Inflation Is Hot, But Not As Bad As It Looks

This morning’s CPI report showed that inflation is hot!

In case you missed it, the Consumer Price Index rose 9.1 percent for the year. That number was above the 8.8% reading economists were expecting.

Prices for gasoline, groceries, rent and dental care were particularly high.

In short, the inflation number was terrible. And investors panicked when the news broke.

But despite June’s hot inflation reading, things may not be quite as bad as they appear!

The CPI Looks Backward — Investors Look Forward

There’s no question inflation is hot right now. But is it really as bad as the CPI report indicates?

Recent evidence actually points to some good signs of inflation.

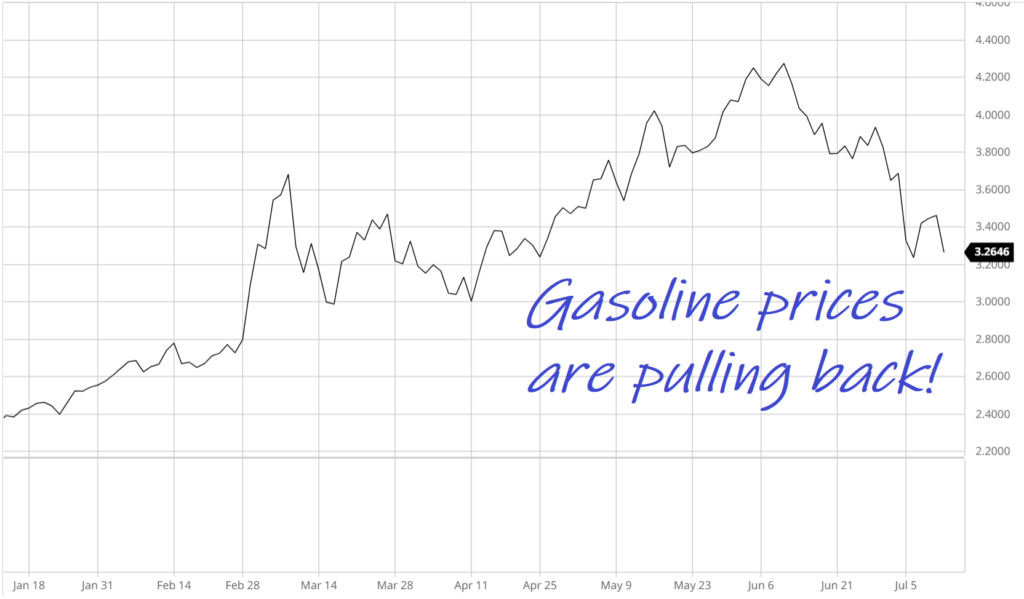

For instance, oil prices have recently pulled back. And nationwide gasoline prices peaked in the first half of June!

Meanwhile, concerns over inflation have driven other commodity prices lower.

Copper, steel, iron ore, and other industrial metals are actually well off recent highs. And the same goes for agricultural commodities like grains.

Meanwhile, big box retailers are struggling with too much inventory. Yesterday, I wrote an article about how Amazon’s “Prime Day” should actually be called “Dump Day.” (Because the online retailer is dumping inventory it can’t afford to keep in its warehouses.

So even though June inflation numbers were hot, the current evidence is pointing to an economy that is cooling off. And that means lower inflation.

Will the Fed Get it Right? (Fingers Crossed)

As an investor, I’m particularly concerned about how the Fed will handle this hot inflation report.

Will Jerome Powell and the Federal Open Market Committee take the numbers at face value?

If so, we could be in for more aggressive interest rate hikes when the Fed meets on July 26th & 27th. Powell’s commentary during the following press conference could also spook investors.

On the other hand, the Fed could look more closely at real-time information. It could decide that inflation is starting to ease. And Powell could tell investors that a “soft landing” is possible.

Depending on which data the Fed is looking at (real-time information or the backward-looking CPI report), the outcomes for the market — and the economy — could be very different.

This will be something to watch very carefully.

For now, I’m encouraged to see the market holding up despite the hot inflation numbers.

And today, I’m putting some of my family’s money to work in a couple of the stocks on my Watch List.

I’ll keep you posted on what I’m seeing as we make our way towards the next Fed meeting. We’re not out of the woods yet, but I’m encouraged by what I’m seeing right now.

Here’s to growing and protecting your wealth!

More By This Author:

The Stock Market Is So Bad, It’s GreatWhat I’m Watching As An Official Bear Market Looms

Can The Stock Market Shift To A New Season?