Inflation Has Eroded Household & Business Confidence

US inflation as measured by the Consumer Price Index (CPI) unexpectedly soared to 9.1% (annual rate) last June, the highest level in 40 years. This sent prices for most consumer goods significantly higher and crimped budgets for millions of Americans.

The CPI has since retreated to an annual rate of 4.9% but it’s still over twice as high as the Fed’s target of 2%. In an effort to get inflation under control, the Federal Reserve has raised its key Fed Funds rate nine times since March 2022, from near zero where it had been for several years to 5.1% today.

The surprising inflation wave has eroded US households’ sense of financial security, the Federal Reserve reported Monday, with many saying they had reduced their savings to make ends meet, felt less secure about retirement and had delayed purchases or swapped into cheaper products as they shopped.

Based on an annual survey showing the corrosive effects of inflation on Americans’ economic confidence, the Fed reported that the percentage of respondents who said they were doing “at least okay financially” in 2022 tumbled by 5 percentage points to 73% – the most since the survey was launched a decade ago and had stood at a record high the year before (2021).

The share of those saying they were “worse off” shot up 15 points to 35%, the highest level by far since the Fed first started asking that question in its survey. Those who considered their retirement savings “on track” fell to 31% among those not yet retired, compared to 40% in 2021.

With a 2024 presidential campaign already in its early stages, the survey also suggested Americans’ souring mood about their own finances carried over to their view of the national economy in general.

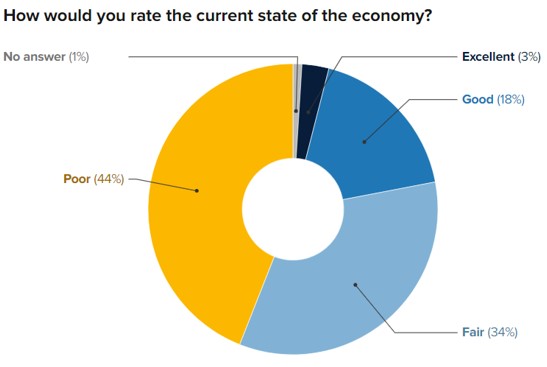

Even though the unemployment rate has been very low, below 4% since January of 2022, only 18% of respondents rated the national economy as “good” or “excellent,” down from 50% as of 2019.

A whopping 54% of adults said that their budgets had been affected “a lot” by price increases, with parents of children under 18, Black and Latin American adults and those with disabilities ranking among the most likely to report a negative impact from inflation.

Indeed, overall one-third of households cited inflation as their main financial challenge, up more than fourfold from 2016.

So, how are businesses feeling about the economy and inflation? Small business confidence remained below the baseline for optimism in the second quarter at 46%. Just 21% say they’d describe the economy as good or excellent. The ongoing labor crunch and inflation remain among the top concerns of small business owners.

In a survey by the National Association For Business Economics (NABE), nearly three-fifths of business economists said the economy is likely to fall into a recession over the next 12 months. That’s an amazingly high number for an economy which is still expanding and with unemployment at the lowest level in more than 50 years.

Despite that, take a look at this latest chart from a survey of 2,200 small businesses conducted in late April by CNBC.

The top concern in this survey was inflation, with 91% expressing worry about price pressures and 41% saying it is their #1 concern. Less than a third of people polled said they have confidence in the Federal Reserve to control inflation.

On another front, with the collapse of regional banks Silicon Valley Bank, Signature Bank, and First Republic, the safety of banks and the ability to access capital is also on the minds of small business owners.

More than 60% say they are banking with community or regional banks, and the survey shows owners are split evenly between those who express confidence in America’s banking system and those who do not. The majority of owners polled say they are confident their business capital is secure, but almost half say it isn’t easy for them to access capital to operate.

Finally, nearly three-fifths of small business respondents said the economy will probably fall into a recession over the next 12 months.

Here too, I find that number amazingly high, especially given the economy is still growing, albeit modestly, and the unemployment rate is the lowest in over 50 years.

The bottom line is, while inflation has taken a toll on household and small business confidence over the last year, consumer spending which accounts for over two-thirds of economic growth, remains solid.

As I have emphasized in recent weeks, I can’t rule out a recession later this year as so many forecasters have been predicting. But if that is where we’re headed, something has to happen to slow down consumer spending.

Is higher inflation enough to do it? I guess we’ll find out in the next few months. I’ll keep you posted.

More By This Author:

U.S. Debt Limit Coming Faster Than ExpectedAnother Debt Ceiling Showdown – They Just Never Learn

Economy On Solid Ground Or Headed For Recession?