Indices Attempt Support Rally

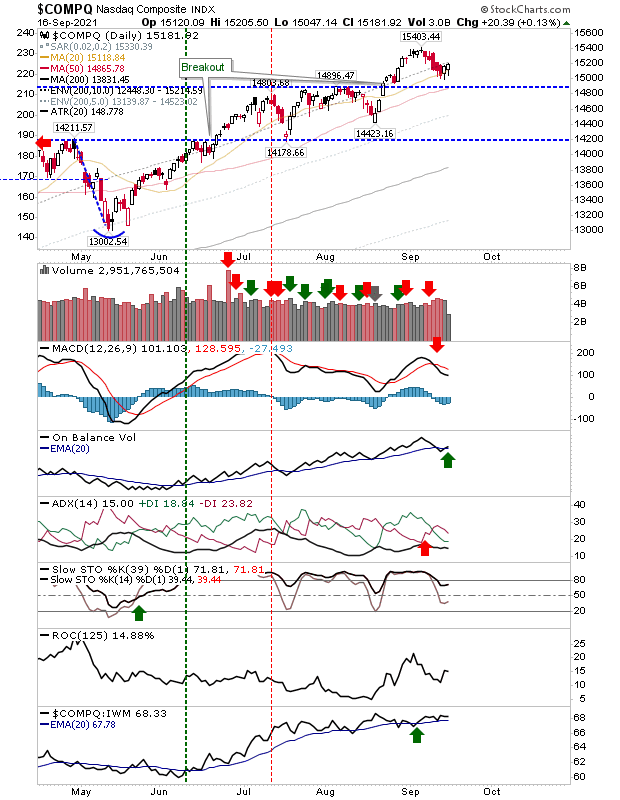

Markets aren't exactly powering higher but there is an attempt to develop some form of swing low. The Nasdaq has the clearest opportunity. The last couple of 'white' candlesticks have developed at 20-day MA - well above closest (breakout) support. Add to that, we have 'sell' triggers in the ADX and MACD, offset by On-Balance-Volume and strong momentum from Stochastics. I'm liking the action even if the trading volume could be a little higher.

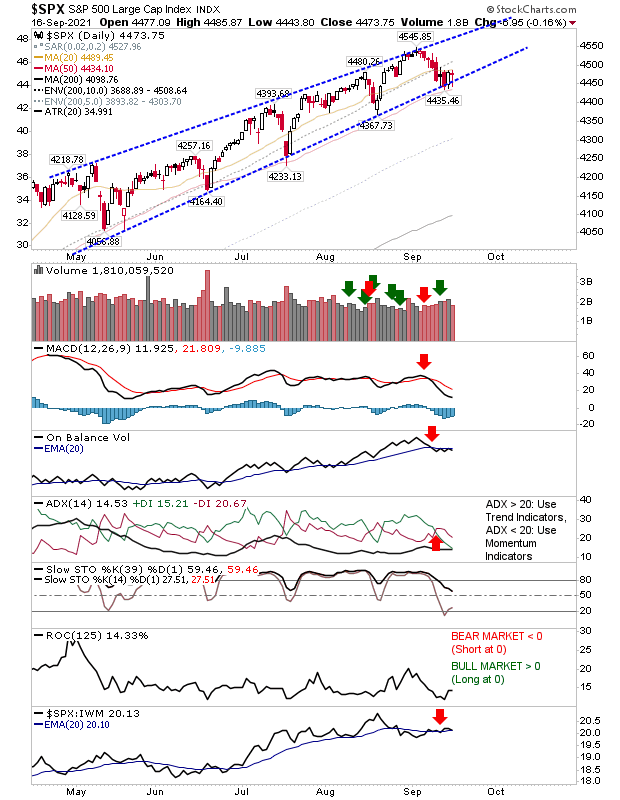

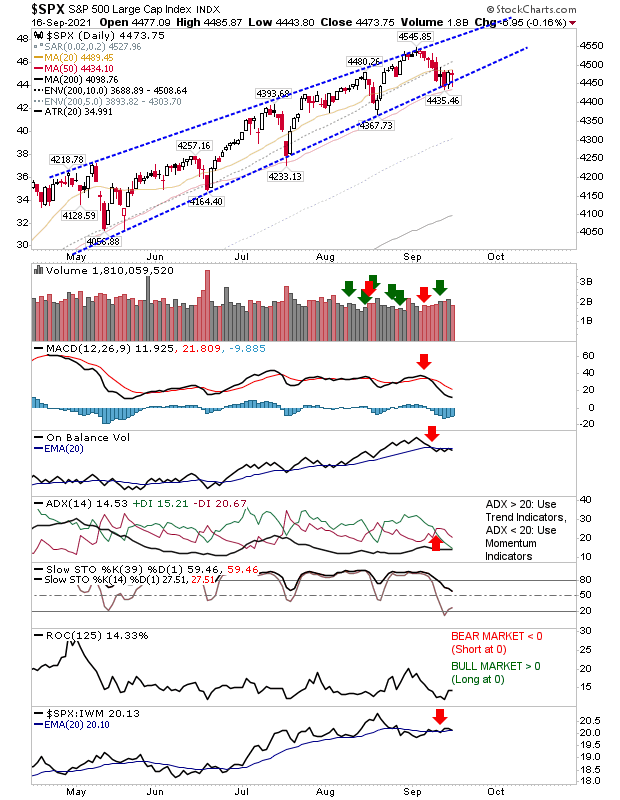

The S&P still has the bearish wedge, but it is interesting to see the attempted support test from the 50-day MA. Technicals are not as positive as the Nasdaq, but Stochastics are holding in favor of a bullish trend which still has to count as something.

The Russell 2000 has taken advantage of the support tests by defending flat-lined 20-day and 50-day MAs.Volume is down, but more important is the rapid ascendancy of the 200-day MA, which hasn't been a factor in months as support - the last such test occurred in mid-2000 - and may offer a kick on point for bulls.

It's hard to know what may follow. Across the indices, support tests suggest there is more upside on offer as sellers struggle to break the momentum of this long standing uptrend. The Russell 2000 continues to confound, but the sideways indecision simply builds up the tension for the eventual break - up or down - when it comes.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more