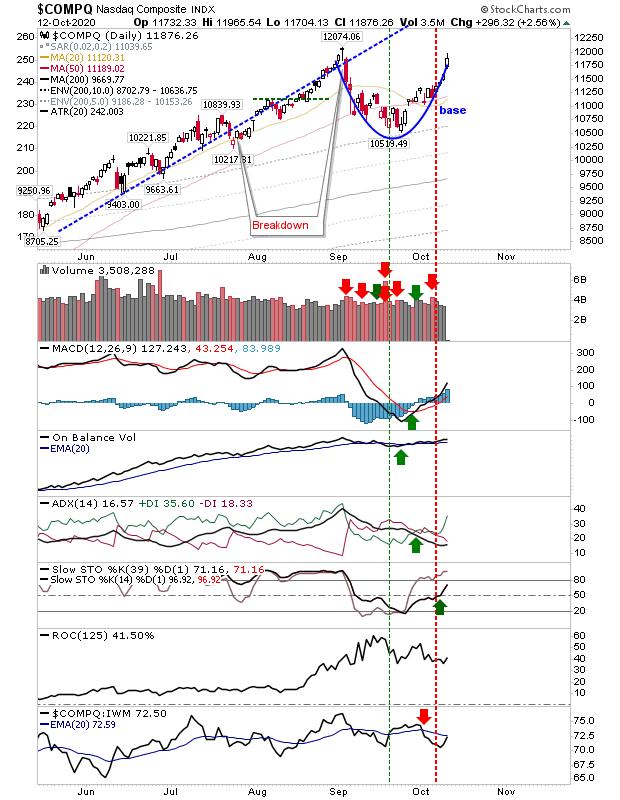

Indices Accelerate Gains

Base development continued across the board as all lead indices posted gains. The biggest gain came with the Nasdaq as it moved ever closer to its last swing high in September. Technicals for this index are all bullish, with the index making relative gain inroads versus Small Caps.

The S&P was not to be left behind, although it didn't post the same one-day gain as the Nasdaq it still had a successful day. The structure of its base is similar to the Nasdaq with a nice gap in the morning followed by some decent intraday gains to ensure a higher close by the finish. Relative performance against Small Caps is a bit of a concern, but that would be nit picking here given Small Cap leadership is crucial for any sustainable rally. A test of 3,588 would look to be the minimum here

Small Caps perhaps suffered a little with the rotation into Tech and Large Cap stocks. The gains over the last few days have all come off the open with little follow through over the course of the day. Buying volume has steadily decreased to go with the sequence of small, narrow intraday candlesticks we have seen. The index is still outperforming the Nasdaq and S&P, although I would like to see some sideways consolidation in place of these small gains to give traders a chance to digest what has been a strong last couple of months for the index. As with the Nasdaq and S&P, technicals are all net bullish.

Another good day for indices kept things moving along. If there wasn't an election it would all appear very positive for the foreseeable future. If you are holding index funds there is no reason to be panic selling, although it would be hard to be an individual stock holder coming into November.