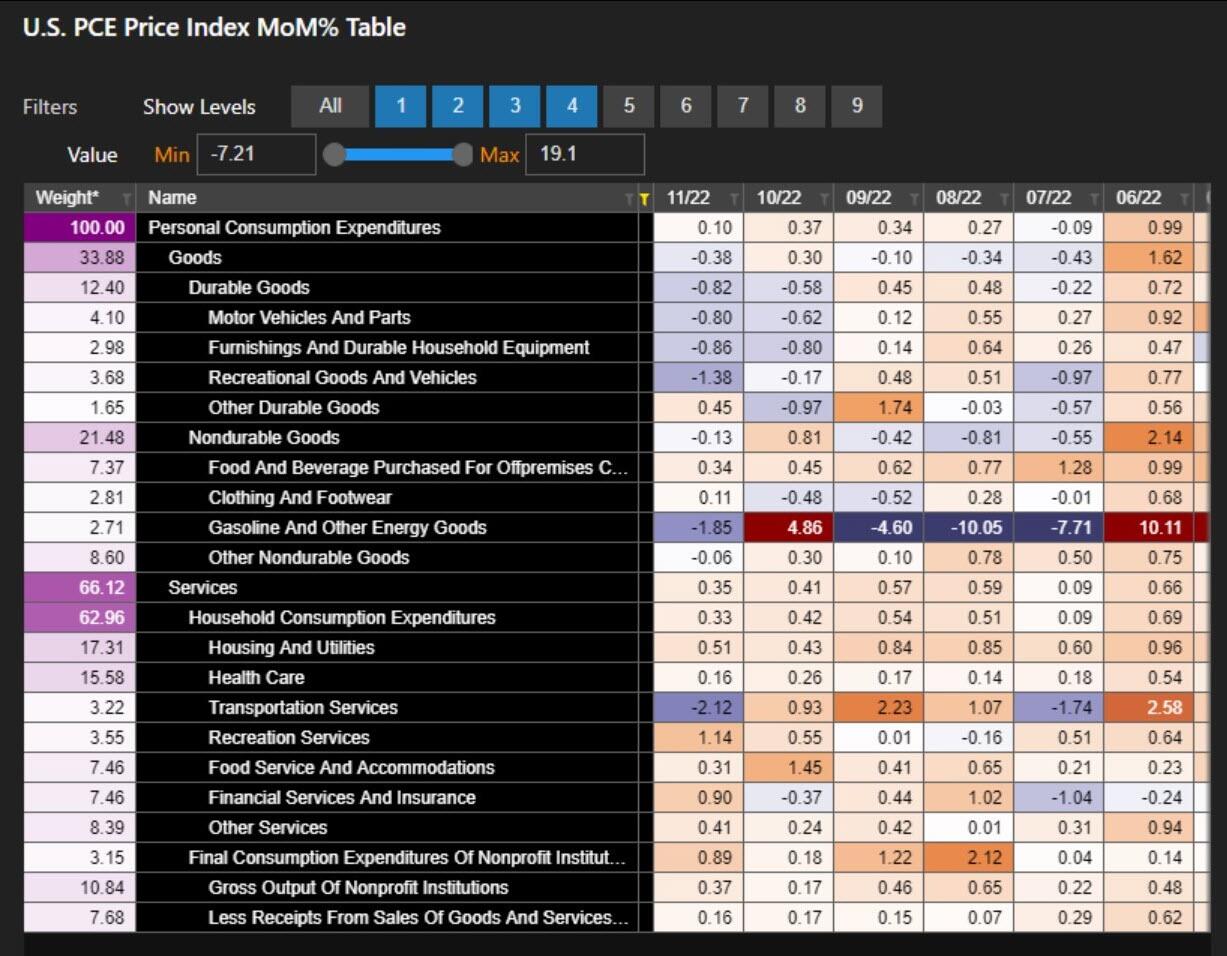

Inflation Split Between Declining Goods Prices And Higher Services

This morning’s mixed data highlight the divergence between still-climbing costs for services, like housing (although it now appears that the Fed is now realizing that the CPI index is 1 year delayed), and falling goods - both durable and non-durable - prices.

(Click on image to enlarge)

As BBG's Felize Maranz observes this morning, cheaper gasoline has clearly been cheering consumer sentiment, but the overall direction of inflation remains troubling (at least as long as the Fed is guided by the 12-month lagging CPI/OER data). That complicates the Fed’s dilemma as it seeks to cool, but not crush, the economy — and poses risk for assets like equities.

A look at PCE month-over-month drivers shows drops for autos and energy along with higher recreation and food:

(Click on image to enlarge)

As Maranz notes, these trends are reflected in recent company earnings, like CarMax’s miss and Nike’s bid to offload bloated inventories, as well (our warning from this May about collapsing goods prices due to the reverse Bullwhip effect turned out to be spot on). Durable goods orders also surprised to the downside and capex is losing steam.

Lower demand ahead - as per Micron’s warning - will lead to slower growth, which will help tame inflation. But that’s a careful-what-you-wish-for situation as well, and looks set to hurt equities in the short term, especially as the narrative turns from inflation to lack of growth and recession while the Fed looks on and does nothing.

More By This Author:

Final Q3 GDP Comes Unexpectedly Hot At 3.2%, Well Above 2.9% EstimateYields Slide After Stellar 20Y Treasury Auction

WTI Extends Gains After Bigger Than Expected Crude Draw; SPR Hits 1983 Lows.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more