I Cannot Believe What Fed Chair Yellen Just Said

I am currently listening to Fed Chair Yellen address Congress in the Committee on Financial Services. A line of questioning just finished regarding social program (welfare) program growth and slowing GDP. Alan Greenspan was quoted by the Congressman saying that you cannot have both entitlement program spending growth and a consistent 3% GDP growth at the same time, as the 'arithmetic simply does not work' for both to happen at the same time. It was also noted by Congress that while unemployment is going down, labor force participation is weakening, which translates to fewer people working overall but the government not addressing those people in their policy decisions. This is the essential difference between the U3 and U6 unemployment numbers and why U3 should not be the primary measure of unemployment by the Fed and the government!

The question posed to Yellen was, in light of recent debates about healthcare in the US as an entitlement program, does the Chair see the growth in entitlement spending conflict with the expectation of the GDP growth prospects.

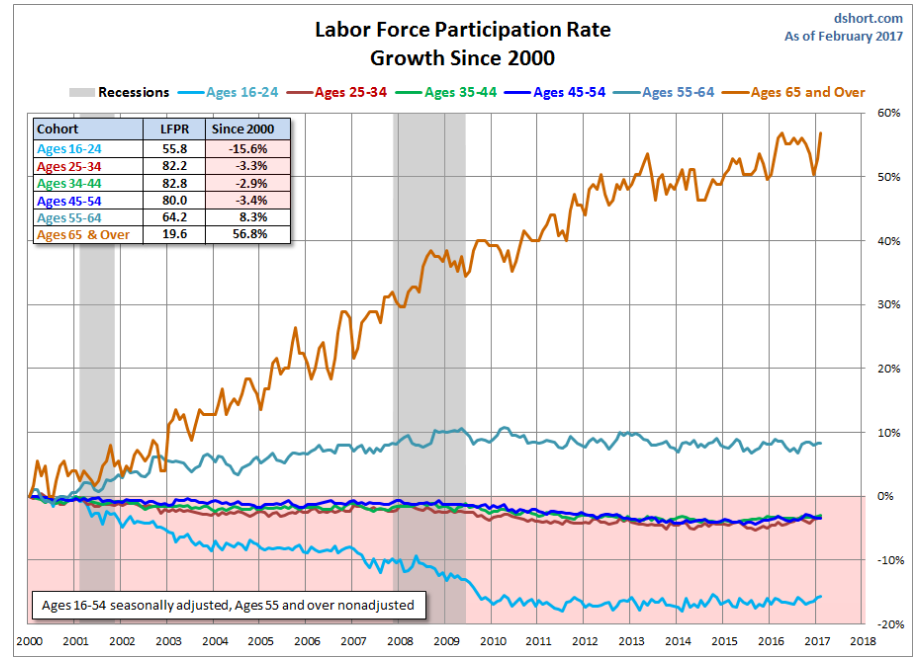

Yellen avoided answering this question directly, and instead said her biggest concern was the retirement of baby boomers in affecting labor force participation. In other words, Yellen just said that baby boomers are the reason for weak labor force participation, and insinuated this affected both the labor force participation weakness and pressures on GDP growth that had just been asked about.

The only problem with this is that labor force participation weakness IS NOT concentrated in seniors, who are in FACT entering the workforce in record numbers due to inability to retire on the savings and investments, see my previous article here. They aren't supposed to be increasing labor force participation, but rather over time dropping out of the labor force measures completely as retirees who should not be counted in the statistics as 'willing and able to work'.

Chart courtesy of Advisor Perspectives

If the Fed Chair does not understand this basic concept, how can she (along with the rest of the Fed members) possibly hope to address the economy effectively using monetary policy?

Hint: they can't!

Either she completely misunderstands the current reasons for weakness in the economy and the depth of these issues over time, or she is purposefully deflecting responsibility for the fact that past monetary policy has negatively affected savings and investment through inflation, such that people cannot actually retire on assets which have been devalued through monetary inflation which waters down current dollar value of savings and investment. And further that current inflation statistics are ridiculously understated, as noted by Shadowstats.com and others, by the government which understates inflation, savings growth, and the ability of current entitlement spending to keep up with real inflation.

All of these topics around the misstatement of government statistics are covered in my book as I examine why the Fed and the US Government base their decisions on faulty logic.

Today's testimony demonstrates the Fed does not have the ability to accurately diagnose economic problems and will not effectively use monetary policy to address both spending and GDP growth issues. Further, I am convinced that despite the Fed's stated 'mandate', the ultimate goal is to preserve the status quo which ultimately benefits large corporate and financial institutions with Fed policy more than helping the individual People of the United States. Today's Fed testimony further proves that point.

The author is not invested in any funds mentioned in the article.

I've found #JanetYellen to be a disappointment.

I can't believe it either!