If A=B And B=C, Does A=C?

No need to listen to the "experts" to understand the ins and outs of commodities markets, according to Bob Moriarty of 321Gold. If investors use common sense and basic tools available online, they too can be successful.

A century ago when I was in high school, one of my teachers wanted to teach us the basics of logic. The teacher began with the simple equation of if A = B and B = C, does A = C? Of course, the majority of the class picked the most obvious answer.

But what happens when the apparent answer is not the correct answer? What if the obvious is dead wrong?

Here is the proof. If an airplane is transportation and a train is transportation, is an airplane the same as a train? Now the correct answer is both apparent and obvious. No. A train and an airplane are both transportation but they are not the same.

As investors, why is this important for us to know? I answer that in my new best-selling Amazon book, "Nobody Knows Anything." Any ordinary person using nothing more than common sense and what they already know or can easily obtain can learn to make profitable decisions if only they learn to ignore the experts, the gurus and other fools.

For example, if you knew that silver had climbed from $4.01/ ounce ($4.01/oz) in November 2001 to $49/oz and change in April 2011. Using nothing but your own common sense you could reasonably conclude that silver was cheap in 2001 relative to silver in 2011. And that it was expensive in 2011 relative to what it had been in 2001.

You didn't need to know anything else to make an intelligent decision. If you did nothing more than buy silver when it was cheap and sell it when it got expensive, you could have made a lot of money—1,140%, in fact. Nobody did, of course, because they were too busy listening to the experts.

One of the greatest experts in silver, Eric Sprott, started a silver ETF in 2010. He spent most of his time on the road telling people what a great investment silver was. He was so successful that those listening to his siren song were willing to pay a 25% premium for his paper silver ETF at the end of April 2011. All of the gurus were mumbling about how high silver was going to go. Silver was somehow moving from weak hands into strong hands.

The loudest voice in silver had been claiming since at least 2001 that silver would go up 10- or 20-fold if the U.S. ever got into another war since it was the most valuable war material. The U.S. had half a dozen wars to choose from, so silver had to take off and go even higher.

There was even a group that managed to convince people that while silver was going from $4/oz to $50/oz it was being suppressed. Now you have to wonder at the gullibility of some people. How many people are actually dumb enough to watch a commodity enter into one of the greatest bull markets in history and still maintain that it was being suppressed?

On the other hand, an ordinary person of average intelligence could access the bullish consensus on silver at the very top of silver on Jan. 21, 1980 and know that it was 94%. If all you knew was that the bullish consensus is always the highest at market tops and the lowest at market bottoms you could have made a very profitable decision in late April of 2011. All you had to do was understand the basics of investing.

If the bullish consensus was 94% at the very top of the silver market in 1980 and the bullish consensus was 96% in April 2011, no matter what the gurus or experts said, we were probably at a top.

Everyone could have done that; they didn't need to listen to anyone else. Yes, they would need access to information. You would have to be able to find out what the price of silver is and a price history. And you would need to follow one of the services tracking bullish consensus, but all that information is at your fingertips now because of the Internet.

You would need to know the basics of investing because none of the experts or gurus wants you to think. They want your money and the only way to get it is to keep you ignorant. So they take your money and tell you what you want to hear. A lack of money is the root of all evil.

It's a very successful business plan; politicians have been using it for centuries. If you tell people what they want to hear, they will vote for you. That's just as true in investing as it is in the voting booth.

I can give you another perfect example where the use of simple basic logic can help you make intelligent investing decisions instead of following the rest of the lemmings over the cliff. Recently Deutsche Bank admitted it had been manipulating the gold fix. They did it the same way high frequency traders clip cents off of every stock trade; they were front-running their customers.

The various banks running the gold fix have to know how supply and demand meet at a specific point in time to determine what the fix should be. So if demand was high, the participants in the fix would set the price just slightly higher than supply and demand would dictate.

If demand was low, they set the price slightly lower that it should have been. Since all markets move both up and down to determine the "right" price, their manipulation was both up and down and didn't last for long before supply and demand resumed getting the price right.

If Deutsche Bank manipulated the gold fix and long-term price suppression is manipulation, is manipulation equal to suppression? No, of course not. Because while suppression is always manipulation, manipulation isn't always suppression.

So when you read a financial guru telling you about how Deutsche Bank admitting it manipulated the fix really means gold was suppressed all the way from $252/oz to $1,923/oz, you can logically determine if you really want to be giving them your hard-earned money. Manipulation isn't necessarily suppression and any commodity that goes from $252/oz to $1,923/oz isn't being suppressed.

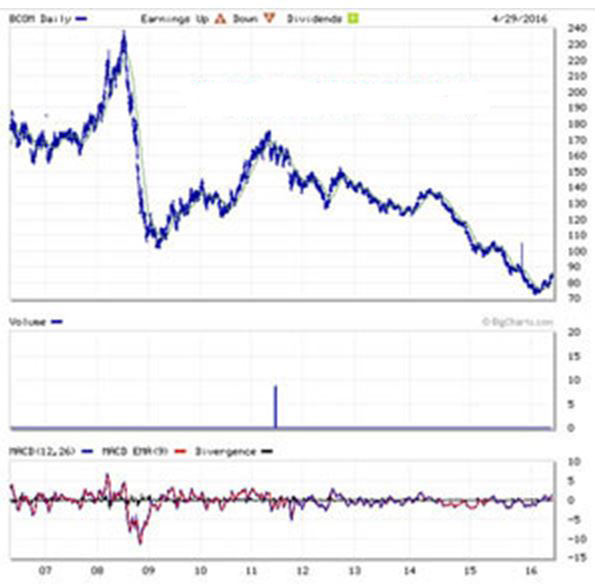

The Next Big Thing in investing is probably going to be commodities.

All commodities had a peak in 2011, not only silver and gold. They suffered a terrible and costly bear market, not only silver and gold. They all hit bottom late in 2015 and early 2016. It's just as true of sugar and coffee as it is of gold and silver. And while a lot of people still want to mumble about how gold is being suppressed, it is factual to say that platinum and oil went down a lot more. Nobody is claiming they were suppressed. You can use your common sense in investing. It is not only a good idea, it is probably mandatory.

When the train finally arrives at the station loaded with bags of money just for you, you don't want to get caught out at the airport.

All commodities, including gold and silver, are going to go up a lot. There will be a time when they get expensive. If you won't sell when you have a profit, the only other alternative is that you sell at a loss. Investing is simple but not necessarily easy. Please remind yourself that it was the bulls who wouldn't sell who lost money in 1980 and 2011. There will come a time to sell both gold and silver as they become The Last Big Thing.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 14 years ago. They later added321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 14 years ago. They later added321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

With all of these people calling for $5,000 gold and $100+ silver, it's hard to imagine the real gold bugs selling at the right time. When gold is $2,000+, many will get greedy and wait for more gains to come. And those on the sidelines may start buying at $2,000. I like PM's but too many have turned into a something like a religious cult.