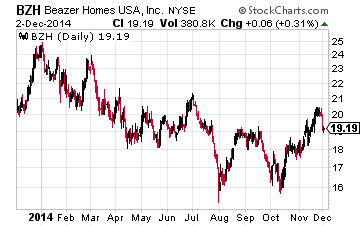

Obviously Beazer’s earnings power will be affected by the strength of the overall housing market, the economy, and job growth as well as the direction of interest rates and how successful it is executing against its strategic plan. I believe Beazer can do anywhere between $3.00 to $4.00 a share of earnings by FY2017. Putting a conservative earnings multiple of 10 times that estimate gives me a price target of $30 to $40 a share on Beazer. Given the stock has a pro forma book value of right around $20 a share currently, the stock would seem to have little downside at a little less than $19 a share unless the housing market goes into a deep contraction which is unlikely.

Another way to look at the proper valuation of Beazer is look at competitors’ valuation based on price to sales. Beazer currently goes for just over 35% of annual revenues. Competitors like Lennar (NYSE: LEN), Pulte Homes (NYSE: PHM), and KB Home (NYSE: KBH) are going for 75% to 120% of annual revenues.

Some of this discount is warranted as Beazer has more debt than the rest of these homebuilders. However as the company works down debt and executes against its strategic plan to raise sales and profit margins, this discount should narrow. Even at 50% of the $2 billion in annual revenues the company is targeting two to three years out, and the stock is worth more than twice its current price of under $19 a share.

I think Beazer can hit the $24 a share level it sold for earlier in this year over the next six to nine months. Over a two to three year perspective, I think the shares can move as high as $40.

Disclosure: None.

Housing stocks are still very unpredictable. Projections seem to be that interest rates are set to increase mid 2015, and along with that will be a rise in mortgage rates.