Inside Day Set Up

Monday's candlestick finish for many of the lead indices was an inside day of an inside day. How this coiling action unravels remains to be seen, but trading a break of Monday's high/lows with a stop on the flip side would give swing traders something to work with.

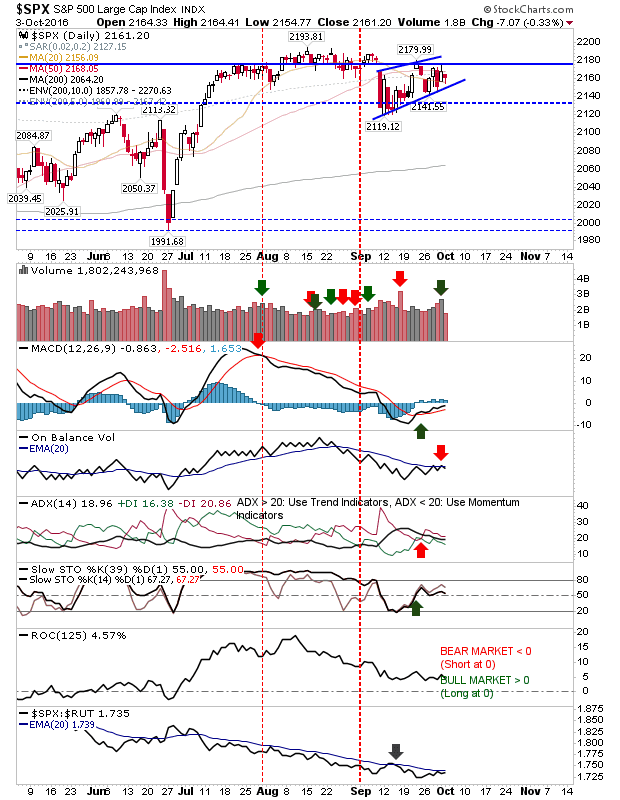

The S&P is playing into a rising wedge with technicals net bearish, although intermediate term stochastics and the MACD are on 'buy' signals. This looks like it will be broken down, but those who follow my ChartDNA posts will see an improving intermediate term picture (for bulls).

I should add, I'm holding a Dow Jones short position, so my bias is bearish - but I have doubts...

(Click on image to enlarge)

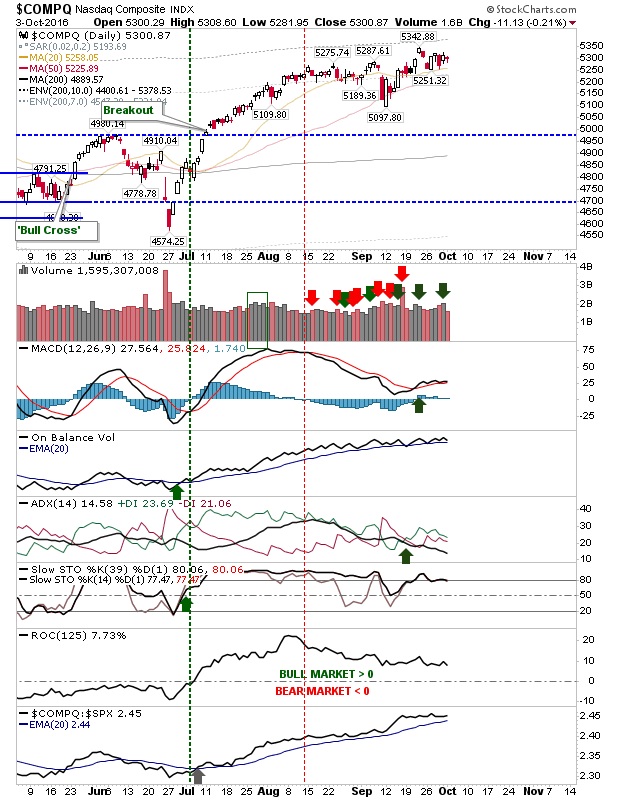

The Nasdaq is coasting along its 50-day MA with good technical strength. It hasn't got the weakness of the S&P with strong relative performance against the latter index.

(Click on image to enlarge)

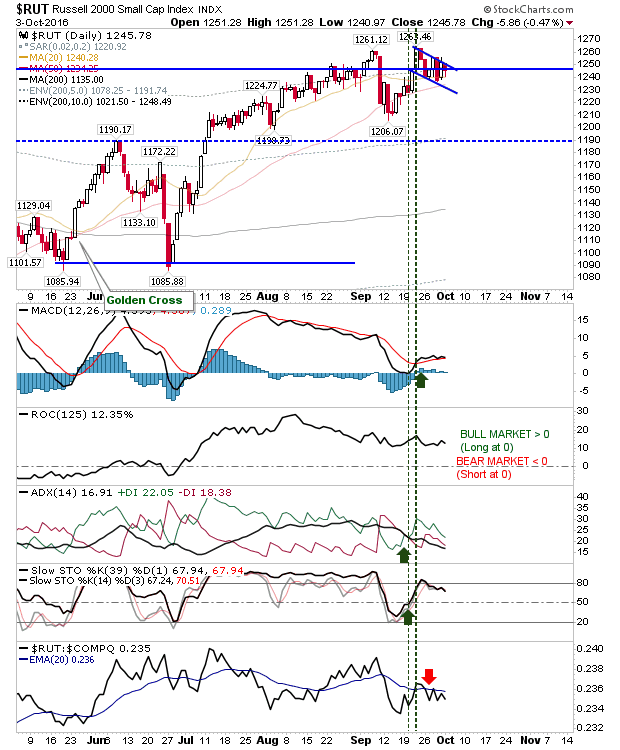

The Russell 2000 is holding to a 'bull flag' and today's action hasn't changed what still could be a solid bullish setup. The index is net bullish in technicals, but underperforming relative to the Nasdaq.

(Click on image to enlarge)

Today was a setup day, but in itself didn't give away too many clues as to what may come next.

Disclosure: None.

Thanks for sharing